- Home

- News

- Analysis

- States

- Perspective

- Videos

- Education

- Entertainment

- Elections

- World Cup 2023

- Features

- Health

- Budget 2024-25

- Business

- Series

- NEET TANGLE

- Economy Series

- Earth Day

- Kashmir’s Frozen Turbulence

- India@75

- The legend of Ramjanmabhoomi

- Liberalisation@30

- How to tame a dragon

- Celebrating biodiversity

- Farm Matters

- 50 days of solitude

- Bringing Migrants Home

- Budget 2020

- Jharkhand Votes

- The Federal Investigates

- The Federal Impact

- Vanishing Sand

- Gandhi @ 150

- Andhra Today

- Field report

- Operation Gulmarg

- Pandemic @1 Mn in India

- The Federal Year-End

- The Zero Year

- Premium

- Science

- Brand studio

- Home

- NewsNews

- Analysis

- StatesStates

- PerspectivePerspective

- VideosVideos

- Entertainment

- ElectionsElections

- Sports

- Loading...

Sports - Features

- Budget 2024-25

- BusinessBusiness

- Premium

- Loading...

Premium

Why the spate of layoffs in the tech sector is a mystery

Layoffs.fyi, a start-up tracking layoffs to offer financial planning consultancy to businesses, has compiled a list of companies that fired staff and documented the number of employees retrenched company-wise. As per the data available on the website, 1,035 companies globally gave marching orders to a total of 158,951 employees in 2022. In 2023, 56,570 techies have already received pink...

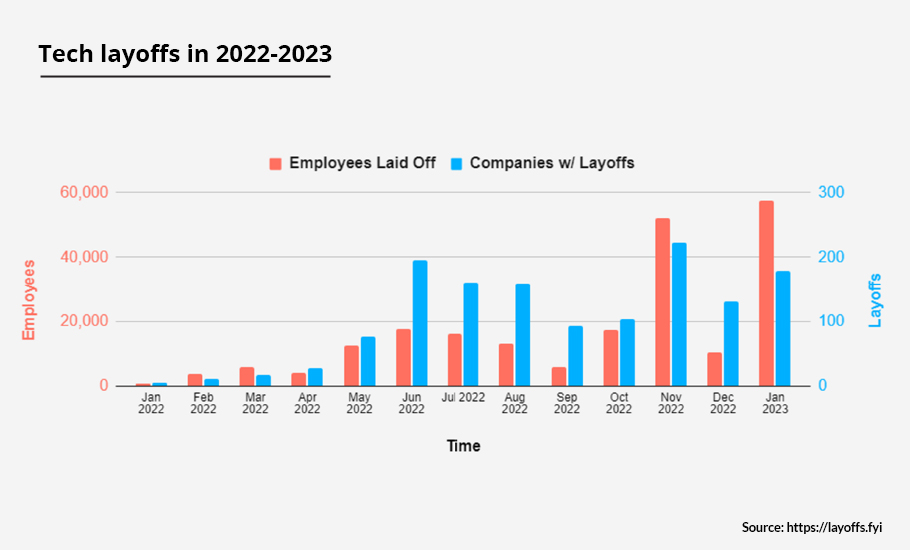

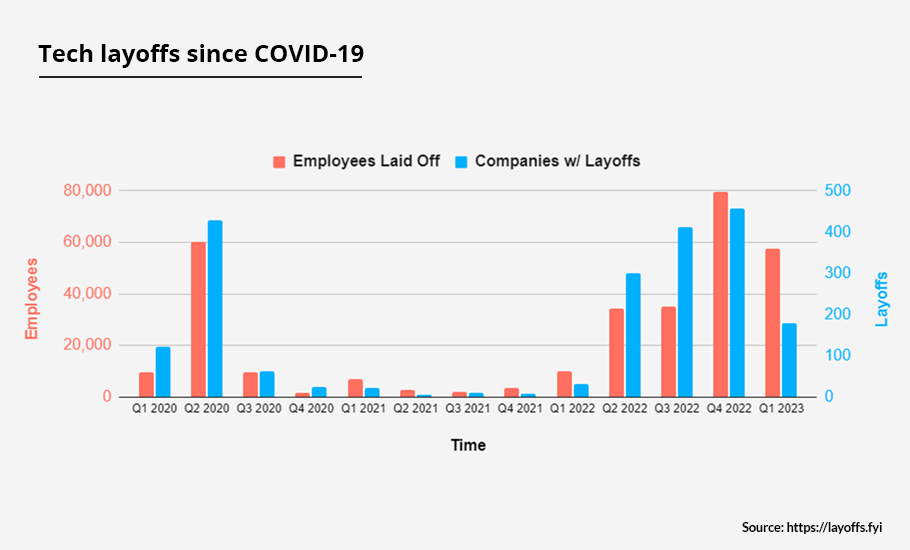

Layoffs.fyi, a start-up tracking layoffs to offer financial planning consultancy to businesses, has compiled a list of companies that fired staff and documented the number of employees retrenched company-wise. As per the data available on the website, 1,035 companies globally gave marching orders to a total of 158,951 employees in 2022. In 2023, 56,570 techies have already received pink slips across 174 tech companies. So, the current wave of layoffs has already taken a toll on close to 2 lakh employees. The scale of the current layoffs is thus the biggest since the 2008 meltdown.

Since most companies with transborder operations such as Apple, Amazon, Microsoft, and Google have not given a country-wise break up of layoffs, the impact of the phenomenon on individual nations is not clear.

“The opinion in Canada is divided on how intense the spillover of the US tech crisis would be in Canada. The tech crisis and layoffs in Europe too are not as severe as in the USA,” said Vishal Varadharajan, who works as an engineer in a tech firm in Calgary, Canada.

Prominent among big tech layoffs are US-based giants such as Amazon (18,000), Microsoft (11,000), Google (12,000), and Tesla (10,000). Not only big tech companies are on a layoff spree, smaller ones, unicorns and start-ups too have joined the trend. Irrespective of whether a company is a unicorn or a small start-up, involves high-tech or not, the maelstrom has hit everyone.

What triggered the layoffs?

While everyone knows that people are losing jobs in the tech sector, there are no clear answers on what is leading the current phase of retrenchments.

Is it the case that US tech companies are all downsizing their workforce because they are falling into the red? Is it possible that around 1,200 companies started making losses all at once over a couple of quarters after reporting brisk recovery from the pandemic in the early quarters of the financial year 2022-2023? The current gloomy tech scenario in the US inevitably raises these pertinent questions.

It is not necessary that a company should move into the red for it to cut the workforce. Even if the revenue and profits decline, companies tend to cut what they think is ‘extra flab’ in the labour force. Even as the possibility of a full-fledged recession in the days ahead is being debated, an earnings recession has already started in the Standard & Poor’s 500 companies. And the tech sector is leading that earnings recession. After all, the infotech segment alone accounts for 25 per cent of S&P 500.

As per data compiled by Bloomberg Intelligence, the fourth quarter earnings of tech firms in the S&P 500 benchmark index are projected to drop by 9.2 per cent over the same period a year ago — the steepest slide since 2016. In an era when the corporate sector as a whole gives greater importance to stock prices and market capitalization than actual physical earnings and profits, this is bound to reflect in the stock market too. Valuation of Nasdaq 100, the exclusive index of 100 top tech companies, tumbled 33 per cent in 2022-23.

Above all, more than being an outcome of actual losses or decline in profits, it seems to be the result of ‘bandwagon effect’ in the face of poor estimates from the rating agencies for 2023-24 and 2024-25 for the tech sector. Tech sector investors are well aware that reputed rating agencies come with relatively more reliable AI-driven predictions. So a ‘herd mentality’ grips the investors and tech CEOs who want to join the bandwagon and use the opportunity to trim the workforce, go for tech upgradation, or simply reshuffle the workforce by bringing in new talent and chipping away what they feel is ‘dead wood’. This bandwagon effect also partly explains why the tech layoffs are spreading from one company to the other.

As inflation is getting entrenched, higher costs are squeezing profits. So, it is important to take note that tech companies are not only cutting workforce, they are also holding back on fresh investments, bringing down the inventories, and going slow on hiring new people.

More than the cost surge and demand recession, the tech sector seems to be a victim of its own overinvestment during the brief spell of recovery in the wake of the pandemic, the so-called ‘bubble effect’. The finance sector ‘bubble’, that is, the free flow of money from venture capital funds and angel investors, flush with funds amidst low bank rates, also fuelled the tech bubble. Now that the treasury is hiking interest rates, the cost of new capital is going up and the interest burden for the companies already saddled with a huge debt is increasing. The axe is thus falling on the workforce.

The cost of surplus labour vs separation cost

The bandwagon effect notwithstanding, the layoffs are not purely whimsical decisions. They are governed by rigorous labour economics. In the labour market, there is already a steady rise in those who have lost jobs and are on the lookout for an alternative job. When their numbers reach a critical point, the labour market trends also hit an inflection point when the savings for firms through replacing existing high-paid workers with fresh and cheaper recruits makes perfect business sense.

Ironically enough, high technology itself has come to resemble the Hindu mythological demon Bhasmasura, who, gifted with the power to kill anyone whose head he touches, killed himself by touching his own head. Companies use AI-based algorithms to decide when to trim the workforce and by what numbers. Some employees contend that these AI-based algorithms are faulty as they cannot capture the underperformance of employees resulting from bullying from the immediate supervisor.

Additionally, in some cases the algorithms might show that fewer staff means financial savings from lower wage cost and lower transportation costs and so on. But they cannot capture the grim reality that being understaffed might result in greater incidence of employee burnout in the days to come.

“In the US, people do not enforce pay cuts unless the situation is very bad or if a person is performing very badly. There may be some cuts in perks and the take-home-pay of senior executives, who are mostly highly paid, but there can’t be a general salary cut. Workload might increase however. But, in view of the economic downturn, orders are not piling up and the work burden might also ease. Transfers may happen if there is merger and acquisition. Earlier, job switches used to be mostly for higher salaries, but now after the layoff, if a person joins a new company, s/he mostly has to accept a pay cut of 10-30 per cent for a new job,” said an NRI from Prayagraj, who works as an executive in an IT company in the USA, on the condition of anonymity.

“While deciding on layoffs, the companies first target those who are more expensive to the company, those who are recent joiners, those who are not fully skilled and, above all, the surplus and idle personnel. When a new management comes in and takes control, they typically get rid of all top guys associated with the old CEO/CFO/CTOs. In social terms, those on temporary visas and those who do not have an immigrant toehold like permanent residency permits would be the most vulnerable,” he added.

A senior executive in the London branch of one of the Indian IT majors told The Federal that in Europe and the UK, slashing wages is very difficult because it is seen as an assault on human rights. “Strangely, it is very difficult to terminate individual employees here while huge chunks can be laid off en masse with relative ease,” she said, requesting anonymity.

“Being a victim of market-driven redundancy and layoffs doesn’t attach a stigma while looking for a new job. In the UK, redundancy pay is given to anyone with two years of experience, which would be three months of pay or more depending upon the company,” she added.

There are some who believe the layoffs will not have much of an impact because those fired are likely to get absorbed in other firms.

“Wages have been going up for the past two years. Layoffs might arrest that. Major wage reduction need not be associated with job mobility in all cases because there are still 4 million open jobs in the economy. I am myself in the process of changing my job and expect to make 5 per cent more in the new job. The impact of the current layoffs on the labour market should be gauged keeping in mind the fact that 7 million people between 18 and 55 years of age have left the workforce in recent years. They are not looking for a job,” another software programmer in the US, who is a native of Prayagraj, told The Federal.

He also feels that the current layoffs are purely a bottom-line-driven decision and have nothing to do with adoption of new generation technologies and AI-driven automation. “A turnaround is possible, though not before the mid-2024,” he said.

High-tech sectors other than IT sector

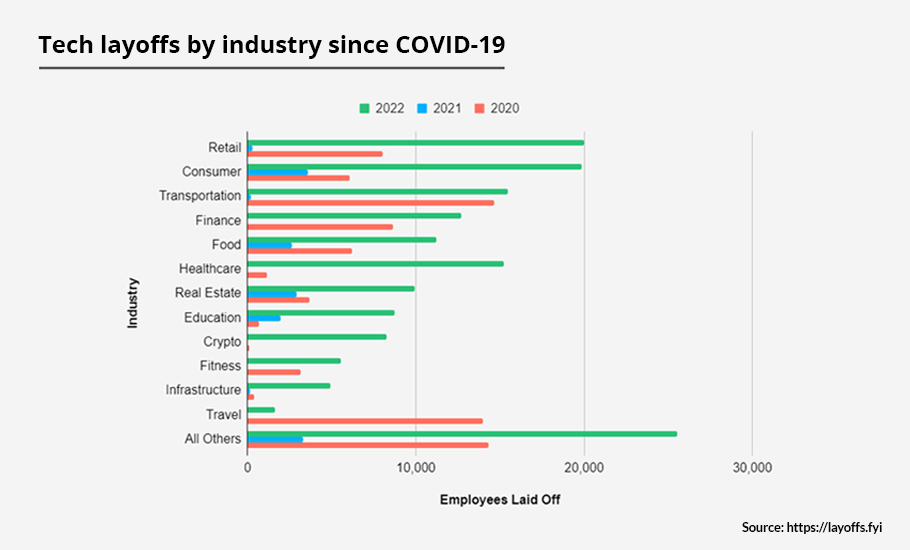

The tech sector doesn’t just refer to infotech. The tech sector firms include those in the business of semiconductors, software, IT and IT-enabled services, tech hardware including electronic equipment and components, and communications. But the current layoff wave is not limited to these high-tech sector alone.

Audio streaming and media services provider Spotify announced a 6 per cent layoff last week. Spotify engages in streaming of music to 456 million monthly active users who listen to music tracks on billions of occasions in a month which is made possible through coded music stored in a huge network of servers spread across the globe. So this music company, similar to Netflix which streams films and even live events, is also tagged a tech company.

Likewise, corporate hospitals in the US which invested massively in state-of-the-art diagnostic gadgets and other medical equipment during the pandemic, are now financially tottering. Corporate hospitals and other private healthcare businesses which made a fortune out of the pandemic are now financially wilting amidst the post-pandemic slump and shrinking revenues. The axe mainly falls on the employees who risked their lives to save others during the pandemic. The healthcare company Ascension for instance has laid off 5 per cent of its 11,000 workforce in five of its facilities around Texas. In a statement, the company cited the difficult post-Covid aftermath as the reason for the layoffs.

Many banks and finance companies are also witnessing a similar trend. To cite a few examples, Goldman Sachs fired 3,200 of its employees (6.5 per cent workforce) in December 2022. Morgan and Stanley axed 1,800 employees (2 per cent). The automobile sector, which was mauled in 2008, has not been spared this time either. Ford Motor units in Europe have announced layoffs. In the coming days, many other sectors too might join in. But still it begs the question why tech is at the forefront of layoffs.

The exact business cycle dynamic is not clear yet. There is yet another unanswered puzzle.

Interestingly, while layoffs are up, the first-time jobless claims in the US were down to 190,000 in January, the lowest since September 2022.

Ironically, the crisis of many is an opportunity for a few in the business world. Some start-ups make brisk business out of this layoff wave. Surveys by consultancies and rating agencies rise in demand. Human resources consultants are hired to advise when and how to shed staff. Expert institutions offering psychological counseling to the terminated mushroom.

Perhaps, some rating agency with necessary research capabilities would also unravel the mysteries around the current layoffs.