RBI hikes repo rate to 6.5%; projects inflation to fall to 5.3% in FY24

RBI Governor: Growth prospects in major economies have improved while inflation is on a descent; real GDP growth for 2023-24 is projected at 6.4%

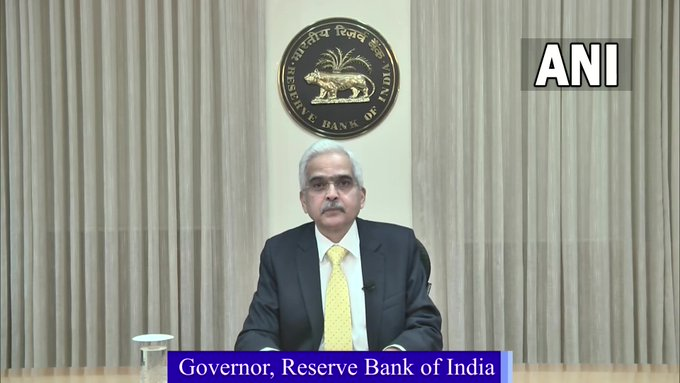

Reserve Bank of India (RBI) Governor Shaktikanta Das on Wednesday (February 8) announced that the central bank had increased the repo rate by 25 basis points to 6.5 per cent.

The Monetary Policy Committee has raised the repo rate — which is the rate at which the RBI lends money to commercial banks — from 6.25 per cent to 6.5 per cent. This is the sixth consecutive time the repo rate has been hiked.

The real GDP growth for 2023-24 is projected at 6.4% : RBI Governor @DasShaktikanta @RBI @FinMinIndia pic.twitter.com/hfgJ56SUCa

— Prasar Bharati News Services & Digital Platform (@PBNS_India) February 8, 2023

“Unprecedented events of the last three years have put to test monetary policy across the world. Emerging market economies are facing sharp trade-offs between supporting economic activity and controlling inflation while preserving policy credibility,” ANI quoted Das as saying.

Also read: Country’s banking system remains resilient and stable: RBI

The RBI chief said the global economic outlook does not look as grim as it did a few months ago.

“Growth prospects in major economies have improved while inflation is on a descent though inflation remains well above the target in major economies,” he added.

GDP growth projection

According to the central bank governor, inflation is expected to average 5.6 per cent in the fourth quarter of 2023-24.

“The Real GDP growth for 2023-24 is projected at 6.4 per cent with Q1 at 7.8 per cent, Q2 at 6.2 per cent, Q3 at 6 per cent and Q4 at 5.8 per cent,” Das said. He said the Indian rupee remained least volatile among its Asian peers in 2022 and so far this year.

Retail inflation to ease next fiscal

The RBI governor said retail inflation is projected to ease to 5.3 per cent in next fiscal from 6.5 per cent this year on assumptions of lower imported inflation, even though core inflation remains sticky.

The RBI’s inflation outlook for current fiscal has improved from 6.8 per cent projected earlier, to 6.5 per cent, on the back of steeper than expected decline in vegetable prices and Indian basket of crude at USD 95 a barrel.

“Looking ahead, while inflation is expected to moderate in 2023-24, it is likely to rule above the 4 per cent target. The outlook is clouded by continuing uncertainties from geopolitical tensions, global financial market volatility, rising non-oil commodity prices and volatile crude oil prices. At the same time, economic activity in India is expected to hold up well,” Das said.

Also read: Indian economy set to do better, inflation to be well-behaved: CEA

“…assuming an average crude oil price (Indian basket) of USD 95 per barrel, inflation is projected at 6.5 per cent in 2022-23, with Q4 at 5.7 per cent. On the assumption of a normal monsoon, CPI inflation is projected at 5.3 per cent for 2023-24, with Q1 at 5 per cent, Q2 at 5.4 per cent, Q3 at 5.4 per cent and Q4 at 5.6 per cent. The risks are evenly balanced,” Das said.

Consumer price index-based inflation in India moved below the upper tolerance level of 6 per cent during November-December 2022, driven by a strong decline in prices of vegetables. Core inflation, however, remains sticky, the RBI governor said.

UPI for travellers from G20 countries

The RBI chief also announced the proposal to permit all inbound travellers to use UPI payments for their merchant payments while they are in the country. “To begin with, this facility will be extended to travellers from G20 countries arriving at select international airports,” he said.

Also read: Now NRIs from 10 countries can make payments through UPI, here’s how

(With inputs from agencies)