CEA says lenders must take steps to avoid risks, monitor lending

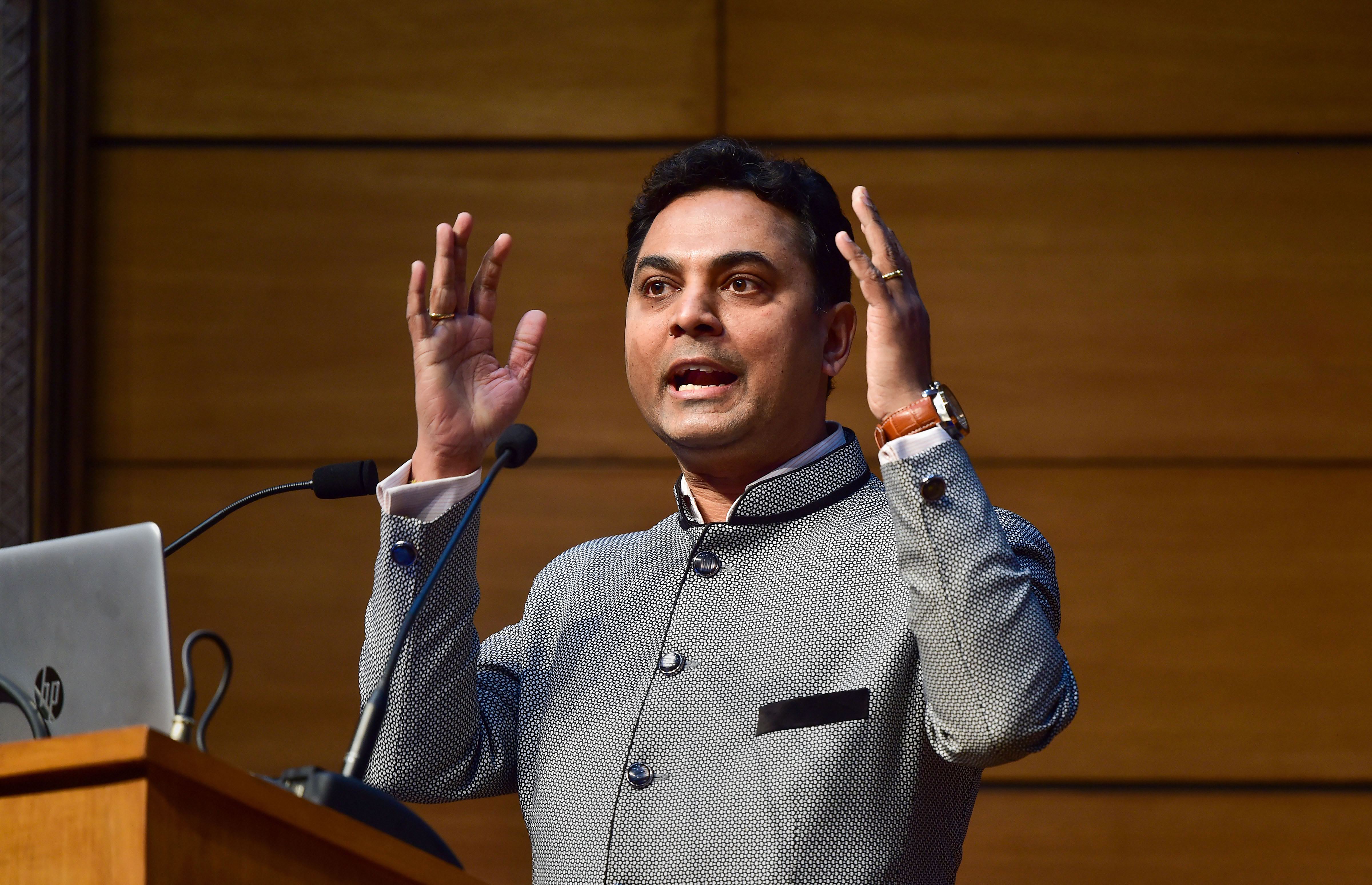

Lenders should be conscious of their asset quality to avoid a repetition of lending that occurred following the financial crisis of 2008-2009, said chief economic adviser (CEA) KV Subramanian.

Non-banking financial companies (NBFCs) need to follow prudent measures to ensure that risks do not mount, Subramanian said on Thursday (October 29).

“One of the other key aspects that must be kept in mind is that forbearance is necessary at this point in time, but the previous episode in 2008-09 illustrates very well the kind of zombie lending that continued, evergreening that happened during that time, which came back to bite three-four years later,” said Subramanian.

He was speaking at industry body Ficci’s non-banking financial company (NBFC) Summit.

Zombie lending refers to providing credit to entities that do not have the capability to repay. While this inflates credit growth, loan defaults of financial institutions mount at a later stage.

Also read:RBI raps lending apps, NBFCs for harassing customers

Subramanian said that all financial institutions, and their boards, in particular, should keep a very careful watch on lending. “For instance, lending to firms with interest coverage ratio (ICR) of less than one increased significantly after 2008-09, and that is the kind of thing that must be watched,” said Subramanian.

The ICR is the ratio of a company’s earnings before interest and tax to interest expenses and is a measure of the debt-servicing capacity.

Post global meltdown, there was a spurt in non-performing assets (NPAs) of banks.

Also read:Sitharaman announces ₹30,000 crore support for NBFCs, HFCs, MFIs

Non-bank financiers, he said, must keep in mind the interconnected risk which arises when mutual funds invest in their commercial papers (CPs).

“At this point in time, while the regulators are mandated to monitor these things, at an individual level, every NBFC needs to monitor its rollover and interconnected risk as well. I think it is in times like these that the prudential measures must be taken by each NBFC to ensure that risks do not mount,” he said.

About the emerging opportunities, Subramanian said the Bilateral Netting of Qualified Financial Contracts law that has been passed recently paves the way for credit derivatives.

“It is a big move”, he said, adding, that reforms undertaken by the government in the agriculture and manufacturing sector also provide opportunities to the sector.

Observing that the financial sector plays an important role in the growth of the economy, he said it happened during the growth phase of Japan and China.