RJio’s move to charge for calls may force other operators to raise tariffs

One of the biggest brand promises made by Mukesh Ambani while launching Reliance Jio Infocomm (RJio) three years back was that subscribers would never again have to pay a penny to make or receive calls on the RJio network.

Of course, Asia’s richest man also promised unprecedented data speeds and other firsts, but the prospect of never again having to pay for a call became an industry benchmark from then on. So when RJio announced on Wednesday that it will now charge six paise per minute for each outgoing call to other networks, Ambani seemed to have gone back on his memorable promise.

Does it create a trust deficit between RJio’s subscribers and the most aggressive mobile services provider? And will RJio subscribers now lessen their outgoing calls to other networks?

Also read: Jio to charge users 6 paisa/min in view of TRAI’s review of IUC regime

Analysts at brokerage Edelweiss said in a note that they viewed this decision “as a circuitous price hike that may not go down well with subscribers and may prompt a behavioural change among RJio subscribers, discouraging them from making off-net calls.”

Behaviour change refers to typical Indian practice where people would make missed calls from other network phones such as Airtel or Vodafone to Jio network and expect the recipient to call back because the calls are free and the consumers did not have to pay inter-connect charges when calls are transmitted from one Jio network to other networks also referred to as “off-net” calls.

Edelweiss noted that RJio will recover the IUC (interconnect usage charge) for off-net calls from its subscribers at 6 paise/minute via a separate recharge voucher and compensate for the hike by offering an equivalent value of data, signaling no effective change in tariffs for subscribers.

In a statement, RJio said that this practice will continue “till such time that TRAI (Telecom Regulatory Authority of India) moves to zero termination charge regime. Presently, this date is 1 January, 2020.” However, even after this charge has been imposed on outgoing calls to other networks, calls from an RJio number to another RJio number remain free; all incoming calls, calls from RJio network to landlines and calls made using WhatsApp or FaceTime and similar platforms also remain free.

The stated reason for this sudden reversal of lifetime free voice calls policy by RJIo is an indication that the IUC regime, which was earlier thought to be phased out by January 1, 2020, may continue beyond that cut-off date.

In 2017, after intense lobbying for and against removal of the IUC, the TRAI had cut the IUC rate from prevailing 14 paise per minute to 6 paise per minute and had also set January 1, 2020, as sunset date for IUC to become zero. But last month, it again sought industry views on whether this date needed to change, prompting the tariff hike by RJio now.

What is interconnect usage charge?

In simple terms, IUC is a charge that a network pays for calls originating on it to be connected on a competing network. So when an RJio user makes a call to, say, an Airtel number, Airtel has to be paid six paise per minute by RJio for the call to get through. This is the charge that RJIo now wants to recover from subscribers.

RJio has said that it relied on TRAI’s stance of removing the IUC by the 2020 deadline and continued to pay IUC from its own resources to Airtel and Vodafone-Idea while offering free voice services to subscribers.

In the last three years “RJio has paid nearly Rs 13,500 crore as NET IUC charges to the other operators.” That works out to almost Rs 12.3 crore IUC payable by RJio to competing networks every single day in these three years.

RJio’s decision “baffling”

Analysts at brokerage Kotak Institutional Equities termed RJio’s decision “baffling”. They said “we aren’t in sync with RJio’s views of having paid IUC from its own resources while offering free voice to its customers. Of the bundled price paid by a customer, any attribution to voice, data, off-out IUC recovery is an arbitrary one. The other aspect we find equally puzzling is the mode chosen to recover the off-out IUC instance. It is in the form of IUC top-up vouchers ranging from Rs 10 (124 minutes off-out allowance; no validity) to Rs 100 (1,362 minutes off-out allowance). In effect, RJio is making an additional recharge compulsory for off-out calling. This dilutes the ‘simplicity’ proposition of RJio’s pricing architecture, one of the most critical changes RJio brought to the industry”. Most subscribers are going to view the compulsory IUC top-up voucher as an additional spend for no incremental value.

Meanwhile, RJio further claimed that the price differential of free voice on RJio network and exorbitantly high tariffs on 2G networks (of competitors) caused the 35 – 40 crore 2G customers of Airtel and Vodafone-Idea to give missed calls to RJio customers daily. “The 25-30 crore missed calls per day should have resulted in 65-75 crore minutes of incoming traffic to RJio. Instead, the callbacks made by the RJio customers result in 65-75 crore minutes of outgoing traffic.”

Next challenge

So what are RJio’s competitors expected to do now? They are widely expected to also raise tariffs even if not in the manner that RJio has adopted, since Airtel, Vodafone-Idea may see a drop in incoming calls from RJio network now.

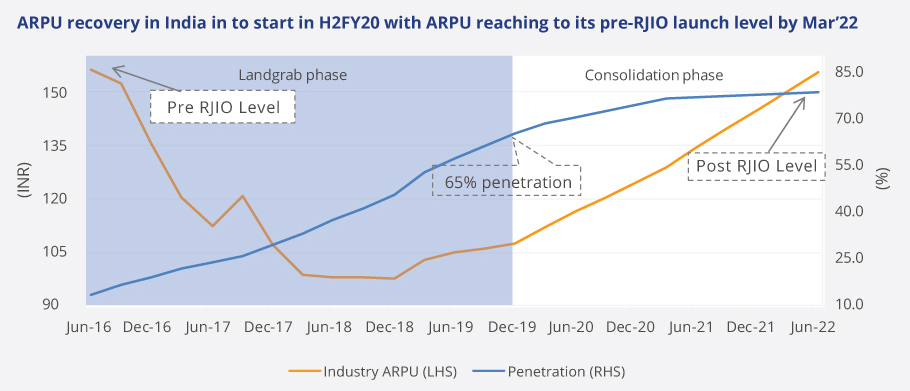

Analysts at Edelweiss said, “We believe RJio’s tariff hike is prima facie positive for the industry as it enables other operators to raise tariffs too. Other operators may not take the price hike in the same form though considering its potential negative effect on user experience.

Other operators may see a drop in calls terminating on their networks, but the tariff hike should be able to compensate for it well. We are already building in 4% higher Q4FY20 (January-March 2020) ARPU (average revenue per user) for Bharti and Vodafone Idea than Q1FY20.”

Also read: Airtel, Vodafone shares rise after Jio’s move on call connect charges

Why IUC is such a big bone of contention between Indian telecom operators is obvious: analysts at brokerage Jefferies had noted earlier that IUC accounted for as much as 30% EBITDA for Vodafone-Idea combine, 5% for Bharti Airtel while IUC accounted for an almost 18% drag on RJio. So if IUC continues beyond January 1, the incumbents will continue to benefit while RJIo will continue to lose revenue.

Bharti Airtel said in a statement that the telecom industry “is in a state of deep financial stress since the last three years with several operators having gone bankrupt and thousands of jobs having being lost. The IUC is determined based on the cost per call. Given the massive 2G customer base in India the cost of the call at 6 paise is already significantly below the real cost of completing the call.”

As telecom service providers slug it out, subscribers will obviously have to bear additional cost burden.