Why Modi badly needs to woo India Inc. now

It is rather ironic that a government widely perceived to be of big business and for big business is desperately trying to dispel fears that seem to have crept in among the latter.

During the first term of the Narendra Modi government, his opponents were critical of his proximity to the bigwigs of India Inc., especially to two large business houses from Gujarat.

The opposition left no opportunity to allege that mega policies were being framed to suit the interests of the ‘favourite’ business groups and that the Centre was not empathetic to the needs of the small and medium businesses.

For a government that initially earned the moniker ‘suit-boot Sarkar,’ it was quite a turn of fate that the PM, a few months into his second term, felt the need to reassure India Inc. about his government’s ‘positive’ approach to business houses and corporates.

On Monday (January 6), PM Modi said action against a few corrupt entities should not be seen as a government crackdown on the corporate sector. Speaking at the centenary celebrations of Kirloskar Brothers, he said his government allowed the industry to create wealth fearlessly in a transparent environment and was attempting to rid the industry of a web of laws.

The latest promise to India Inc. comes amid a reiteration of making India a $5-trillion economy soon, never mind the currently shrinking economic growth.

It also follows a series of (mis)steps by the government, which have caused the corporates to think that the government isn’t too friendly.

The economy is already on a tailspin as idle capacities in the manufacturing sector are deterring businesses from committing further investments. Stringent taxation activity is also irking the corporate sector.

Scary terms

Around August 2019, the government amended the Companies Act. The amendment to Section 135 of the Companies Act added a jail term for non-compliance on CSR. “If a company contravenes the provisions of sub-section (5) or sub-section (6), the company shall be punishable with fine which shall not be less than fifty thousand rupees but which may extend to ₹25 lakh and every officer of such company who is in default shall be punishable with imprisonment for a term which may extend to three years or with fine which shall not be less than ₹50,000 but which may extend to ₹5 lakh or with both.”

This naturally riled India Inc., which was already struggling to comply with the stringent existing provisions on CSR funding.

The jail term was rolled back in October but not without causing considerable heartburn to corporates.

With every move, the industry was left wondering as to what the government was actually doing — with promises on one hand and a hard-hitting, bureaucratic approach on the other.

A case in point is the telecom sector. It has seen intense headwinds in the past few months after the Supreme Court asked telcos to pay past dues in licence fee and other levies to the government.

Also read | TRAI breather a relief for telcos, but may not pull them off the financial precipice

These dues add up to a huge sum and are payable by the older, incumbent telecom companies Bharti Airtel and Vodafone Idea (besides some others which have now ceased operations).

The enormity of the payouts – which spare the new aggressive telecom player Reliance Jio Infocomm – brought the telecom industry to a virtual standstill till the government agreed to a moratorium and the telcos banded together to raise tariffs.

Even now, the financials of the two incumbents are far from satisfactory and they blame the government for playing favourites and bringing the industry to its knees.

Not just sector-specific instances, multiple cases of alleged ‘tax terrorism’ have also raised the industry’s hackles.

The charge seemed to stick when the owner of India’s biggest coffee chain V.G. Siddhartha killed himself last summer. The Opposition and some vocal India Inc. captains blamed it on the aggressive tax collection zeal by government officials.

Also read | Government may rationalise personal income tax rates

A recent media piece quotes a presentation made by the Indian Private Equity and Venture Capital Association before a Parliamentary panel to say that uncertainty in tax administration is one of the key threats to private investments in the country.

Importance of private investment

The reasons the PM is trying to woo the industry back is obvious. India’s GDP growth rate has nearly halved in less than a year and private investment slackened. Unless the corporate sector steps in, growth will certainly remain elusive in the medium term.

NIP plan

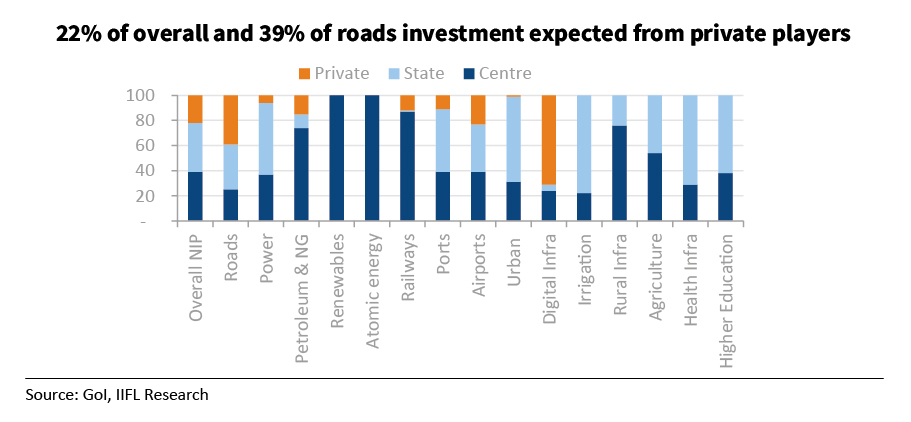

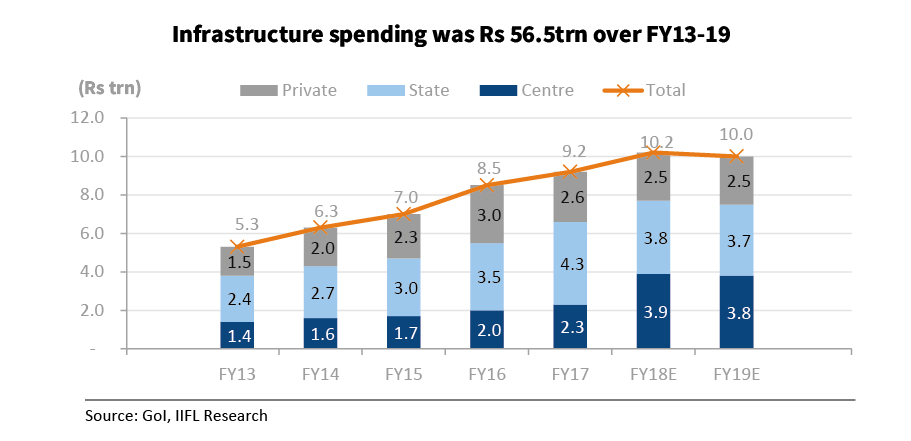

Take the recently unveiled National Infrastructure Pipeline (NIP), for example. The government has unveiled a roadmap which envisages a total investment of ₹102 trillion between FY20-25 in creating mega infrastructure across various sectors. But the premise of this mega investment is that more than a fifth of the contribution will come from the private sector, primarily in roads and digital infrastructure building.

Unattainable target

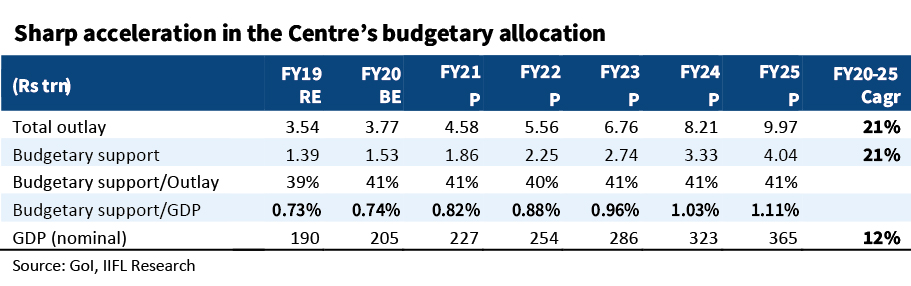

On top of that, the Centre expects to meet 41% of its own share of this investment via budgetary allocation and this, of course, would be quite tough, since the fiscal situation is far from ideal.

So, unless the private sector steps in, India’s infra spending could be a major concern in the coming months and years.

For 2019-20, various reports have quoted unnamed government officials to say that the overall government expenditure may be slashed by nearly ₹2 trillion as revenue collections have fallen way below target this fiscal.

Also, private investment has not kept up.

Corporate tax lower

The government, on its part, is right when it points to several measures it has taken in recent months to help India Inc. The most significant move has been lowering of the headline corporate tax rate though with unintended consequences.

Also read | India’s economy in deep crisis, all eyes on Sitharaman before budget

India Inc. cheered lower taxes (coupled with a removal of earlier exemptions) but not many companies have ploughed back tax savings into business, as expected.

IBC amendment

Another major reform the government has implemented is amending the Insolvency & Bankruptcy Code (IBC) for several provisions like the one where new owners of bankrupt companies are shielded from criminal liabilities arising due to the offences committed by previous promoters.

But as the general impression of a none-too-business friendly government lingers, the establishment will probably have to announce more measures in the upcoming Union Budget to ‘befriend’ and make the best of India Inc.