Reliance buys REC Solar for $771 million in green energy push

Reliance plans to build solar capacity of at least 100 gigawatts (GW) by 2030, accounting for over a fifth of India’s target of installing 450 GW by the end of the decade

Reliance New Energy Solar Ltd (RNESL), a subsidiary of Reliance Industries Limited (RIL), on Sunday (October 10) announced acquisition of REC Solar Holdings for an enterprise value of $771 million from China National Bluestar (Group) Co Ltd.

Norwegian-headquartered REC Group is a leading solar energy company known for its high-efficiency, long-life solar cells and panels.

The purchase follows the June announcement by RIL – operator of the world’s biggest refining complex – that it would invest $10.1 billion in clean energy over three years.

Also read: Reliance eyes $300-million stake in Bengaluru-based Glance

Reliance plans to build solar capacity of at least 100 gigawatts (GW) by 2030, accounting for over a fifth of India’s target of installing 450 GW by the end of the decade.

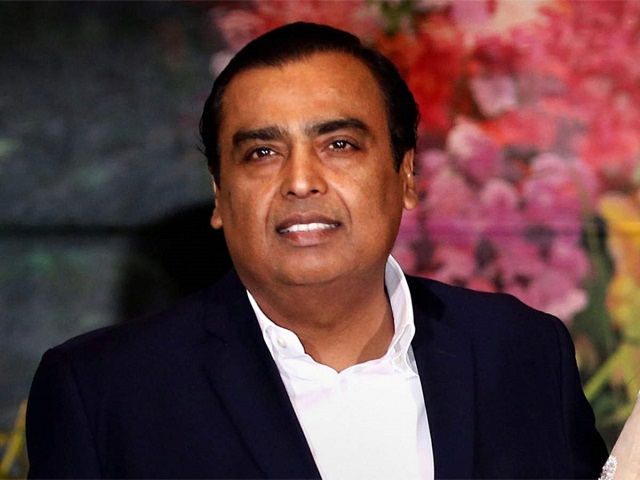

The group aims to build four “giga factories” in Jamnagar, Gujarat, to produce solar cells and modules, energy storage batteries, fuel cells and green hydrogen. As a part of the plan, the oil-to-telecom-to-retail conglomerate has already started developing Dhirubhai Ambani Green Energy Giga Complex over 5,000 acres in Jamnagar. “It will be amongst the largest integrated renewable energy manufacturing facilities in the world…,” RIL Chairman Mukesh Ambani had said while revealing the group’s green energy plan.

“Together with our other recent investments, Reliance is now ready to set up a global scale integrated photovoltaic giga factory and make India a manufacturing hub for lowest cost and highest efficiency solar panels,” Ambani said in a statement on Sunday.

RNESL said in August it would invest $50 million in US energy storage company Ambri Inc as part of a $144 million investment by RIL, along with billionaire Bill Gates, investment management firm Paulson & Co and others.