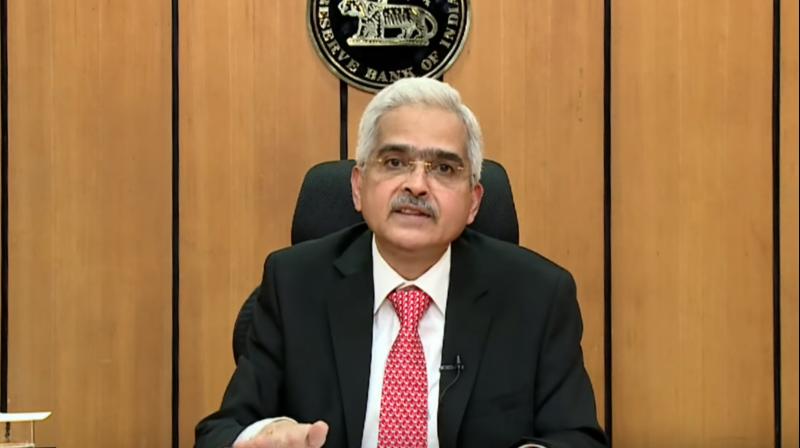

Adani issue: RBI chief says Indian banking too strong to be hit by ‘case like this’

Allaying fears over the impact of Adani Group’s stock rout, Reserve Bank of India (RBI) Governor Shaktikanta Das on Wednesday (February 8) said the strength, size, and resilience of the country’s banking system are too strong and large “to be affected by a case like this.”

Concerns have been raised in various quarters about Adani Group companies, and lenders’ exposure to the conglomerate, in the wake of an adverse report by US-based short seller Hindenburg Research. The report triggered a massive sell-off in the shares of the Group’s companies.

To queries about the Group, Das said the RBI made its own assessment to come out with a statement on Friday (February 3), in which it termed the banking sector as strong and resilient.

“The strength, size and the resilience of the Indian banking system now are much stronger and larger to be affected by a case like this,” Das said without directly mentioning the Adani Group.

“Banks’ exposure not very significant”

He was responding to a query on whether the RBI would guide domestic banks about their exposure to the Adani Group companies in the context of rating agencies’ reports related to banks’ exposure to the Group.

Briefing reporters after the monetary policy announcement, Das said when banks do lend, they take their calls on the fundamentals of a company and the expected cash flows from projects. He also clarified that the market capitalisation of the company does not have any role to play in it.

Also read: Hindenburg effect: RBI seeks details of banks’ Adani Group exposure

Deputy Governor MK Jain said domestic banks’ exposure is “not very significant” to the Adani Group and the exposure against shares is “insignificant.”

Das said that over the years, the appraisal methods of the banks have significantly improved.

In the past three to four years, the RBI has taken several steps to strengthen the resilience of banks, including guidelines on governance, audit committees, and risk management committees, making it mandatory to appoint chief risk officers and chief compliance officers.

(With agency inputs)