Explained: How Freshworks took a different route to script history

Freshworks on Wednesday became the first Indian software-as-a-service (SaaS) firm to go public on the US stock exchange, with shares closing at $47.55 on Nasdaq, thereby giving it a market value of about $13 billion.

In the process, 500 of its employees have become millionaires, as was noted by founder Girish Mathrubootham: “…and 69 of them (employees) are under 30 years of age”.

I am proud and humbled that @FreshworksInc is now trading on @Nasdaq as $FRSH. The journey to get here has taken 11 years, a lot of hard work, and loads of good fortune. Thank you to everyone who’s been on this journey with us. Here’s to life as $FRSH! #Freshworks #IPO #NASDAQ pic.twitter.com/02dNkfj6zw

— Girish Mathrubootham (@mrgirish) September 22, 2021

Started in Chennai and later headquartered in California, the way Freshworks began is in itself a story. The start-up was born after the company’s CEO struggled with poor customer service while trying to get his broken television fixed.

The company, which started as FreshDesk in October 2010, was rebranded as Freshworks in 2017. Both co-founders Mathrubootham and Shan Krishnasamy earlier worked at Zoho, that makes web-based business tools.

Zoho had last year alleged violation of the Defend Trade Secrets Act and various other trade laws of the US by Freshworks, saying the latter had built its entire business model by stealing sensitive information from Zoho, including trade secrets like critical client data, software products as well as pricing strategy. It had gone on to file a suit against Freshworks at a US district court.

Eleven years since its founding, Freshworks today provides innovative customer engagement software for businesses of all sizes, making it easy for businesses to acquire, and retain their customers. Freshworks SaaS products are ready-to-go, easy-to-use and offer a quick return on investment.

“The Freshworks’ IPO is a landmark event that will strengthen the India SaaS model among global enterprise customers – much like the Infosys listing on Nasdaq did for the Indian IT Services segment in the previous decade. The fact that a company can go from being two first-generation co-founders in a Chennai suburb all the way to a Nasdaq IPO in 10 years is the stuff of startup lore. This will inspire a generation of new founders (including those from non “IIT-IIM” backgrounds)” says Arun Natarajan CEO of deal tracking firm Venture Intelligence

The company is believed to have got a solid boost in revenues last year – to the extent of 50 per cent – after the coronavirus pandemic prompted businesses to go digital. Its sales continue to grow in 2021, while its net loss shrank, thereby boosting its path to profitability in the long term.

There are many interesting aspects to Freshworks’ journey, however, this write-up is about an important part of the entrepreneurial landscape – growth via the inorganic route.

Freshworks has reached where it is today by acquiring capital-efficient start-ups,13 in fact, till date.

Creating ‘Synergy’

Synergies are when two companies merged together create greater value than on a standalone basis – ‘sum of parts greater than the whole’. These synergies could include operational, financial, and tax synergies. In most M&A transactions, it is usually the cost-savings that are the most important and easily quantifiable synergies. An acquisition usually involves the buyer paying a premium above the target’s traded share price to achieve control. This is valuable because it gives an acquirer the ability to set strategy for the target, make operational improvements, extract cost savings, and ultimately, create value. The value creation is driven by synergies. The combined business normally takes time to realise tangible synergies, in fact it is mostly over several years.

Why is SaaS really cool or superhot?

From an investor’s point of view, SaaS literally has unlimited upside! Afterall, SaaS is a software distribution model in which applications are hosted by a vendor or service provider and made available to customers, typically enterprises, over a network, either a private one or a public one like the internet. But the fact also is that it is an incredibly crowded market with Goliaths like Amazon, Oracle, Google, Microsoft and Adobe having presence in it. All of them want to scale this part of their business and high-growth companies are attractive propositions to buy out at some point even if they are meant only as defensive acquisitions.

‘Defensive Acquisitions’

A defensive acquisition is a corporate strategy that consists of companies acquiring other companies and assets as “defence” against market downturns or possible takeovers. A defensive acquisition contrasts with the normal raison d’etre for an acquisition, which is usually increased market share or revenue. An acquisition is generally categorised as defensive if its aim was primarily to prevent a company from losing market share or likely coming under attack, and potentially one day being swallowed by a larger predator.

A textbook example of a defensive strategy in tech acquisition is that of Facebook acquiring WhatsApp and Instagram. Facebook was working on or had similar capabilities, but the built-in user bases and growing competitive threats from each of these platforms made a defensive acquisition an attractive opportunity.

The biggest name in technology, Google, arguably became what it is now thanks to the acquisition of a little-known firm that hired linguists and journalists – Applied Semantics. It was Applied Semantics that gave Google (that had huge swathes of data with itself) its monetisation capabilities.

The majority of tech acquisitions involve small start-ups with valuable patents or talented engineers. Acquisitions are tricky, though some result in multibillion-dollar ventures while many others fizzle out, and result in products being sold off or dumped in entirety.

“Tech M&A is going to move gears to large transactions from small,” says a tech investment banker who did not wish to be named.

Freshworks’ path to IPO

Freshworks in 2015 acquired Cloud-based video collaboration platform 1Click. It also acquired the online social discovery platform Frilp (founded in 2012 and which had raised $500,000 in funding from angel investors, including Freshdesk’s Mathrubootham in August 2014 and an undisclosed venture round with Microsoft Accelerator). It then had over 1 lakh users and was poised for exponential breakout.

This author had the privilege to be present at a duplex flat complex which served as the “corporate headquarters” of Frilp right before its acquisition in 2015. It was a young team of 20-somethings who were hungry to scale and had the right advisors to show them the path ahead.

Freshworks in all made 13 acquisitions, most of them for undisclosed amounts. Last year it acquired three – in May it bought US-based customer management platform Natero to add relevant data and analytics capabilities for its existing customer engagement suites. In February this year, it acquired US-based AnsweriQ, a provider of intelligent automation for customer service.

Other acquisitions of Freshworks include marketing software start-up Zarget in August 2017, a chatbot venture Joe Hukum, SaaS start-up Pipemonk, social chat platform Chatimity and social media analytics venture Airwoot.

These deals would not have been possible without a clear strategy and blind trust of its investors in the management.

“It is amazing to see Freshworks very close to the market cap of Zendesk. In fact, in a few days, I won’t be surprised if it crosses it. We have to remember Zendesk is the company that trolled FreshDesk seven years ago and this is a good way to respond to that trolling,” says Suresh Sambandam, Founder and CEO of Chennai-based SaaS company Kissflow.

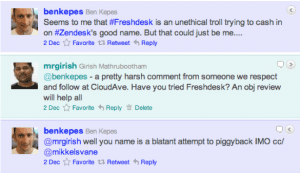

Suresh was referring to the legendary Twitter spat that happened about eight months after Freshdesk started operations, when it got into a war of words with San Francisco-based Zendesk, now its closest competitor.

Seems to me that #Freshdesk is an unethical troll trying to cash in on #Zendesk‘s good name. But that could just be me….

— Ben Kepes (@benkepes) December 2, 2011

The row started when Ben Kepes, a tech blogger, tweeted: “Seems to me that #Freshdesk is an unethical troll trying to cash in on #Zendesk’s good name. But that could be just me…”

The “junta” then piled on the thread. The spat got uglier when Mikkel Svane, CEO of Zendesk, called Freshdesk “A Freaking-RIP OFF”.

Mathrubootham then grabbed the opportunity to get all of those listening to a now-public social media conversation to sign up for a free trial of Freshdesk for 30 days! The thread thus ended up being some kind of a free marketing opportunity, and what followed till its IPO is now indeed history.

“Freshworks’ IPO brings tremendous focus to an already hot SaaS market in India. This puts India and especially Chennai on the global map. It will make the trillion-dollar SaaS (Indian) economy possible in a reduced timescale,” Sambandam said.

To the question on choosing the organic versus inorganic path, he said: “There is no one right answer. Interestingly, Chennai, being the SaaS capital of India, has a few great examples. We have Freshworks and Chargebee in the heavily funded category, and Zoho and Kissflow in the organic growth segment. Only to prove the point that it is possible to build companies in both models.”

Anil Kumar, founder and CEO of Jodi365.com, is more tempered in his reaction: “I am happy for the Freshworks team. A Chennai start-up going public, in the US, is indeed a milestone event with significant ripple effects on the start-up ecosystem in India. Yet, I’d remind fellow entrepreneurs not to get distracted by ‘startup porn’, of which there is no shortage on social media. Leave the celebrating to the Freshworks team and its stakeholders. They got to where they are by staying focused and executing relentlessly. Stay focused on your own start-up and executing on your game plan!”

On valuations and the listing, Kumar added: “I strive not to get caught up in debates over valuations or react to, ‘did you hear about Canva’s $40 billion valuation? And Freshworks just got valued at $10 billion!’ Valuations are what they are. If someone is willing to sell something at a price and there’s a buyer willing to buy at that price, you have a deal at that valuation. The markets decide.”

What Kumar likes most about Freshworks going public is that more entrepreneurs in India will dare to dream big – “as they say… when someone aims for the moon, and if they miss, they will still land among the stars.”

Also read: Explained: China’s Evergrande crisis and should India worry