Inflation matters: Why RBI cannot afford to pause repo rate hikes

The RBI must do whatever it takes to keep inflation under control and to keep the vibrant banking system intact

The Monetary Policy Committee (MPC) of the Reserve Bank of India is likely to hold its next review meeting between April 3 and 6. The meeting will be held weeks after the RBI hiked the repo rate from 6.25 per cent to 6.5 per cent in February, taking the total quantum of hike to 250 basis points (bps). It was the sixth consecutive hike in the repo rate — the rate at which the RBI lends money to commercial banks.

It is no wonder then that the borrowers have started appealing to the RBI to maintain the status quo on policy rates. Before every MPC meeting, the borrowers’ lobbies highlight their sufferings due to the high cost of funds. They argue that high interest rates affect GDP growth.

Watch: SVB collapse will lead to more stringent norms: Vittal Ramakrishna of funding platform POD

This time round, industry bodies like the Federation of Indian Chambers of Commerce & Industry (FICCI) and the Confederation of Indian Industry (CII) have come out with their statements.

All-round pleas

“Primacy must be given to growth and a case can be made out to consider decoupling from the (US) Fed approach and look at what works for India,” FICCI president Sanjiv Mehta said. He referred to the RBI data on weighted average lending rate for fresh rupee loans that had increased by 135 bps between May and November last year. For outstanding loans, it was 71 bps.

Sanjiv Bajaj of CII said the RBI has more elbow space to delink rate hikes from the US Fed, as some sectors may soon feel the pinch. “In some segments, for example the housing sector, people are taking loans, which are floating interest rates for a very long period of time — their EMIs have gone up. We have by and large the interest rate at pre-Covid level.”

Explainer | AIS for Taxpayers app: How to download, check your income details

Apart from these industry bodies, a research report from the State Bank of India states that the 2.5 percentage points interest rate increase has been correctly frontloaded, but the RBI would do well to pause the monetary tightening and assess the impact of the higher rates. While the industry bodies have their own interest, it is not clear why a bank research team must also plead for a pause of rate hike.

Inflation is still a time bomb

Data available in the public domain shows that the battle against inflation is not over and the problem persists all over the world. In India, when inflation was inching up, the RBI did not act in time and we are now paying the price. But the RBI argues it had not not increased repo rates to maintain the growth rate.

The annual inflation for 2021-22 was 6.7 per cent. The inflation rate for January 2023 was 6.5 per cent and for February 2023, 6.4 per cent. As per its preamble, the primary duty of the RBI is to maintain the value of the rupee. This means that its primary goal should be to contain inflation to maintain the purchasing power of the rupee.

Further, the RBI has a target of keeping inflation at 4 per cent, plus or minus 2 per cent. When the inflation exceeds 4 per cent, the RBI must initiate action so as to bring it to the mandated level. There is no case for RBI to allow it to exceed 6 per cent, which is the upper limit.

So, it is evident that last year, as well as during the last two months, the RBI did not control inflation as mandated. Then why should it pause a repo rate revision now?

As per the latest report of RBI Governor Shaktikanta Das, he expects inflation to moderate in 2023-24 but to remain above the 4% target. It is expected to average 5.6% in Q4 of 2023-24. We have to wait and see what happens as things are so fluid and unpredictable all over the world.

There is no scope for the RBI removing its guard. Hence, it should be allowed to use all the weapons available with it to arrest galloping inflation and industry bodies should not put any pressure on its functioning.

Depositors neglected

For many years now, depositors have been largely ignored vis à vis borrowers. The former have been continuously getting negative returns by parking their funds in banks. Only recently have banks started raising deposit rates and depositors are getting positive returns. This should not be stopped by tinkering with the repo rate to favour borrowers.

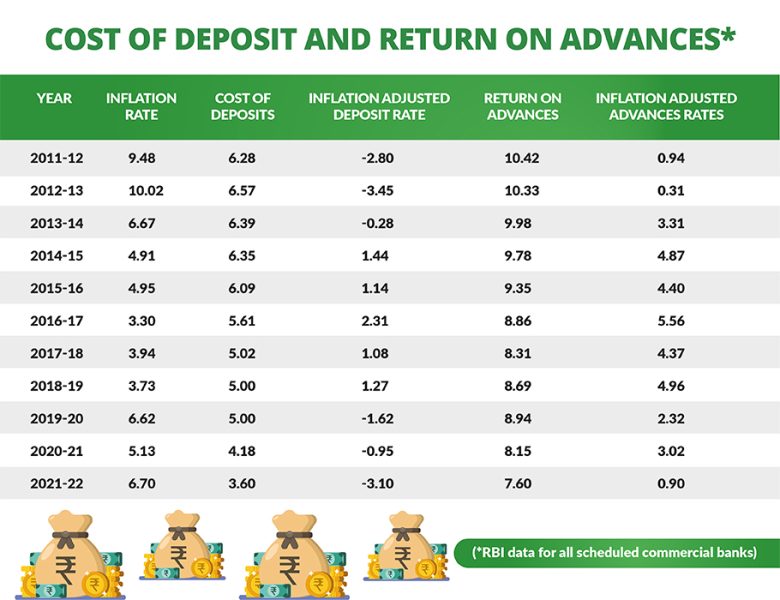

The table below shows how depositors are getting negative returns and how borrowers are favoured at the cost of depositors. Borrowers have simply paid an inflation adjusted rate of 0.90 per cent in 2021-22. Depositors have got a return of minus 3.10 per cent.

Our economy predominantly functions based on the saving of the community which is channelised through the banking system. With tremendous faith in the system, people deposit their savings with banks, even with reduced rates of interest.

But the system should not be allowed to go on punishing a segment of society that is vital for the economy. Let us not forget that the growth in scheduled commercial bank deposits moderated to 10 per cent year-on-year in March 2022, compared to an increase of 11.9 per cent a year ago as per RBI data.

The RBI must do whatever is required to keep inflation under control and to keep the vibrant banking system intact and should not try to help the borrowers at the cost of depositors. It should not stop its battle against inflation.