IBC report card: It's win some, lose some for the bankruptcy law

About 47% of the CIRPs that were closed yielded orders for liquidation, as compared to 14% ending up with a resolution plan, according to IBBI data

It has been just over six years since the Insolvency and Bankruptcy Code, 2016 (IBC) was enacted to consolidate the laws relating to reorganisation and insolvency resolution in India.

The IBC is the umbrella legislation for insolvency resolution of all entities in India – both corporate and individuals. The law came into force on December 1, 2016. Prior to the IBC, the insolvency and bankruptcy laws in India were multi-layered and fragmented.

Also read: Home buyers in the lurch after real estate firm Supertech faces insolvency

In view of the COVID crisis, the government had suspended the IBC for a year, from March 2000 to March 2021.

‘Gamechanger’

Last year, IBC was hailed as a “gamechanger reform” by Union Commerce Minister Piyush Goyal. He said IBC has been the “most successful law” in insolvency resolution in the country. According to him, after IBC was enacted, India’s rank in the ‘Resolving Insolvency’ indicator improved drastically.

“Since the enactment of IBC, India’s rank in ‘Resolving Insolvency’ indicator in World Bank’s Ease of Doing Business Report has seen a meteoric rise of 84 places! Our recovery rate has also dramatically improved from 26 (cents on dollar) to 71.6 (cents on dollar),” Goyal said in November 2021 while addressing the 5th Foundation Day function of the Indian Institute of Insolvency Professionals of ICAI (IIIPI).

Also read: Bank of India moves NCLT against Future Retail, files insolvency plea

This March, the Finance Ministry said the corporate insolvency resolution process (CIRP) under the IBC was initiated by banks in the 12 large accounts that were referred by the Reserved Bank of India (RBI).

“Financial creditors had aggregate outstanding claims of ₹3.45 lakh crore against these corporate debtors. With regard to resolution and settlement in these accounts, the eight corporate debtors, which were resolved through the market-driven CIRP, owed a total of ₹2.26 lakh crore to financial creditors while their liquidation value was ₹0.52 lakh crore. Further, realisable value for financial creditors through the approved resolution plans was ₹1.16 lakh crore, which is 221% of the liquidation value and 51 % of the admitted claims,” Union Minister of State for Finance Dr. Bhagwat Kisanrao Karad had told the Rajya Sabha.

The case numbers

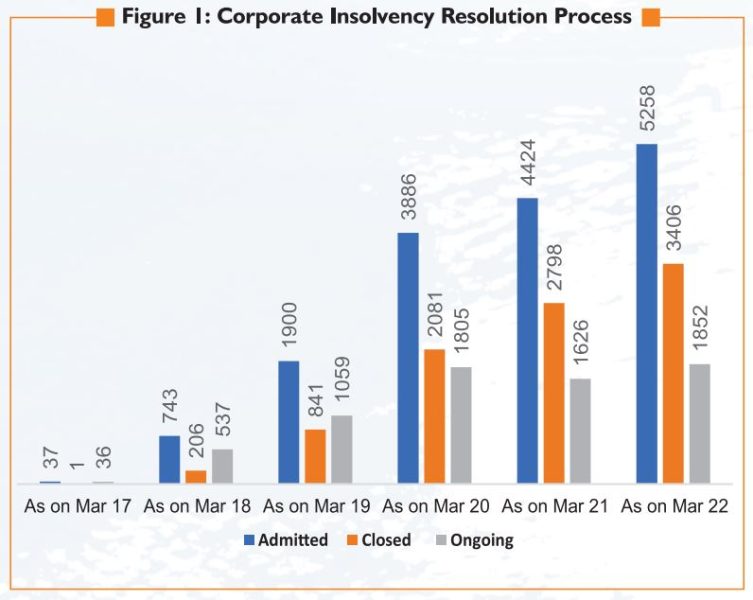

According to Insolvency and Bankruptcy Board of India (IBBI) data released in March, since IBC came into effect on December 1, 2016, a total of 5,258 CIRPs have commenced, as of March-end, 2022. Of these, 3,406 have been closed. Of the CIRPs closed, 731 have been closed on appeal or review or settled, 586 have been withdrawn, 1,609 have ended in orders for liquidation, and 480 have ended in approval of resolution plans.

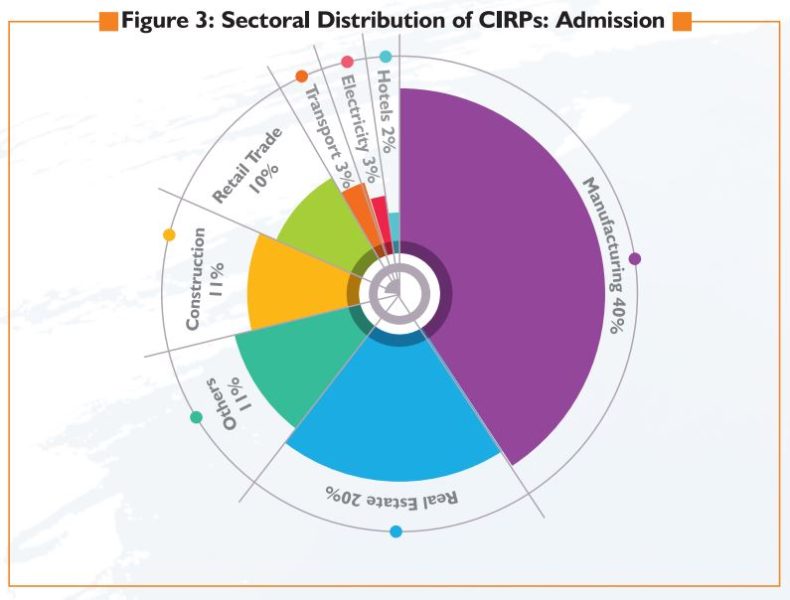

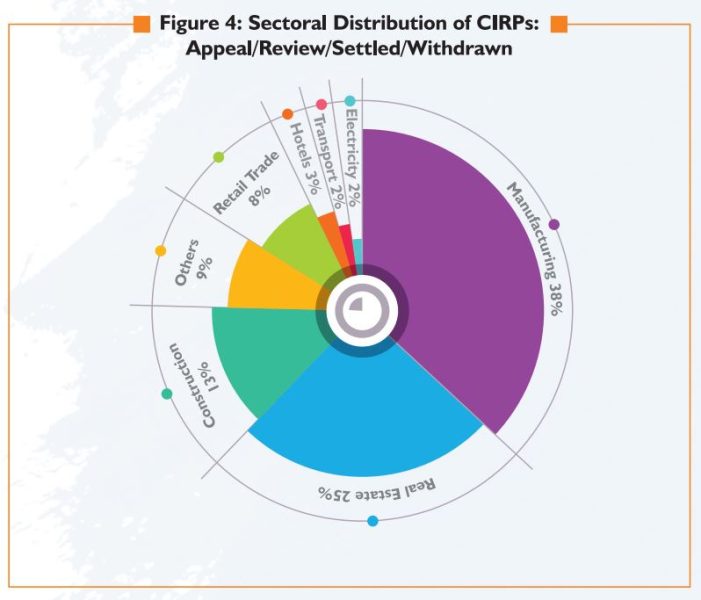

Among the CIRP cases admitted, the manufacturing sector had the highest at 40%, followed by real estate at 20%. The construction sector saw 11% cases and retail trade was next at 10%.

Also read: Chennai firm that made headlines with $4 billion funding faces insolvency

Only nine cases out of 223 debt-laden real estate companies admitted for resolution under the IBC until September 2021 have been resolved, a study by advisory firm Grant Thornton Bharat revealed. This represents just 4% of cases accepted, compared to overall resolution rate of 9% under IBC, it said, according to an Economic Times report.

“Operational creditors (OCs) triggered 51.33% of the CIRPs, followed by 42.53% of financial creditors (FCs) and remaining by the corporate debtors (CDs). However, about 80% of CIRPs having an underlying default of less than ₹1 crore were initiated on applications by OCs while about 80% of CIRPs having an underlying default of more than ₹10 crore were initiated on application by FCs. The share of CIRPs initiated by CD is declining over time. They usually initiated CIRPs with very high underlying defaults,” the IBBI said.

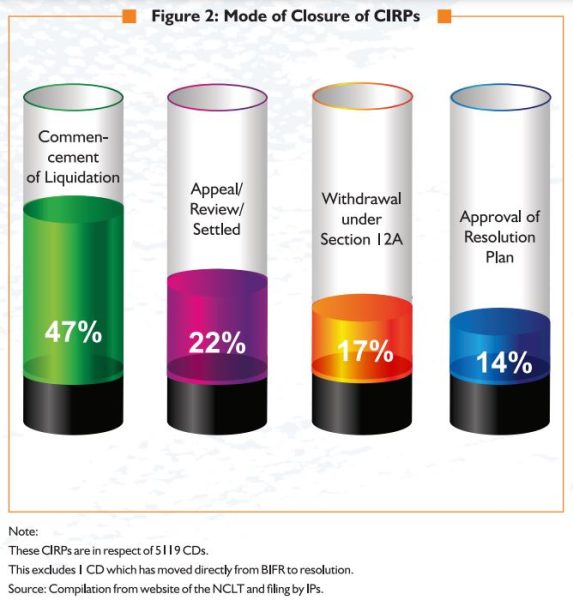

About 47% of the CIRPs, which were closed, yielded orders for liquidation, as compared to 14% ending up with a resolution plan. However, 76% of the CIRPs ending in liquidation (1,196 out of 1,581 for which data is available) were earlier with Board for Industrial and Financial Reconstruction (BIFR) and/or defunct.

“The economic value in most of these CDs had almost completely eroded even before they were admitted into CIRP. These CDs had assets, on average, valued at less than 8% of the outstanding debt amount,” the IBBI stated.

Also read: Future Enterprises to raise Rs 3,000 cr from insurance biz sale; aims to pare debt, avoid insolvency

Till March 31, 2022, a total of 586 CIRPs have been withdrawn due to settlements. Almost three-fourths of these CIRPs had claims of less than ₹10 crore. During January-March 2022, 29 CIRPs yielded resolution plans with different degrees of realisation as compared to the liquidation value.

Resolution plans realised ₹2.34 lakh crore

The 1,609 CDs ending up with orders for liquidation had an aggregate claim of ₹7.95 lakh crore. However, they had assets, on the ground, valued at only at ₹0.56 lakh crore. Till March 2022, 328 CDs have been completely liquidated.

The 480 CIRPs, which have yielded resolution plans by the end of March 2022 took on average 450 days (after excluding the time excluded by the adjudicating authority) for conclusion of the process. Similarly, the 1,609 CIRPs, which ended up in orders for liquidation, took on average 412 days for the conclusion. Further, 328 liquidation processes, which have closed by submission of final reports took on average 456 days for closure. Similarly, 644 voluntary liquidation processes, which have closed by submission of final reports, took on average 422 days of closure.

Till December 2021, 19,803 applications for initiation of CIRPs of CDs having underlying default of ₹6,09,470.72 crore were resolved before their admission.

Till March 2022, a total of 480 CIRPs have yielded resolution plans. The cost details are available in respect of 455 CIRPs. The cost works out on average 1.17% of liquidation value and 0.62% of resolution value.

The realisable value of the assets available with 480 CDs rescued, when they entered the CIRP, was only ₹1.31 lakh crore, though they owned ₹7.61 lakh crore to creditors. The resolution plans realised ₹2.34 lakh crore, which is around 178% of the liquidation value of these CDs, the official data showed.

Rescuing corporate debtors in distress

The IBBI said the primary objective of the Code is to rescue lives of CDs in distress. The Code has rescued 480 CDs till March 2022 through resolution plans one-third of which were in deep distress.

However, it has referred 1,609 CDs for liquidation. The CDs rescued and assets valued at ₹1.31 crore, while the CDs referred for liquidation had assets valued at ₹0.56 lakh crore when they were admitted to CIRP. Thus, in value terms, around 70% of distressed assets were rescued. Of the CDs sent for liquidation, three-fourth were either sick or defunct and of the firms rescued, one-third were either sick or defunct, the data showed.

In last August, Union minister of State for Corporate Affairs Rao Inderjit Singh informed the Rajya Sabha that as of 30 June 2021, 4,540 companies were admitted into CIRP under the IBC.

Giving details on the resolution status, the minister stated that 394 companies were resolved till 30 June 2021 wherein financial creditors (FCs) including financial institutions, had total claims amounting to ₹6.80 lakh crore, out of which ₹2.45 lakh crore have been realised, which is 36% of their claims.

The minister further stated that the insolvency resolution process of the corporate debtor (CD) is market-driven and the outcome depends on market forces which varies from case to case and sector to sector. The value realised by creditors depends on available assets at the stage of admission of the case under the Code.

Those that bounced back

There are some companies that have bounced back after being acquired under IBC, including Uttam Galva Metallics Limited (UGML) and Uttam Value Steels Limited (UVSL).

“In under 12 months of being acquired under the Insolvency and Bankruptcy Code (IBC) by Nithia Capital (Nithia) – a global investments firm specialising in industrial turnaround – Uttam Galva Metallics Limited (UGML) and Uttam Value Steels Limited (UVSL) has secured a positive ‘A; STABLE’ rating by CARE Rating, India,” UVSL said in December 2021.

Nithia and CarVal Investors completed the acquisition of UGML and UVSL for in excess of ₹2,000 crore in early 2021 after securing the approval of the National Company Law Appellate Tribunal (NCLAT).