SBI wasting Indian taxpayers' money on UK legal fees: Mallya

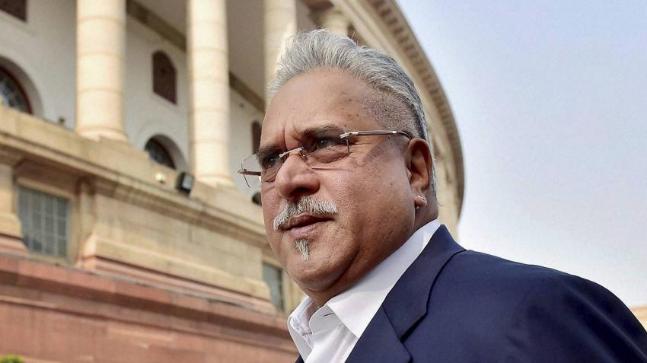

Embattled liquor tycoon Vijay Mallya once again used social media to reiterate his offer to pay back the debt owed to public sector banks in India, this time targeting the State Bank of India (SBI) for allegedly wasting Indian taxpayers money on expensive legal fees in the UK.

Days after a UK High Court judge refused to dismiss an interim order freezing nearly £260,000 in one of his London bank accounts, the 63-year-old issued a string of statements on Twitter to allege that the SBI-led consortium of PSU banks were wrongly going after him in the UK courts.

“SBI Lawyers in UK making presentations on their accomplishments against me. Indian Tax payers cost. Despite full recovery in India confirmed by the Prime Minister himself,” he tweeted on Friday (April 19).

His statements were illustrated with a series of document screenshots showing TLT LLP, the bank’s law firm, hailing its victory in the £1.142-billion worldwide freezing order judgment in their favour last May.

“SBI UK Lawyers in self-promotion at Indian public cost. SBI must answer,” reads Mallya’s tweet. In his characteristic style, the media was once again at the receiving end of the former Kingfisher Airlines boss’ social media comments.

He noted: “Whilst media love sensational headlines, why doesn’t anybody ask the PSU State Bank of India under RTI [Right to Information] on how much they are spending on legal fees trying to recover money from me in the UK when I have offered 100 per cent payback in India.”

“To substantiate my point, assets belonging to me in the UK were sold and the costs of sale were almost 50 per cent of value. The remaining assets yet to be sold wont cover legal costs. So whats this all about? To enrich UK Lawyers? SBI please answer.”

On April 17, Mallya had made another reference to Prime Minister Narendra Modi’s interview from last month, in which he had claimed that the government had recovered assets worth ₹14,000 crore related to the now-defunct airlines loan defaults. Mallya is wanted in India on charges of fraud and money laundering amounting to an alleged ₹9,000 crore.

The series of statements follow a ruling by Master David Cook, a judge in the Queens Bench Division of the Royal Courts of Justice in London earlier this week, which went against Mallya. Master Cook ruled that an interim debt order in favour of SBI and other banks seeking access to funds in Mallya’s ICICI UK bank account should remain in force.

However, the application to make it final has been adjourned until after the hearing of Mallya’s pending bankruptcy petition, expected by the end of this year. The funds held in the account £258,559.79 will meanwhile remain frozen as part of the worldwide freezing order in favor of the Indian banks last year.

Mallya’s lawyers had argued for the dismissal of the interim order on a number of grounds, including a claim that it was a deliberate ploy to prevent Mallya reasonable court-sanctioned living expenses.

However, the judge rejected the assertion and noted that the Indian banks are within their rights to discover the true extent of Mallya’s assets in order to recover the estimated £1.142 billion owed to them, arising from proceedings in the Bangalore Debt Recovery Tribunal (DRT) against Kingfisher Airlines and others. The DRT case was registered in the UK under the Foreign Judgments (Reciprocal Enforcement) Act 1933 and went in favour of the Indian banks in an appeal in May 2018.

The banks — SBI, Bank of Baroda, Corporation bank, Federal Bank Ltd, IDBI Bank, Indian Overseas Bank, Jammu & Kashmir Bank, Punjab & Sind Bank, Punjab National Bank, State Bank of Mysore, UCO Bank, United Bank of India and JM Financial Asset Reconstruction Co. Pvt Ltd — have since also filed a bankruptcy petition against Mallya, which is being challenged by the former Kingfisher Airlines boss and is expected to come up for hearing around December this year.

TLT LLP, the law firm acting for the Indian banks, has been pursuing a series of court orders in the UK courts as part of efforts to enforce last years High Court judgment in favour of the banks.

Meanwhile, Mallya remains on bail after his extradition was signed off by UK home secretary Sajid Javid in February and is seeking leave to appeal against that order in the UK High Court. An oral hearing on his appeal renewal application is expected in the coming weeks.