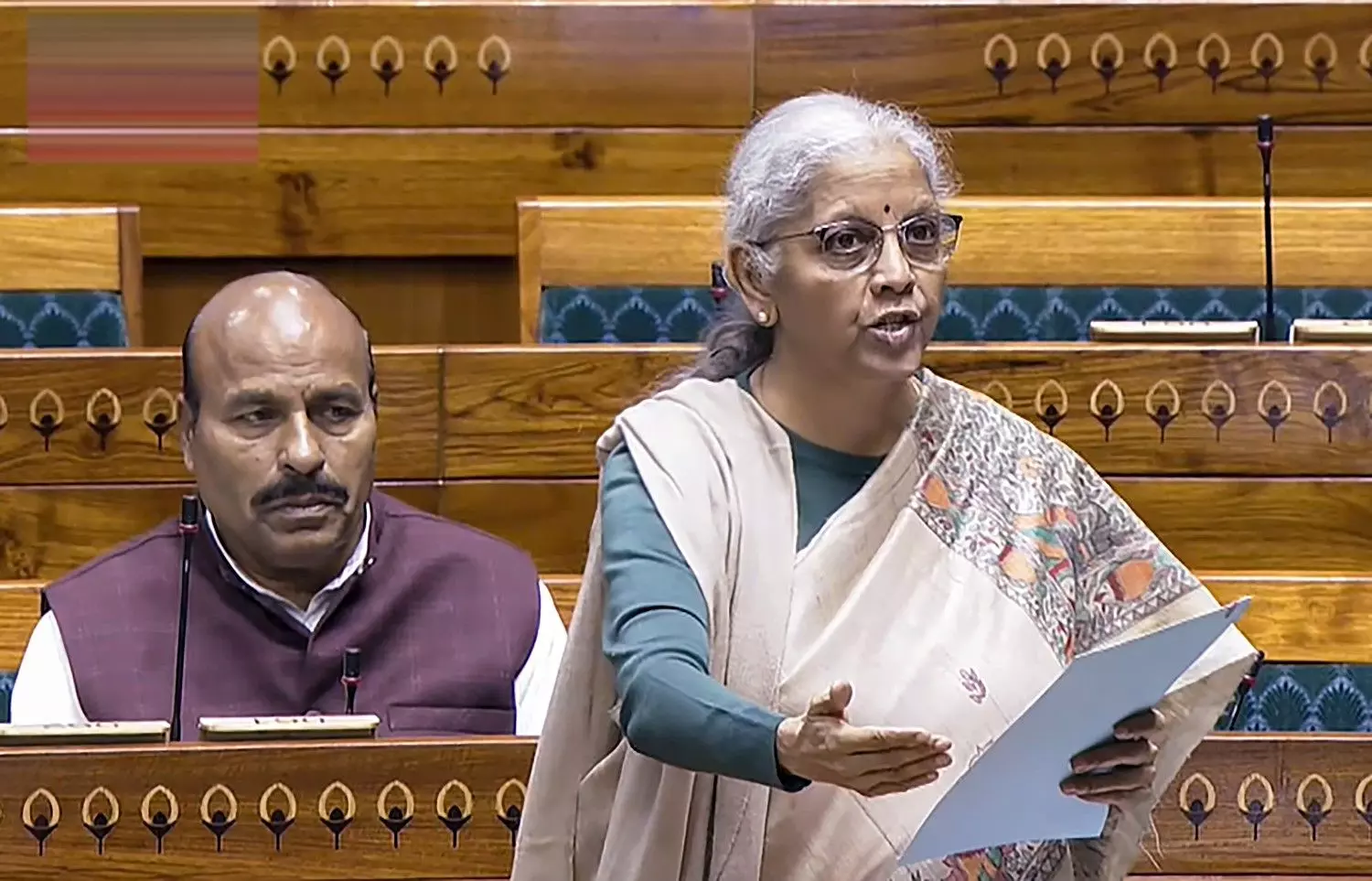

Union Finance Minister Nirmala Sitharaman speaks in the Lok Sabha during the Winter Session of Parliament, in New Delhi, on Wednesday, December 3, 2025. (Sansad TV via PTI Photo)

Explained: What Central Excise (Amendment) Bill means for tobacco taxation in India

The legislation seeks to replace outgoing GST compensation cess with higher excise duties on tobacco products — here’s what’s changing and why it matters

The Union government has introduced the Central Excise (Amendment) Bill, 2025, in the Lok Sabha in the ongoing Winter Session of Parliament, seeking to revise and increase excise duty rates on tobacco and tobacco-related products.

What happened on Day 3 of Winter Session of Parliament

Tabled by Union Finance Minister Nirmala Sitharaman on Monday (December 1), the Bill aims to provide a permanent tax structure as the GST (Goods and Services Tax) compensation cess nears its sunset deadline. While the government argues the move is both fiscally prudent and health-conscious, critics have flagged concerns over its potential impact on tobacco farmers, workers, and the informal sector.

Under Central Excise (Amendment) Bill, 2025

Cigarettes will now attract duties ranging from Rs 2,700 to Rs 11,000 per 1,000 sticks, depending on length and type — a considerable jump from the current Rs 200–Rs 735 range.

Unmanufactured tobacco (like sun-cured varieties) will see duties raised from 64 per cent to 70 per cent.

Chewing tobacco will attract a 100 per cent duty, up from 25 per cent.

Hookah and pipe tobacco products will face a duty increase from 25 per cent to 40 per cent.

Smoking mixtures and other specialised forms of tobacco will face the steepest hikes, with duties proposed to rise from 60 per cent to as much as 325 per cent.

Permanent replacement for GST cess

The Central Excise (Amendment) Bill, 2025, marks a significant shift in India’s approach to taxing tobacco products. Since the implementation of the Goods and Services Tax (GST) in 2017, most indirect taxes have been subsumed under the unified regime. However, to maintain a high tax incidence on “sin goods” like tobacco and pan masala, the Centre had imposed an additional compensation cess. That cess, intended to offset revenue losses faced by states post-GST, is now being phased out as repayment obligations wind down.

Also read: Govt sets December 9-10 debate on electoral reforms amid SIR logjam

The new legislation proposes to replace the compensation cess with sharply increased central excise duties on various tobacco products. This is intended to prevent a decline in overall tax collections and uphold public health objectives by discouraging tobacco consumption through higher prices.

Also read: Explained: What is the Sanchar Saathi app and why has it triggered a row?

The Bill also aligns excise levies to ensure that the overall tax incidence on these products remains broadly equivalent to what it was under the previous cess regime. This adjustment, the government contends, is necessary to ensure fiscal continuity and to prevent a drop in the effective tax burden on tobacco products post cess.

Government’s justification

While introducing the Bill, Sitharaman said the proposed changes are not only a fiscal measure but also a step toward public health protection. With the withdrawal of the compensation cess, continuing to tax tobacco at the same effective level will help dissuade consumption and ensure stable revenues for the exchequer.

Also read: Bira 91 in turmoil after name change, faces financial crisis, employee revolt

Officials have clarified that the aim is to create a stable, long-term tax structure for tobacco products, replacing the temporary cess with a permanent excise regime. This is especially pertinent as the government intends to retire the cess by this month, having used its proceeds to compensate states for GST-related revenue losses.

Opposition and stakeholder concerns

Despite the government’s stated objectives, the Bill has sparked criticism in Parliament and among industry observers. Several opposition members called for the Bill to be referred to a Standing Committee for detailed review. They argued that the steep duty hikes could adversely affect tobacco growers, especially those in states where tobacco cultivation is a major source of rural employment.

Also read: Parliament is not a warm-up arena for elections, say experts | Capital Beat

Concerns have also been raised about the potential for these increases to push consumers toward unregulated or illicit markets, undermining both public health and tax compliance. Small manufacturers and workers in the informal tobacco sector — such as beedi makers — could also be disproportionately affected by the revised tax burden.

Some lawmakers also questioned whether price increases alone would serve as an effective deterrent to tobacco use and called for a more holistic public health policy to address tobacco addiction.

What lies ahead

The Bill is currently under discussion in the Lok Sabha. Its passage would mark a decisive policy shift, cementing a new excise framework for tobacco products as the era of the GST compensation cess ends. While the government maintains the changes are necessary to maintain tax incidence and discourage harmful consumption, further debate is expected on how to balance fiscal needs with the socioeconomic impact on vulnerable communities dependent on the tobacco industry.