Why FM’s ‘rupee not weak, dollar strong’ comment is not troll-worthy

When we pay more for petrol, we say fuel prices have shot up; when we pay more rupees for the same dollar, why do we say that the rupee has depreciated instead of saying the dollar has become costlier?

When the US dollar exchange rate breached ₹83, it resulted in a lot of hullabaloo. Many took it as an opportunity to criticise the government and the Reserve Bank of India (RBI), terming it as the weakness of the rupee. They said it happened because of the government’s wrong economic policies.

When Finance Minister Nirmala Sitharaman recently made a statement that the rupee had not become weak but the dollar had become strong, trolls and meme creators had a field day. We will try to dissect the subject objectively to understand the real position of the rupee in terms of the US dollar.

Demand and supply

The RBI issues the Indian rupee as the legal tender in the country. Currencies issued by any other entity are not legal tender in our country, and those can have only some exchange value. In other words, as commodities have some value in rupee, currencies other than the rupee have some value in rupee as well. This is what we call the exchange rate. If you can buy a litre of petrol for, say ₹100, you can buy a US dollar for ₹ 83 in the same way. Hence, any foreign currency is like a commodity for us.

When it is equivalent to a commodity, what decides its price? Naturally, it is demand and supply. Next, we may ask how the demand and supply of any foreign currency are decided. Factors affecting demand and supply of foreign currencies are the amount of import, export, and inward and outward remittances.

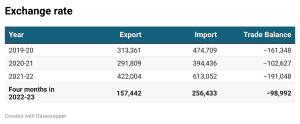

The following table provides the quantum of import and export India has undertaken over the past three years and the first four months of this year (in million dollars):

When the trade balance is in the negative, it means there is greater demand for foreign currency, according to the economic theory of demand and supply. The price of the dollar is then bound to go up. Our foreign trade is predominantly invoiced in US dollars.

Coming to remittances, traditionally, we get more inward remittances compared to outward remittances. That is how we can build our forex reserve. For example, we received $87,000 million in remittances in 2021. In FY21, the outward remittances were about $18,760.69 million, which increased to $19,610.77 million in FY22.

Inland inflation

As explained above, any foreign currency is like a commodity in our country. Hence, the price behaviour of forex will be like that of any commodity. Apart from the demand and supply for that foreign currency, the purchasing power of the rupee also matters for the exchange rate. The rupee’s purchasing power gets depreciated with inflation.

Also read: No collapse, rupee finding its natural course: FM Nirmala Sitharaman

The inflation rate in India between 2012 and today has been 80.55 per cent. The average annual inflation rate between these periods has been 6.09 per cent. That means ₹100 in 2012 is equivalent to ₹180.55 in 2022. In other words, the purchasing power of ₹100 in 2012 equals to that of ₹180.55 today.

The dollar-rupee exchange rate was around ₹51 in April 2012. When we apply the inflation rate in our country, it is equivalent to ₹92.08 now. Hence, we need not be perturbed by the weakness of the rupee against the dollar.

FM’s statement

People made fun of the Finance Minister’s statement, that the dollar had appreciated and the rupee had not depreciated. But when we read between the lines, we can understand it better.

For example, we were buying petrol at ₹75 per litre. Now, we are paying more than ₹100 per litre. We say “the price has increased.” No one says “the rupee’s purchasing power has depreciated.” But when we pay more rupees for the same dollar, why do we say that the rupee has depreciated instead of saying the dollar has become costlier? At the end of the day, whether the dollar appreciates or the rupee depreciates, the effect is the same. It is like the “half full or half empty glass” logic.

Also read: RBI needs to be more synchronised to curb inflation, says Nirmala Sitharaman

However, there is nothing unusual about politicising economic matters in the country. When the BJP was in the opposition, its leaders claimed that a fall in rupee indicated a fall in the economy’s strength. Now, it is the turn of the Congress to politicise the issue in the same way. Therefore, when Sitharaman says something like ‘it is not the rupee but the dollar that is misbehaving’, some people snigger.

RBI’s role

Successive RBI governors have explained time and again that the central bank does not want to maintain any particular exchange rate. All it tries to do is to avoid too much volatility in the exchange rate. Forex reserve is precious, and it should never be wasted to maintain any exchange rate.

There is also no mandate for the RBI to maintain any exchange rate, whereas it has got a targeted inflation rate. But recently, the RBI governor said at an event organised by the Fixed Income Money Markets and Derivatives Association of India, “Our intervention policy is to prevent excessive volatility in exchange rate, to anchor expectations around depreciation.”

Also read: RBI to launch e-rupee on pilot basis, releases concept note

A paper prepared by Rakesh Tripathy of the RBI, under the guidance of G Mahalingam and Harun R Khan, for the Emerging Markets Deputy Governors’ Meeting hosted by the Bank for International Settlements at Basel on February 21-22, 2013, summarised the following:

“The exchange rate of the rupee is determined largely by the market forces of demand and supply. The Reserve Bank of India has intervened occasionally to maintain orderly conditions and curb excessive volatility in the foreign exchange market. Being a current-account-deficit country, India is dependent on capital flows for financing the current account deficit. Given the dependence on volatile capital flows, there may be a case for augmenting forex reserves when the situation permits without any bias for a particular exchange rate band.”

No one can find fault with the above objective of the RBI, and the RBI cannot be expected to tinker with the exchange rates. Moreover, when the rupee depreciates, exporters will be benefited, and it will be an incentive to increase the export from our country.

(The writer is a retired banker)