Retail inflation climbs to 6.01% in January, highest in seven months

India’s retail inflation climbed to 6.01 per cent in January on the back of rising consumer goods and telecom prices, and has crossed the upper limit of the Reserve Bank of India’s target range, showed government data on Monday (February 14).

The inflation, which is measured by the consumer price index (CPI), rose to 6.01 per cent in January, the highest in seven months, according to the data released by the Ministry of Statistics and Program Implementation. The CPI-based retail inflation in December 2021 was at a five-month high of 5.59 per cent from 4.91 per cent in November, mainly due to an uptick in food prices.

Inflation is going up across the world and the same is playing out in India. But price escalations have stayed relatively tame giving room for the central bank to leave interest rates unchanged for now. Though the prices of daily consumables like tea, cooking oil, pulses, among others, have gone up by 20 per cent to 40 per cent since the start of the COVID-19 pandemic.

Also read: FM says ‘complete harmony’ with Reserve Bank of India on cryptos

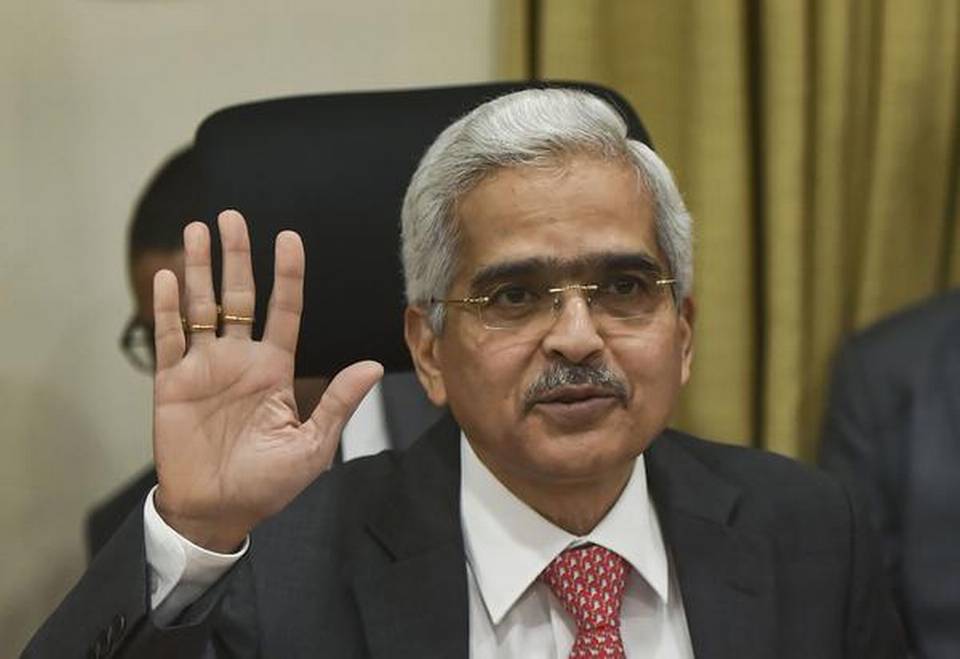

The RBI Governor Shaktikanta Das however said earlier on Monday that today’s inflation print should not surprise or create any alarm as it was expected to be around 6 per cent and they had taken this figure into consideration.

“… If you look at the momentum of inflation, right from October onwards, last October onwards, the momentum of inflation is on the downward slope,” Shaktikanta Das said, adding that the central bank would continue to strike a delicate balance between the need to contain price rise and ensure economic growth.

Last week, while releasing the last monetary policy for the current fiscal year, Das had said headline inflation is expected to peak in the fourth quarter of 2021-22 but it will be within the tolerance band. And then it is predicted to be moderate closer to target in the second half of 2022-23, which will help the monetary policy to remain “accommodative”.