RBI offers respite to small borrowers; banks told not to force KYC updation

The Reserve Bank of India on Wednesday has allowed loan restructuring for individual and small businesses hit hard by the second COVID-19 wave and told banks not to impose any punitive actions should be taken against customers for failure to update their KYC till December end.

The Reserve Bank of India on Wednesday has allowed loan restructuring for individual and small businesses hit hard by the second COVID-19 wave and told banks not to impose any punitive actions should be taken against customers for failure to update their KYC till December end.

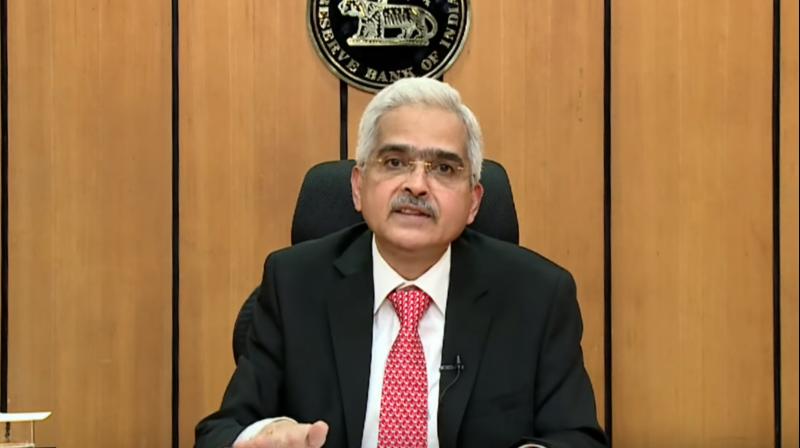

RBI has announced rationalisation of certain components of the know-your-customer (KYC) norms for enhancing customer convenience. “Keeping in view the COVID-related restrictions in various parts of the country, regulated entities are being advised that for the customer accounts where periodic KYC updating is due/pending, no punitive restriction on operations of customer account(s) shall be imposed till December 31, 2021,” RBI Governor Shaktikanta Das said while announcing a slew of measures to deal with the COVID pandemic.

Also read: What if there’s another lockdown? RBI report says it’ll be ‘unbearable’

With regard to restructuring, he said, borrowers that are individuals and micro, small and medium enterprises (MSMEs) having an aggregate exposure of up to ₹25 crore would be considered for the new scheme.

This would be for those who have not availed restructuring under any of the earlier frameworks, including the Resolution Framework 1.0 of RBI dated August 6, 2020, and who are classified as standard as on March 31, 2021, shall be eligible for the Resolution Framework 2.0, he said. Under the proposed framework, bank may be invoked up to September 30, and shall have to be implemented within 90 days after invocation, he added.

To augment supply of goods for COVID care, the central bank has opened a ₹50,000 crore on-tap window to ease access to emergency health services, to boost availability of immediate liquidity for ramping up COVID-19 related healthcare infrastructure and services in the country.

This liquidity window is being opened till March 31, 2022, he said, adding that under the scheme, banks can provide fresh lending support to a wide ranging of entities including vaccine manufacturers, importers and suppliers of vaccine and medical devices, hospitals and dispensaries and suppliers of oxygen and ventilators importers and also patients for treatment.

“Banks are being incentivised for quick delivery of credit under the scheme, through extension of priority sector classification to such lending…and these loans will continue to be classified under priority sector till repayment or maturity, whichever is earlier,” he said an unscheduled press briefing.

RBI has also introduced ₹10,000-crore special long-term repo operation for small finance banks. Under this, loans up to ₹10 lakh to MSMEs will be considered as priority sector lending, Das said.

Also read: From COVID’s ‘deep abyss’, economy reflating faster than expected: RBI

Das also announced relaxation in overdraft facility for state governments to enable them to better manage their fiscal situation in terms of their cash flows and market borrowing. Under this new rule, the maximum number of days of overdraft that are only in a quarter, have been increased from 36 to 50 days.

Henceforth, banks or regulated entities will not impose punitive restrictions on customers unless warranted due to any other reason or under instructions of any enforcement agency or court.

The RBI has also decided to extend the scope of video KYC (know-your-customer) or V-CIP (video-based customer identification process) for new categories of customers such as proprietorship firms, authorised signatories and beneficial owners of legal entities.

In his address, Das stressed that RBI stands in “battle readiness” to ensure that financial conditions remain congenial and markets continue to work efficiently. He said that they will work in close co-ordination with the government to “ameliorate” the extreme travails that citizens are undergoing in this hour of distress.

“We are committed to go unconventional and devise new responses as and when the situation demands. We must also stay focused on our future, which appears bright even at this juncture, with India set to emerge as one of the fastest growing economies in the world,” he said. The governor, further said the central bank will continue to be proactive throughout the year taking small and big steps to deal with the evolving situation.