Chinese checkers: Of conspiracy theories and economic realities

Conspiracy theories are flying think on social media and WhatsApp groups. Convoluted arguments are being made out on how China has used COVID-19, its latest export to the world, for potential global supremacy. Right out of a spy thriller some even include Russia and North Korea as the other two protagonists aligned against the US and Europe. So much so, we now also have reports of a $20 trillion class-action suit against China by a Washington-based advocacy group and a Texas company.

But is it as simple and straight forward? To understand this one needs to look at where China was before and after the epidemic declared a Pandemic by the World Health Organization (WHO), several months after it struck Wuhan.

From a gallop to trot

China at the turn of this decade was a far cry from what it was, say 15 years back, when it was clocking a growth rate close to 15%. Gradually this came down to 6.6% in 2018 and 6.5% in 2019. The International Monetary Fund (IMF) said this was further expected to fall to 5.5% by 2024.

China by choice embraced a slower pace of growth in pursuit of a new and more manageable economic model driven by innovation and local consumption rather than huge infrastructure build-up as in the past. Towards this it launched in 2015 the ‘Made in China 2025’ initiative with a thrust on 10 key sectors where it wanted to build technology and innovation-led capacity.

But skeptics suspected its main intent was to acquire IP through its innovation drive and investments in foreign companies and ultimately by locking out foreign investors in China to gain dominance on global markets. However, while China’s tech and consumer prowess is known, it is a fact that it is, and will be, an export led economy for a long time to come.

Despite China’s efforts to rebalance its economy towards internal demand from export supply it is still highly dependent on exports for growth. In 2019 the EU and the US, accounted for 17% each of its exports followed by Hong Kong and Japan with 11% and 6% respectively. India accounted for 3%. Nearly half the total exports were made up of machinery and transport equipment while electrical machinery and allied products accounted for 14%. But thanks to a trade war with the US, China’s exports in 2019 grew just 0.5%, a far cry from the 10% rise in 2018.

Related news: Coronavirus: The pandemic the world asked for

China had said in December it would target a lower 6% GDP growth rate for 2020. But this would still be enough to achieve the stated decadal goal of doubling China’s GDP and incomes. It would continue to infuse huge capital for infrastructure buildup to revive jobs and consumer buying during the year. For this local governments were to be allowed to issue some $430 billion worth bonds. However, cut to January 2020 and China was forced to recapitulate and settle for a truce with the US with the First Phase Trade Deal. Perhaps the Coronovirus was brewing and China knew about the potential impact with the first cases being reported in late December.

COVID rate of growth

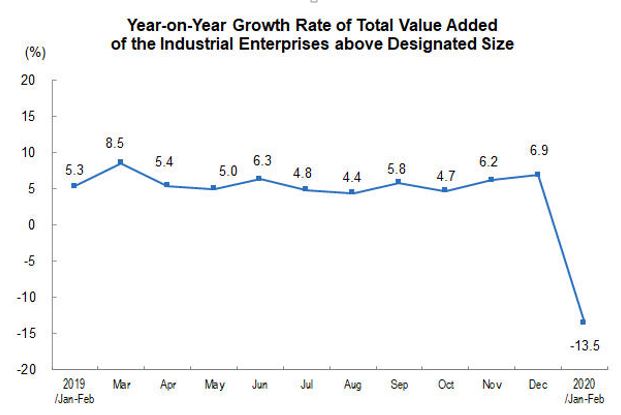

But few visualized a global event of this magnitude. The first to be hit by the SARS-CoV2 virus, what later came to be called the COVID-19, China reported huge drop in industrial output and investment in the first two months of this year. The impact of the factory shutdowns and lockdowns is such that for the first time since 1976, when the Cultural Revolution is said to have ended, the country could be reporting an economic contraction for the current quarter. Industrial production fell off the cliff with a 13.5% drop in the first two months from a growth of nearly 7% in December. Outlook downgrades followed with analysts pegging 2020 full year growth anywhere between 1.5% and 5% an unheard prospect for China to date.

Though China dealt with the Coronavirus with an iron fist and seems to have stemmed the virus, the success has come at an immense economic and human cost. Though large factories have begun reopening in China restarting the small and medium units which fuel them would be crucial. Going by reports, that still seems to be a struggle. Unemployment has jumped to 6.2% and consumption has dipped to an all time low with retail sales tumbling 20.5% from a year ago.

External linkages

Therefore, much would depend on how soon and how much China is able to restart its factories and get its workforce and consumers to start buying again. But that is easier said than done. For one, if China is to get its factories up and running, it would soon have to get its people to start buying, which they cannot do until the jobs are back in good numbers. Furthermore, no matter how much it would like to be an inward looking economy, it still needs the external markets to generate jobs internally. But both Europe and the US, its two biggest markets, will continue to reel under the COVID-19 impact for months and perhaps well into 2021. This means China will struggle to sell – a Catch 22 of sorts.

“The economic damage to China is severe, and its prospects for recovery even with massive financial support remain uncertain. Sustainably restoring China’s productive capacity in the coming weeks would require an unlikely revival of U.S. demand,” observed the Washington-based Carnegie Endowment in a note.

Related news: Coronavirus: Contagion now threatens the health of Indian economy

COVID-19 is not the SARS of 2003 or for that matter even the 2008-09 financial crisis, when the US and European markets were intact and supply chains undisturbed. The current pandemic is global and the US and EU are hit more than any other region. Lockdowns and loss of jobs, not to speak of loss of life, are taking a toll on the world from which it will take a long time to recover.

Ring fenced nations

But is China’s larger game plan to buy up businesses in the West at the current floor bottom prices? Reality could be quite different. While, the world will be a more restrictive place post-COVID-19 with barriers coming up to the movement of people and even investments, at least in the medium term, the resistance to Chinese investments has been rife for several years now.

Chinese global investments and construction activity have been on the wane since 2018 with state-controlled giants engaging in fewer transactions, points out the American Entrepreneurs Institute (AEI), which tracks Chinese investments across the globe. This could be on account of greater foreign hostility towards Chinese investment starting, but not limited to the US, it adds in its China Global Investment Tracker. Rather the Chinese investment footprint may not again approach the peak it had achieved in 2016. Overall investment in the first half of 2019 fell over 50% compared to first half 2018 reaching the 2011 level. Similar is the case with Chinese investments in Europe.

The conspiracy theories notwithstanding, the immediate priority for China in the aftermath of COVID-19 will be to correct its own shortcomings, particularly in healthcare and to address the economic fallout of the virus on its SME sector and create jobs for its citizens. If analysts are to be believed, this will take away Chinese attention from overseas investments for at least the next 12-24 months. Rather its attention may shift to opportunities closer home in Southeast Asia instead of the West.

(The writer is a Hyderabad-based journalist and has covered business and technology trends for the last three decades)

(The Federal seeks to present views and opinions from all sides of the spectrum. The information, ideas or opinions in the articles are of the author and do not reflect the views of The Federal.)