RBI proposes plan to make UPI payments simpler for consumers

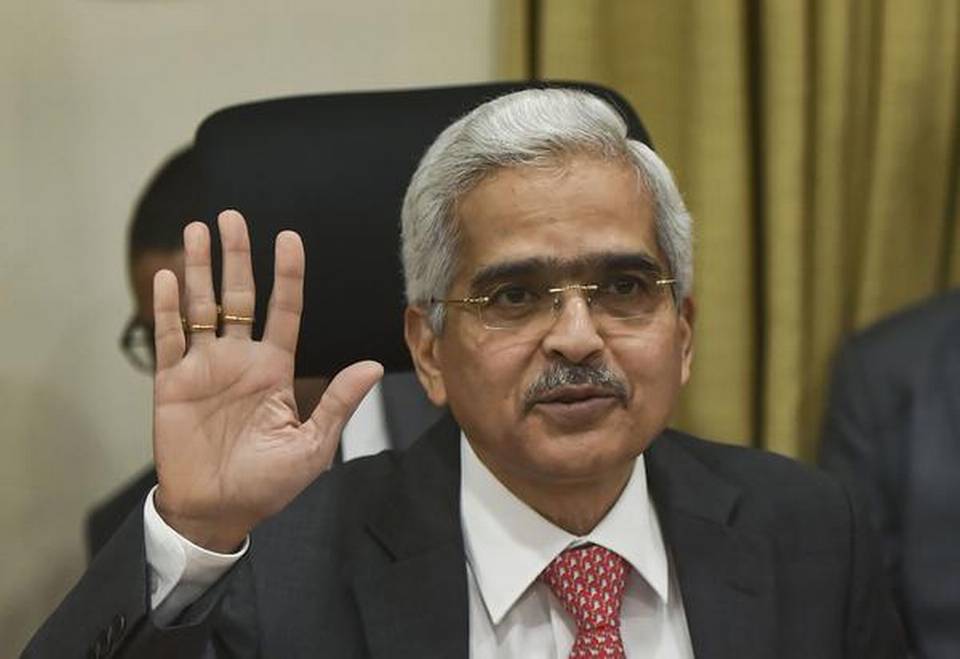

Reserve Bank of India (RBI) Governor Shaktikanta Das on Wednesday (November 8) announced the launch of digital payment systems for feature phones – basic phones that typically only provide voice calling and text messaging functionalities.

This means that the central bank will allow Unified Payments Interface-based (UPI) products on feature phones and an internet-free UPI payments system.

The governor proposed three measures to make UPI payments simpler for consumers.

Also read: Ease of use, pandemic give a leg up to UPI-based transactions

“In order to further deepen digital payments and make them more inclusive, ease transactions for consumers, facilitate greater participation of retail customers in various segments of the financial markets and enhance the capacity of service providers, it is proposed to launch UPI-based payment products for feature phone users leveraging on the Reserve Bank’s regulatory Sandbox on Retail Payments,” he said.

The governor also proposed to make the “process flow for small-value transactions simpler through a mechanism of ‘on-device’ wallet in UPI applications”.

The RBI also proposed to enhance the transaction limit for payments through UPI for the Retail Direct Scheme for investment in G-secs and initial public offering applications from ₹2 lakh to ₹5 lakh, Das noted in his statement at the MPC announcement.

Also read: e-RUPI explained: Digital payment without card or bank account

“Reserve Bank has been making efforts to facilitate greater participation of retail customers in financial markets, e.g. investment in the G-secs segment through the recent launch of Retail Direct Scheme, where UPI, in addition to other options such as internet banking, can be used to make payments for participating in both the primary and secondary markets. Over time, UPI has also become a popular payment option for initial public offerings since its availability from January 01, 2019. It is reported that IPO applications of ₹2 to ₹5 lakh constitute approximately 10 per cent of subscription applications. The transaction limit in the UPI was enhanced from ₹1 lakh to ₹2 lakh in March 2020. To further encourage the use of UPI by retail investors, it is proposed to enhance the transaction limit for payments through UPI for retail Direct Scheme and IPO applications from ₹2 lakh to ₹5 lakh,” read the RBI’s statement on developmental and regulatory policy.