- Home

- News

- Analysis

- States

- Perspective

- Videos

- Education

- Entertainment

- Elections

- World Cup 2023

- Features

- Health

- Budget 2024-25

- Business

- Series

- NEET TANGLE

- Economy Series

- Earth Day

- Kashmir’s Frozen Turbulence

- India@75

- The legend of Ramjanmabhoomi

- Liberalisation@30

- How to tame a dragon

- Celebrating biodiversity

- Farm Matters

- 50 days of solitude

- Bringing Migrants Home

- Budget 2020

- Jharkhand Votes

- The Federal Investigates

- The Federal Impact

- Vanishing Sand

- Gandhi @ 150

- Andhra Today

- Field report

- Operation Gulmarg

- Pandemic @1 Mn in India

- The Federal Year-End

- The Zero Year

- Premium

- Science

- Brand studio

- Home

- NewsNews

- Analysis

- StatesStates

- PerspectivePerspective

- VideosVideos

- Entertainment

- ElectionsElections

- Sports

- Loading...

Sports - Features

- Budget 2024-25

- BusinessBusiness

- Premium

- Loading...

Premium

How MSMEs, households are falling deeper into debt trap despite FM’s stimulus

Data indicates most of the 6.33 crore MSMEs in the country, employing nearly 11 crore people, are hurting due to debt burden that worsened due to the COVID lockdown.

Laxman Pethekar, 44, a banking correspondent working in ICICI bank in Mumbai, had borrowed two personal loans from Aditya Birla Finance (₹1 lakh in February 2020) and from Bajaj Finance (₹4 lakh in 2019) for a five-year term. As Pethekar already had a two-wheeler loan from ICICI bank, he was told he was not eligible for another loan. Hence, he opted for loans from NBFCs. During the...

Laxman Pethekar, 44, a banking correspondent working in ICICI bank in Mumbai, had borrowed two personal loans from Aditya Birla Finance (₹1 lakh in February 2020) and from Bajaj Finance (₹4 lakh in 2019) for a five-year term.

As Pethekar already had a two-wheeler loan from ICICI bank, he was told he was not eligible for another loan. Hence, he opted for loans from NBFCs.

During the COVID-19 lockdown, Petherkar opted for two months of loan moratorium for both the loans and sought to restructure the Aditya Birla Finance from 5 years to 7 years. But he says the bank rejected his plea.

Restructuring of loans were meant to help repay as per their changed repayment capacity. Depending on the agreement reached with the bank, it could be by way of rescheduling of EMI tenure, lower interest rates or granting loan moratorium for maximum of two years.

Even if the loans are restructured, the benefit would come at a price. It would affect the financial future of the borrower, with a change in CIBIL score (a person or entity’s credit score shared among banks), which in turn would dent chances of availing another loan or credit card or even be treated as “considering turning to be a defaulter”.

Pethekar’s family income every month was ₹30,000 before the pandemic which included his salary of ₹20,000 and his wife’s income of ₹6,000-8,000 earned as a private chef, and rent of ₹3,500 from a property, a small room, let out in Panvel area.

“Ever since the pandemic started, my wife lost her income source and my rental income also stopped as the tenant vacated and I found no replacement ever since. So the income has dropped by a third,” Pethekar said.

COVID economic crisis

The COVID-19 pandemic has affected people in multiple ways. What started as a health crisis turned into a full-blown economic crisis, impacting people’s ability to save, borrow and spend.

The economy shrank nearly a quarter during the first three months of this fiscal year, a historical low in four decades as a result of an almost-complete lockdown in economic activity across the country.

Primarily, it increased the debt burden of individuals and small businesses. Despite the Centre announcing various measures like loan moratorium and stimulus package for “stressed” micro small and medium enterprises (MSMEs), loan restructuring option among others, much of it remains only on paper.

Several borrowers in various cities told The Federal how their debt burden had increased and banks were using harsh recovery mechanisms to force customers to repay their loans.

For instance, despite paying the dues on time to both the NBFCs, Pethekar says one of the lenders has been sending a third party recovery agent who abuses and uses harsh words, asking him to repay the loan amount.

“The banks are neither agreeing for restructuring nor are their agents abiding by the rules in their recovery mechanism,” he says. Despite being a banking professional himself, he’s grappling with the “failing” system.

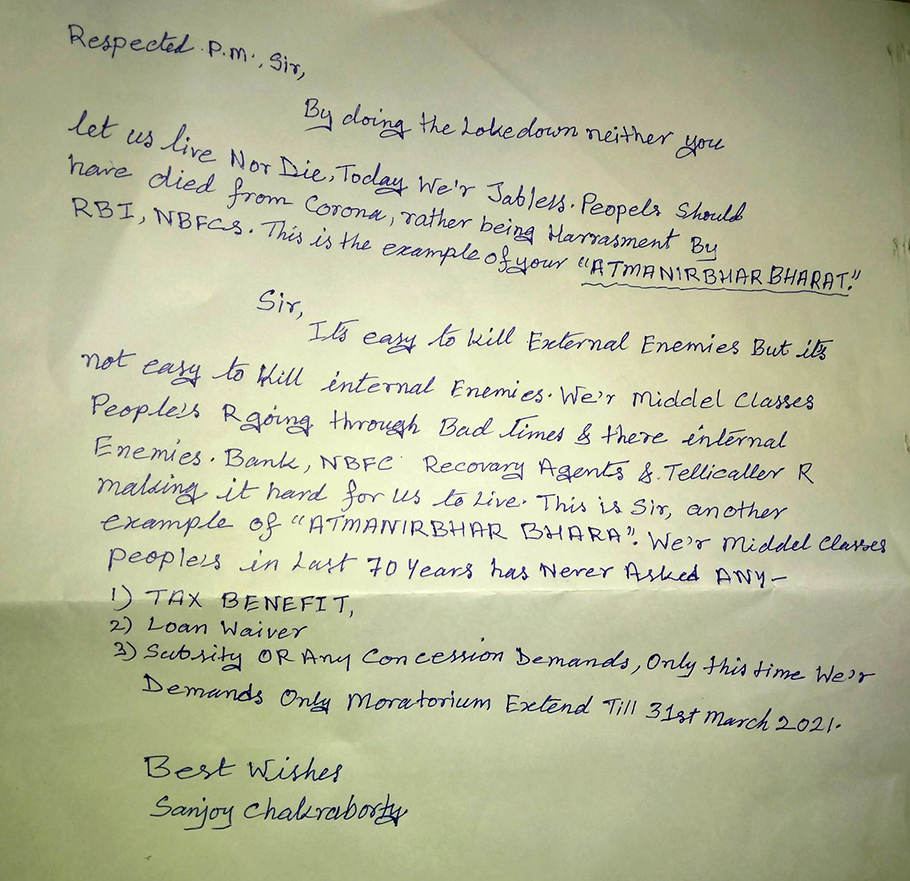

#WeWantMorethorium3 @narendramodi @FinMinIndia @PMOIndia @RBI @Mankibat Modi ji please Aam Janata bahut pareshan hai Aaj Man Ki Baat Mein recovery harassment ke bare mein Kuchh boliye please loan recovery wale Bank Walon Ko samjhaie bahut pareshan kar rahe hain vah Moratoriumextd

— Mohammed Aqeel Maniyar (@AqeelManiyar) October 20, 2020

In 2008, the Supreme Court had reiterated its earlier stand that banks cannot deploy musclemen for recovery of loans from defaulters. The judgment came after several borrowers took extreme steps to end their lives. The RBI had expressed its concern following a number of cases filed in courts against the banks for engaging recovery agents who purportedly violated the law.

“We deem it appropriate to remind the banks and other financial institutions that we live in a civilised country and are governed by the rule of law,” the SC bench had said.

On the one hand banks and non-banking financial institutions are pressuring customers to repay their loan amid some opting for loan moratorium and seeking restructuring of loans. On the other hand, MSMEs seeking additional loans, as announced by the Centre in its stimulus package, are getting rejected by banks. It is impacting their businesses further.

MSMEs denied loans amid stimulus announcement

Concerned about a sharp fall in economic activity, finance minister Nirmala Sitharaman in May announced a ₹3 lakh crore Emergency Credit Line Guarantee Scheme for MSMEs under the Atma Nirbhar Bharat Abhiyan, as part of a larger ₹20 lakh crore package to save the economy as announced by Prime Minister Narendra Modi.

The scheme was put in place to help businesses tide over the economic crisis faced due to the pandemic lockdown. As per the scheme, MSMEs with up to ₹25 crores of total borrowing could avail an additional 20% of the loan outstanding from banks, NBFCs and other financial institutions (FI).

But ask the MSMEs, and you will get a different story altogether.

Pawan Kumar, who runs a small photo studio in Odisha’s Sambalpur since 2011, said he shut his shop in May as his income sources dried up with the economic activities coming to a standstill. While his annual turnover was about ₹3 lakh before the pandemic, in the past six months he could barely earn ₹50,000.

In September, Kumar sought a loan of ₹50,000-1,00,000 from Andhra Bank and Union Bank, so that he could restart his business by opening a shop again.

“A month ago I gave them the estimates for material purchase. Then they asked me to get a MSME certificate, which I did. I then asked them to inspect the new shop and grant the loan, but they haven’t done so far,” he says.

Kumar has now decided to opt for NBFCs and get the loan at a higher interest. “The government won’t give us a loan, neither under the Mudra scheme nor as part of the stimulus package,” Kumar rues.

Another borrower, Deepak Kumar Kushwaha, who has a fleet of 8 private taxis and had invested ₹20 lakh, says with the business down, he needed about ₹6 lakh to maintain the vehicles in running condition, pay the drivers and pay his EMIs for vehicle loans.

“The vendors who we rented our vehicles are now asking for a 20% drop in prices. And the bank officials are saying they haven’t got a circular about the stimulus package that allowed borrowers to avail an additional 20% of the loan outstanding from banks,” Kushwaha said.

He had approached Indusind Bank, Mahindra Finance and Shriram Finance for loans. “The loan scheme is only helping the big corporates. They are not helping small businesses like ours,” he said.

Govt lets down contractors

The government’s own contractors dealing in various activities are struggling with delayed payments and banks rejecting loans.

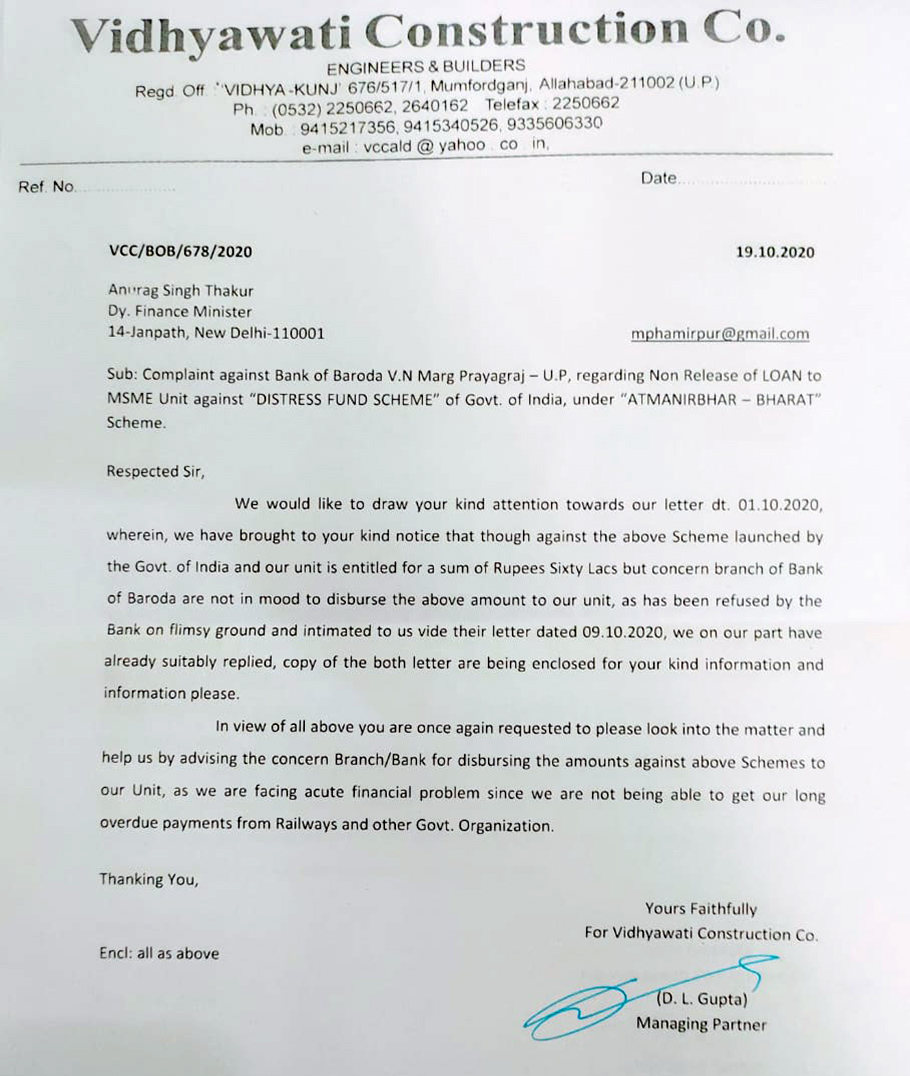

Vidyawathi Construction, an Allahabad-based construction company which takes contractual work from Indian Railways and other government organisations, wrote a letter to the deputy finance minister complaining against Bank of Baroda for not granting them a loan of ₹60, lakh which they are eligible as per the government’s “Distressed Fund Scheme.”

DL Gupta, a managing partner at the firm, alleged that the Railways hasn’t paid them an amount of ₹3 crore post the pandemic and because of that, they were unable to pay salaries of nearly 100 employees.

“Besides, we also need money to bid for future contracts. The government is neither releasing their pending dues nor are they helping us avail the bank loans under stressful conditions,” Gupta said. “So where is all the money/ benefits announced by the government going? Who is benefiting from it?” he asked.

Email queries sent to the Bank of Baroda did not elicit any response.

Industry bodies say MSMEs are on the verge of dying. In Karnataka, which is home to about 6.5 lakh MSMEs, a third of which are in Bangalore, employing nearly 70 lakh people, industry bodies estimate that nearly 20% of them are affected due to lockdown and 10% of them haven’t reopened yet.

“The industry’s turnover is back to 2010 levels. Several businesses have been shut or are struggling to avail loans to keep themselves running. And labour movement is another worry,” Srinivas Asranna, president, Peenya Industrial Association.

The association members alleged that many sops and schemes announced by the government remained only on paper. “ Bank loan unavailability has pushed MSMEs to the brink,” Asranna added.

Government data indicates there were 6.33 crore MSMEs (99% are micro enterprises) in the country, employing nearly 11 crore people. MSME ministry said the sector contributed to 29.7% of GDP and 49.66% of Indian exports, as of December 2019.

An IIT-Madras survey in July indicated that 68% of the MSMEs in Tamil Nadu were on the verge of closure, with less than a month of cash flow. Many of them were hit by delayed payments, cancellation of orders led by a fall in demand and revenue losses.

Another survey by credit rating agency Care Ratings indicates that banks have so far sanctioned loans to around one-third of applicants and the cost of borrowings is 8-9% for most of the borrowers.

CJ Nandakumar, president of Bank Employees Federation of India, said the banks are somehow forced to lend to those with big turnover as they see small businesses are also not in a position to take loans.

“As the economy is not reviving and the industrial demand is not taking an upturn, the smaller businesses are worried about taking loans as it would affect their repayment. The loans they seek are only to clear the pending dues or existing stress, which should have come as a waiver,” he said.

Gold loan to the rescue

Failed by banks, many customers have started to pawn their gold assets or sell their gold already pledged as the prices are higher.

VP Nandakumar, MD & CEO, Manappuram Finance, in an email response to The Federal said, the surge in gold prices this year acts as a strong incentive to borrowers to repay their loans on time.

“After the lockdown, we also observed stressed customers taking advantage of the high gold prices to sell their jewellery as scrap (after settling their loans),” he said.

The company on October 2, put two full page ads in a leading English daily in Karnataka auctioning the gold pawned by its customers due to delayed/non repayment of loan taken on them. Much of it was in the range of ₹10,000-50,000.

“Due to the nationwide lockdown followed by localised lockdowns, auctions were delayed in many centres and this would have caused a bunching of auctions in such centres,” the MD said. That said, he added that there’s a significant fall in the overall auction volume this year as compared to the last financial year with rise in gold prices.

The company says they are seeing an uptake in the demand for gold loans. “In the days following the nationwide lockdown, availability of credit from banks and NBFCs was an issue due to the heightened risk aversion. More recently, we are seeing demand for gold loans pick up as economic activities head back to normalcy and rural economy showing improvement,” he added.