- Home

- India

- World

- Premium

- THE FEDERAL SPECIAL

- Analysis

- States

- Perspective

- Videos

- Sports

- Education

- Entertainment

- Elections

- Features

- Health

- Business

- Series

- In memoriam: Sheikh Mujibur Rahman

- Bishnoi's Men

- NEET TANGLE

- Economy Series

- Earth Day

- Kashmir’s Frozen Turbulence

- India@75

- The legend of Ramjanmabhoomi

- Liberalisation@30

- How to tame a dragon

- Celebrating biodiversity

- Farm Matters

- 50 days of solitude

- Bringing Migrants Home

- Budget 2020

- Jharkhand Votes

- The Federal Investigates

- The Federal Impact

- Vanishing Sand

- Gandhi @ 150

- Andhra Today

- Field report

- Operation Gulmarg

- Pandemic @1 Mn in India

- The Federal Year-End

- The Zero Year

- Science

- Brand studio

- Newsletter

- Elections 2024

- Events

- Home

- IndiaIndia

- World

- Analysis

- StatesStates

- PerspectivePerspective

- VideosVideos

- Sports

- Education

- Entertainment

- ElectionsElections

- Features

- Health

- BusinessBusiness

- Premium

- Loading...

Premium - Events

Is the UK's central bank ready for the Raghuram Rajan effect?

Recent news that former Reserve Bank of India (RBI) governor Raghuram Rajan is one of the top contenders for the Bank of England (BoE) chief caught the attention of top economists, RBI officials and general citizens alike. Pundits in the world of business, finance and economics are closely following the developments to see if Rajan, ranked second in the most-likely nominees to take over...

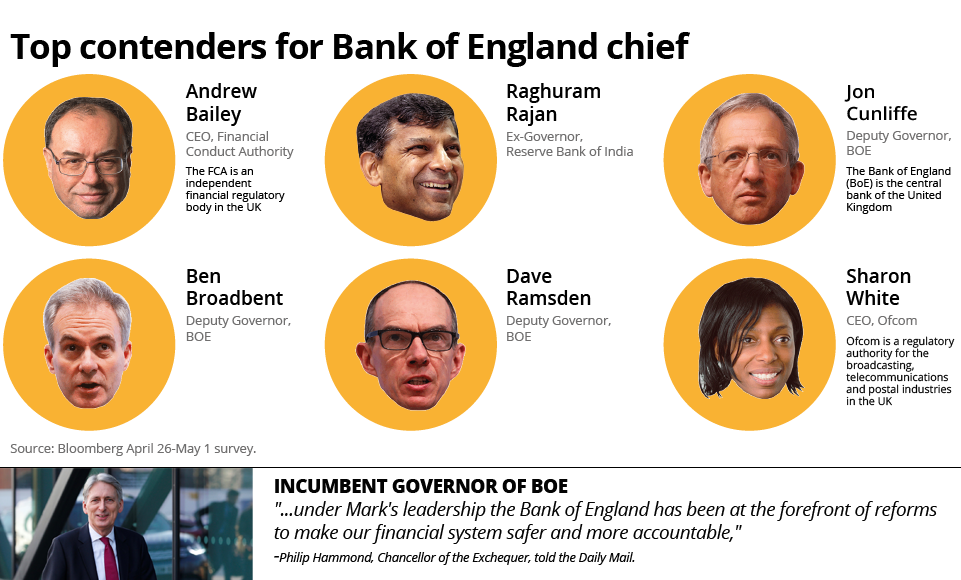

Recent news that former Reserve Bank of India (RBI) governor Raghuram Rajan is one of the top contenders for the Bank of England (BoE) chief caught the attention of top economists, RBI officials and general citizens alike. Pundits in the world of business, finance and economics are closely following the developments to see if Rajan, ranked second in the most-likely nominees to take over from 54-year-old Mark Carney according to a Bloomberg survey, will get the position.

- What is Bank of England?

- It is the central bank of the United Kingdom. The BoE started in 1694 as a private bank lending money to the government. However, it has now become the official central bank of the UK.

These speculations started pouring in a month ago, when the UK Chancellor of the Exchequer Philip Hammond started his ‘head hunt’ for a successor to Carney, who is scheduled to leave at the end of January 2020. Since the Chancellor stressed on the need for a governor with international stature and the current governor is Canadian, economists rated Rajan as a prime contender.

The 56-year-old Indian, who wears several hats including that of an academician and an economist, has strong foresight to have been able to predict the US economic crisis of 2008 beforehand. Often respected for his straightforward and practical approach, he helped his home country India battle inflation, which plagued the nation when he assumed the role of governor in 2013.

Rajan earns global respect

If you were working in sales and trading on any derivatives desk in 2005, it was probably the ‘golden period’ with fat bonuses. At times, executives wondered if the additional ‘0’ in their bank statement was an arithmetic error. The year was flooded with crazy weekend parties, and the blind belief that good times last forever. That year, at the Federal Reserve annual conference in Jackson Hole, Wyoming, Rajan warned about the growing risks in the global financial system and proposed policies that would reduce these risks. Former US treasury secretary Lawrence Summers called the warnings “misguided” and Rajan a “Luddite.”

With the benefit of hindsight, one could say that the Jackson Hole speech, considered contrarian then, may have been Rajan’s hour of glory. He gave the bitter medicine at a global central bankers’ conference that was celebrating the career of Alan Greenspan, the high priest of ‘free markets’ and financial deregulation. Rajan was then considered a party-pooper. He warned that securitisation had made the financial system more vulnerable and not safe. He questioned the practice of leveraging and went on to even publicly ask whether banks had sufficient liquidity to cope “if the tail risk does materialise.” How right the “Luddite” was! Following the 2008 economic crisis, Rajan’s views came to be seen as clairvoyant and he was extensively interviewed for the Oscar-winning documentary Inside Job (2010).

Contribution back home

Rajan was described as a ‘rock star’ during his three-year tenure as governor of India’s central bank. During these years, he worked towards formalising the Monetary Policy Committee (MPC) and cleaning up bad loans in the banking system.

“The major decision taken by Dr Rajan as Governor was to bring in order in terms of recognising non-performing assets (NPAs). This was through the asset quality recognition process which made banks clean up their books and introduce transparency,” Madan Sabnavis, Chief Economist at CARE Ratings, told The Federal.

Rajan took a bold step against the rising NPAs and brought in policy changes that helped India handle its skyrocketing retail inflation. Retail inflation, or consumer price inflation, was around 10 per cent in 2013. He increased interest rates — the most common tool used by central banks in such situations — to keep the double-digit inflation under check. He brought down retail inflation from 9.8 per cent in September 2013 to 3.78 per cent in July 2015 — the lowest in three decades. Wholesale inflation came down from 6.1 per cent in September 2013 to a historic low of -4.05 per cent in July 2015. Inflation is considered the cruelest of taxes and it hurts the poor most.

His work relating to NPAs has since been carried forward by his successor at the RBI, Urjit Patel. “His war against borrowers who chose not to repay loans was probably the biggest move in the Indian banking history. Backed up by the Insolvency and Bankruptcy Code (IBC), the system has now moved towards more stable levels,” Sabnavis said.

Apart from these, Rajan addressed the issue of falling forex reserves in a novel way through the forex swaps mechanism, Sabnavis said, adding that Rajan steered the central bank through difficult times. As soon as he took over as RBI governor, he launched a scheme that lasted for 100 days and which made it cheaper for them to bring home foreign currency as deposits from NRIs. India’s forex reserves quickly rose and helped to avoid a crisis.

Is Rajan the better pick?

Rajan is known for turning around the fate of India’s economy when he took charge as the RBI governor. His work in three years gained the attention of many economists across the globe as he led the central bank during difficult times. Apart from leading India’s central bank, Rajan has served as Chief Economist at the International Monetary Fund (IMF), adding to his credibility to lead the BoE.

Rajan’s name has been floated as a potential candidate for the UK job because economists believe he could bring a global perspective to monetary policy as the UK gets ready to exit the European Union. Moreover, his previous experience in handling India’s economy at turbulent times may help him deal with Brexit.

BoE vs RBI

- What are the roles of a central bank?

- The central bank’s primary function is to control the money supply in the economy. Maintaining money supply in an economy is important because it helps in stabilising the value of a currency.

By decreasing the money supply, a central bank can prop up the value of its money and stop inflation.The central bank is responsible for issuing currency on behalf of the government. In addition to this primary function, it performs the following duties: - The central bank supervises the commercial banking system and ensures its smooth running. It keeps the cash reserves of the commercial banks, monitors inter-bank transactions and acts as a lender of last resort.

- It controls the currency and capital markets by regulating the supply of money and the interest rate.

- It is the custodian of foreign exchange and gold reserves. It also keeps a close check on the external value of the domestic currency and prevents its deterioration.

- It is the adviser to the government on all the monetary affairs. It is responsible for the formulation and implementation of the monetary policy.

- It checks the monetary stability that relates to maintaining stable prices of consumer goods by altering the interest rates.

- The central bank’s primary function is to control the money supply in the economy. Maintaining money supply in an economy is important because it helps in stabilising the value of a currency.

Broadly, the functions carried out by the central banks of India and the UK are similar, such as periodic MPC meetings to discuss the need to alter the interest rate and supervise open market operations, commercial banks, government securities market and money markets. In terms of managing financial stability, both the banks — BoE and RBI — have a dedicated committee to specifically look at the overall financial stability of the countries. These similarities may help Rajan grasp the financial situation of the UK faster and help steer it.

While the broader structure of functioning remains the same, there are areas where the banks function differently. For instance, the BoE gets involved in the resolution and management of failed financial firms to make sure the impact on the economy is kept to a minimum. However, in India, there is a separate body — Insolvency and Bankruptcy Board of India — to oversee insolvency proceedings. The RBI, however, may make amendments to the IBC.

Unbiased face

In the current Brexit climate, the UK requires an unbiased, independent leader who has fresh ideas and is prepared to stand by them. Rajan’s track record shows that he stood up against corruption across India’s banking system at great personal risk and political animosity. Despite facing hostility from some sections of the Bharatiya Janata Party, which disliked his liberal ideas on social cohesion and nationalism, Rajan delivered results within three years of his tenure.

Rajan’s selection may help the BoE retain its image as a truly independent central bank. Media reports suggest that most people are skeptical about this and think that another insider will get chosen.

BoE needs someone who will shake things up, but at the same time it is aware of the externalities associated with that disruption. If you are the betting type you must look at those odds offered for Rajan rather seriously. “He is a respected person and he has all the credentials to become the chief of the Bank of England,” KC Chakrabarty, former deputy governor, RBI, told The Federal.

(With inputs from Anupa Kujur)