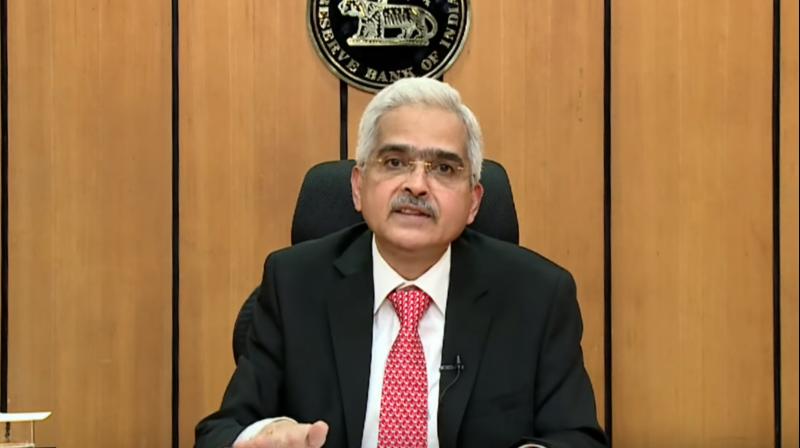

Unacceptably high inflation behind 50 bps rate hike: RBI Governor Das

The Indian economy is an isle of macroeconomic and financial stability in a turbulent ocean right now, and has braved the two black swan events of the pandemic and the Russian invasion of Ukraine, said Shaktikanta Das

The “unacceptably high” inflation trending around 7 per cent mark led the Reserve Bank of India to hike rates by an aggressive 0.50 per cent on Friday, according to Governor Shaktikanta Das.

Stating that there are signs that headline inflation, which has breached the 6 per cent upper threshold set for the RBI for six consecutive months, has peaked, Das on Friday said policy moves from here on will be “calibrated, measured and nimble” and will depend on unfolding dynamics.

The Governor refused to spell out any guidance on the way forward, pointing out that “we live in a dynamic world where things are changing very fast”. He also noted that generally, guidance in a rate hiking cycle is difficult as compared to that in a rate cut cycle.

“… inflation still remains at uncomfortably or unacceptably high levels and therefore, monetary policy has to act,” he told reporters after the central bank’s six-member Monetary Policy Committee (MPC) decided to hike the repo rate at which it lends to the system by 0.50 per cent.

Calibrated hike predicted

It can be noted that ahead of the policy announcement, many analysts had been of the view that the hike would be a calibrated 0.35 per cent while a few expected the RBI to frontload by being aggressive with a 0.50 per cent increase.

Das said steps have to be taken to contain inflation and inflation expectations in the economy. The MPC also took the growth aspect into consideration while taking its call, he added.

The Governor also mentioned that as per the RBI’s assessment, the Indian economy is an isle of macroeconomic and financial stability in a turbulent ocean right now, and has braved the black swan events of the pandemic and the Russian invasion of Ukraine.

Seeking to defend the deep rate cuts undertaken during the pandemic, Das said inflation does not have its roots in the monetary policy actions of the past but is led by supply-side factors and international events.

Inflation seen to moderate

In what may come as a relief to many, he reiterated that inflation may have peaked and will moderate going forward.

It can be noted that while the MPC retained the FY23 forecast at 6.7 per cent, it said the April-June 2023 quarter will see the headline number at 5 per cent. There was also a mention of the objective to achieve 4 per cent CPI target in Das’ statement earlier in the day.

When asked about the role played by the depreciating rupee in the policy formulation, Das admitted that there is an impact of imported inflation but added that the MPC’s deliberations were influenced by the overall inflation and growth aspects. Without spelling out what constitutes “volatility” for the RBI, Das said the central bank does not have a level in mind for the rupee and intervenes only when it finds volatilities to ensure that the currency moves smoothly.

The MPC also deliberated on the negative interest rates being earned at present, Das said, terming it as a “matter of concern”.

Neutral rate

Answering a query on whether we have hit the neutral rate yet, Deputy Governor Michael Patra, who heads the important monetary policy function and also sits on the rate setting panel, said: “The path to the neutral rate is a two milestone journey”.

“The first milestone is when inflation falls into the tolerance band and the second is when it aligns with the target,” he said.

With agency inputs