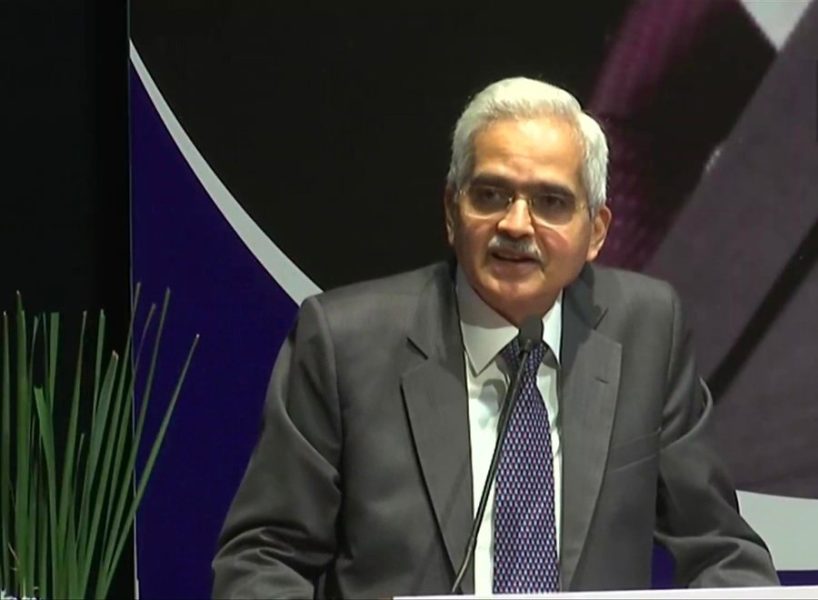

After Covid and Ukraine war, economy in eye of a new storm: RBI Governor Das

The Reserve Bank of India (RBI) Governor Shaktikanta Das, while announcing an increase in repo rate, said that the world has been confronted with one crisis after another over the last few years, leading to nervousness in financial markets.

After covid and Ukraine war, the world is facing another storm, he said. “The global economy is in the eye of a new storm,” Das said, referring to monetary policy tightening by several central banks across world and their signal for further hikes.

“…now we are in the midst of a third major shock – a storm – arising from aggressive monetary policy actions and even more aggressive communication from Advanced Economy (AE) central banks,” Das said.

Also read: RBI Governor: FY23 inflation likely to remain 6.7%, may fall to 5% early FY24

‘Markets in turmoil’

“The recent sharp rate hikes and forward guidance about further big rate hikes have caused tightening of financial conditions, extreme volatility and risk aversion,” the RBI Governor said adding, “All segments of the financial market including equity, bond and currency markets are in turmoil across countries. There is nervousness in financial markets with potential consequences for the real economy and financial stability.”

Indian economy though continues to be resilient in midst of global turmoil and economic activity in the country remains stable in the face of such global challenges, the RBI governor said.

The RBI today lowered India’s FY23 GDP growth forecast to 7 per cent from 7.2 per cent while maintaining FY23 retail inflation forecast at 6.7 per cent. India’s annual retail inflation rate accelerated to 7 per cent in August, driven by a surge in food prices, and has stayed above the RBI’s mandated 2-6 per cent target band for eight consecutive months

Re depreciation ‘orderly’

The RBI governor said that the though the rupee has depreciated against the US dollar, the movement has been in an orderly manner as compared to other emerging market currencies. From April 1, 2022, to September 30, 2022, the rupee has depreciated 7.4 per cent.

The US Federal Reserve’s relentless and aggressive interest rate hikes over recent months have led to flight to safety, leading to pressure on emerging market assets. Indian rupee has hit record low against the dollar in recent days. Policymakers around the world are grappling with a sweeping shift away from their respective currencies and into the safe-haven dollar, raising worries of capital outflows and further damage to their economies.

Also read: Card tokenisation: RBI unlikely to extend September 30 deadline

Meanwhile the Monetary Policy Committee (MPC) of RBI today raised benchmark repo rate by 50 basis points, the fourth straight increase in the current cycle, as policymakers extended their battle to tame sustained above-target retail inflation rate.