- Home

- News

- Analysis

- States

- Perspective

- Videos

- Education

- Entertainment

- Elections

- World Cup 2023

- Features

- Health

- Business

- Series

- Economy Series

- Earth Day

- Kashmir’s Frozen Turbulence

- India@75

- The legend of Ramjanmabhoomi

- Liberalisation@30

- How to tame a dragon

- Celebrating biodiversity

- Farm Matters

- 50 days of solitude

- Bringing Migrants Home

- Budget 2020

- Jharkhand Votes

- The Federal Investigates

- The Federal Impact

- Vanishing Sand

- Gandhi @ 150

- Andhra Today

- Field report

- Operation Gulmarg

- Pandemic @1 Mn in India

- The Federal Year-End

- The Zero Year

- Premium

- Science

- Brand studio

- Home

- NewsNews

- Analysis

- StatesStates

- PerspectivePerspective

- VideosVideos

- Entertainment

- ElectionsElections

- Sports

- Loading...

Sports - Features

- BusinessBusiness

- Premium

- Loading...

Premium

Your tea or mine? Why Nepal tea is ‘stronger’ than Darjeeling tea

“Chaaya khanu hunchha? [Will you have tea].” Udaya Chapagain has been posing this question over the years to every visitor to his house or office. The time of the day notwithstanding, almost all visitors have promptly said, “Ekdum khanchhu [certainly will have it].” After all, as Nepal’s leading tea planter, Chapagain has had with him the finest tea that Nepal produces. But these...

“Chaaya khanu hunchha? [Will you have tea].”

Udaya Chapagain has been posing this question over the years to every visitor to his house or office.

The time of the day notwithstanding, almost all visitors have promptly said, “Ekdum khanchhu [certainly will have it].”

After all, as Nepal’s leading tea planter, Chapagain has had with him the finest tea that Nepal produces.

But these days, forget asking people for tea, Chapagain is unable to offer orthodox tea to even those asking him for it.

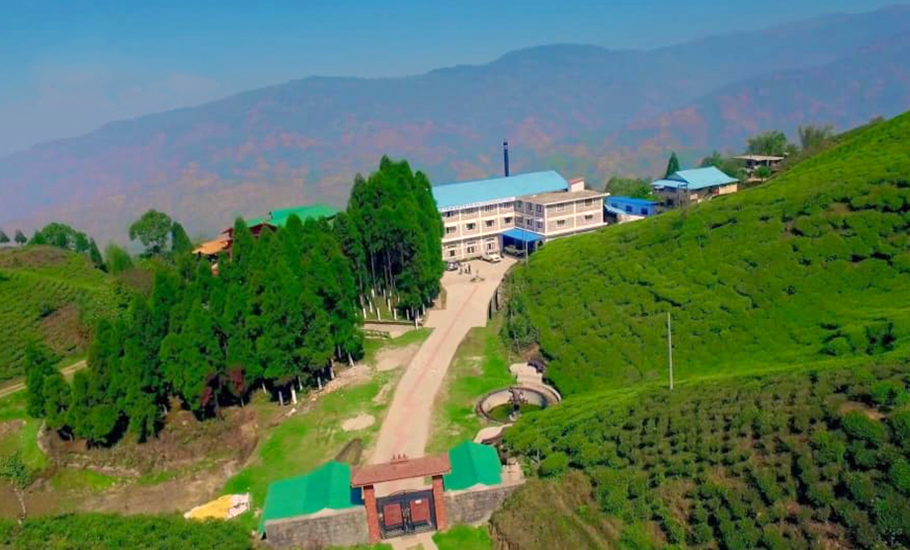

“My entire stock of orthodox tea has been bought by TeeGschwendner, a German chain of retail shops and European bistros, which sells loose leaf tea and tea accessories, this season. I am unable to offer friends even a small pouch of a few hundred grams. I feel truly sorry,” says Chapagain, who runs Gorkha Tea Estate, a multi-co-operative organic tea factory in Ilam, which produces some of the best orthodox whole leaf tea that Nepal has to offer.

Chapagain’s estate produces 60,000 kg of quality tea and sells it under ‘Sundarpani’ brand in five countries. While people may not find orthodox tea at Chapagain’s house, they can find it at Kancha-Kanchi, a Nepali tea stall, opposite the iconic Eiffel Tower in Paris.

Nepal produces between 6 and 7 million kilograms of orthodox tea every year, which almost matches the production of Darjeeling at 6.5 million kg. Some foreign buyers, like the Germans, prefer Nepalese tea over that grown in Darjeeling.

Nepal’s total annual tea output includes 20 million kg of crush, tear, curl (CTC) tea and 7 million kg of orthodox leaf tea. Nearly 12 million kg of CTC and 1 million kg of leaf tea is consumed domestically in the Himalayan country. Much of the rest is exported to India — but Nepal’s tea export is a minuscule 1 per cent of India’s annual tea production of 1,400 million kg.

Increasingly, however, Nepali tea planters like Chapagain are turning to the West and far East for high paying markets, taking up the challenge of “offering premium buyers better tea than Darjeeling can offer”.

“Unlike Darjeeling, where the British developed a large plantation culture on corporate lines, much of Nepal’s quality tea comes from smaller gardens,” Chapagain tells The Federal. “The small growers treat the tea bushes like their children. Strong micro-management and absence of pollution is the reason behind the high quality tea we manage to produce now.”

In Darjeeling, on the other hand, the skilled work of overseeing a tea estate’s production, which was once considered a prestigious career for Indians has been losing its sheen over the decades. Disputes with labour unions have also continue to hit production from time to time.

The brimming cup

Nepal, on its part, is witnessing a boom in the tea sector.

Chapagain challenges the widely held view in plantation circles that quality can only be ensured by a highly efficient corporate culture. “The Darjeeling bushes are 100 to 200 years old, while the Nepal tea bushes are barely 40 years old, which leads to better yield without having to use chemical fertilisers,” says Chapagain.

In Darjeeling, the corporate drive to boost yield and production has led to rampant use of chemical fertilisers that leave much residue in made teas. That, in turn, has driven down the acceptability of Darjeeling tea varieties in markets such as Europe and East Asia, where quality and health considerations run high.

“That explains why many premium tea buyers in Europe are turning to Nepal,” says Udaya Chapagain.

His friend HN Koirala, who also owns a tea garden, said, “There was an organised campaign against Nepal tea that it was not as good as Darjeeling. Now, that has been proven wrong because premium buyers put our tea through extensive tasting and quality control tests before they buy them.”

Other Nepali planters claim a large part of Nepal tea is imported by Indian producers to blend with their own tea. “If our tea is not as good as theirs, why will they import our stuff for blending,” says planter Koirala. “All our tea is exported to India after testing at government food testing labs as per FSSAI standards.”

The angst among Nepali planters, over what they think is an unfair campaign against teas grown and processed in the Himalayan country, adds to bitterness and suspicion that has cast shadows on bilateral relations with India.

“We are a proud martial people, we will never be a satellite of either China or India but we do have very strong cultural connect to India and see the nation as a dear friend. We want this friend to be big-hearted,” says planter Chapagain.

Nepal’s teas have been adjudged the best in many international competitions, one recently in China. The International Tea Competition held in China, where Nepal won several gold medals, was organised by China Tea Marketing Association in September 2022, under the ‘Second World Black Tea Quality Evaluation Competition’ in Fujian Province Fuan City.

“Darjeeling was a global brand promoted by the British, so it had a huge head start but we are fast catching up because our soil is virgin and our bushes are young,” said Suresh Kumar Agarwal, president of Nepal Tea Planters Association.

“We are health conscious people and our government has implemented a complete ban on import of hazardous chemicals. Ultimately, the Nepal government aims to convert our entire tea output into organic,” said Agarwal.

He lashed out at recent reports questioning the quality of Nepal’s tea. “Our teas have rarely failed quality control tests anywhere, be it Japan, Europe or India,” he says.

Meanwhile, planters like Chapagain say the cost of producing quality tea is nearly 30 per cent lower for them than Darjeeling because the soil is virgin and requirement of fertilizer is much less.

How tea came to Nepal

The first tea bushes in Nepal were grown from seeds which were given as a gift by the Chinese Emperor to the then Prime Minister of Nepal Jung Bahadur Rana. Nevertheless, Nepal’s tea industry owes its roots to the colonization of India.

Around 1863, within a time span of 10 years after the first tea plantation was set up in Darjeeling, hybrids of tea bushes were brought and Nepal’s first tea plantation, Ilam Tea Estate was set up at an altitude of 4,500-5,000 feet above sea level.

Visioning better future prospects of the tea industry in Nepal, two years later a second tea plantation, Soktim Tea Estate was set up in the Ilam district. Later into the 1900s, the Nepalese tea producers acted as suppliers to Darjeeling factories when tea bushes became old and yields decreased.

The first private tea plantation was set up in 1959, in the Terai region under the name Bhudhakaran Tea Estate.

In 1966, the Nepal Tea Development Corporation (NTDC) was set up to aid the development of the tea industry. Originally, tea leaves produced in Nepal were sold to factories in Darjeeling as Darjeeling’s tea bushes had become old, leading to the deterioration of the processed tea. The Nepalese tea leaves were therefore a valuable input for the factories in and around Darjeeling.

It was only in 1978 that the first factory was set up in Nepal’s Ilam for the processing of tea leaves and a few years later another factory was set up in Soktim. From 1978 to the 1990s, various efforts were made by the Nepal Tea Development Corporation with the Overseas Development Administration (ODA) to encourage the participation of small and marginal farmers in the growth and production of tea as a cash crop.

As a result, today the small and marginal farmers constitute the majority percentage share in Nepal’s tea industry. Slowly, the stagnant tea industry evolved into a fully commercialised industry, benefitting the country’s economic and socio-economic development. To further aid in the development of its tea industry, in 1982, the government of Nepal under the reign of the then King Birendra Bir Bikram Shah Dev, declared five districts – Jhapa, Ilam, Panchthar, Dhankuta and Terhathum as Tea Zones.

From 1987 to 1993, some of today’s notable institutions were incorporated to further aid the Nepal Tea Development Corporation in the development of a century-old stagnant tea industry.

Since the late 1990s and into the early 2000s, an array of international non-governmental organisations such as Winrock, SNV, GTZ among others have become involved as stakeholders of Nepal’s tea industry because the tea industry in Nepal also played a significant role in the eradication of poverty, especially in the rural areas where the tea plantations were concentrated. By the 21st century, the stagnant tea industry had transformed into a fully commercialized industry, yet it had not yet developed a strong brand in the global market, lacking efficiently integrated production and marketing systems.

In 2000, the government of Nepal ratified the National Tea Policy and the industry took off when young planters such as Chapagaun, who had studied the Darjeeling plantations and learnt about the best plantation practices.