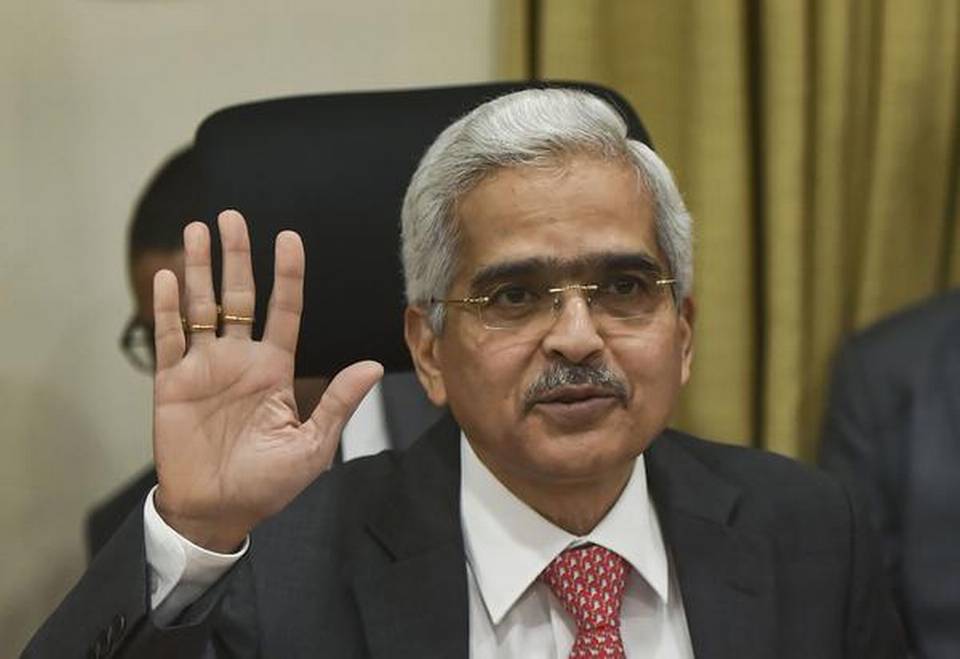

Invest in crypto at your own risk, cautions RBI Governor Shaktikanta Das

Days after the Indian government announced a 30% tax on cryptocurrency trade, RBI Governor Shaktikanta Das on Thursday reiterated the threat to the sector and warned investors that they are investing in the digital currency at their own risk.

Days after the Indian government announced a 30% tax on cryptocurrency trade, RBI Governor Shaktikanta Das on Thursday reiterated the threat to the sector and warned investors that they are investing in the digital currency at their own risk.

“Private cryptocurrencies or whatever name you call it are a threat to our macroeconomic stability and financial stability. They will undermine the RBI’s ability to deal with issues of financial stability and macroeconomic stability,” Das told reporters.

Das warned that investment in cryptocurrencies and NFTs or such assets have no underlying value whatsoever, not even a tulip.

“It can be noted that the tulip mania of the 17th century is often cited as a classic example of a financial bubble, where the price of something goes up, not due to intrinsic value but because of speculators wanting to make a profit by selling a bulb of the exotic flower,” he said.

Also read: Decrypting what we know about the legitimacy of cryptocurrencies so far

“The Reserve Bank of India as the central bank of this country which is entrusted with the responsibility of maintaining financial stability, after due internal deliberations says that there are serious concerns over macroeconomic and financial stability. There are deeper issues which need much deeper discussion,” Das later told a conclave hosted by SBI.

His comments come after several rounds of deliberation within the government over the use of cryptocurrencies. Prime Minister Narendra Modi was part of one such meeting earlier.

A standing committee on finance had in November based on experts’ views said that as cryptocurrencies cannot be stopped, proper mechanisms should be put in place to regulate it.

After long deliberations, Finance Minister Nirmala Sitharaman had announced in the Union Budget a 30 per cent tax on gains made on digital assets, which gave an indirect legitimisation to the trade.

As the economy is recovering from the Covid shock, Das also said that banks need to be ready to ensure investment for high productive sectors.

“It is incumbent upon a competitive and efficient financial system to identify high productive sectors and reallocate resources to harness the growth opportunities,” he said. “Banks, in particular, should be investment ready when the investment cycle picks up.”