Your insurance agent will never suggest a term plan; here's why you should insist on one

A term plan gives low commissions and returns to agents and insurers; for investors, it gives good risk cover and leaves enough in the pocket for other investments

Mohan, a 30-year-old software engineer, holds a lucrative job. His family consists of him, his wife and two children. At a speech on financial planning arranged by his employer, it dawned on him that though he has a well-structured savings and investment plan for the future, he was not sufficiently covered by life insurance. It struck him suddenly — if something were to happen to him, his family would struggle to make ends meet. This drove him to call an insurance agent the next day.

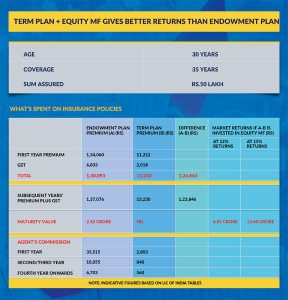

The insurance agent explained the various schemes available and, based on the amount that Mohan could spare every year, recommended an endowment policy for 35 years with a sum assured of ₹50 lakh. The first year premium would be ₹1,34,060 plus GST of 4.5 per cent (₹6,033), coming to ₹1,40,093, said the agent.

From the second year onwards, the total amount payable would be ₹1,37,076, as the applicable GST would be 2.25 per cent for renewal premiums. When the agent informed him that on maturity of the policy, he would get around ₹2.42 crore, Mohan was very satisfied.

Pure insurance

But is it the best insurance cover available for him? There term policy, or pure insurance policies, which are generally not proposed by insurance agents. The insurance companies are also not very enthusiastic about these products and there are valid reasons for their reluctance.

In case Mohan had opted for term insurance (we take the example of Jeevan Amar Term Plan 855) for 35 years for ₹50 lakh coverage, the annual premium would be only ₹13,230 (₹11,212 plus GST at 18 per cent, or ₹2,018), but he would not get any maturity amount.

On the proposed endowment policy, the agent would get a commission of 25 per cent in the first year and 7.5 per cent in the second and third years, and 5 per cent from the fourth year. It means the agent will be getting a commission of ₹33,515 in the first year, ₹10,055 in the second and third years, and ₹6,703 from the fourth year onwards.

If the term policy is taken, the agent’s commission would be ₹2,803 in the first year, ₹840 in the second and third years, and ₹560 from the fourth year onwards. This incentive scheme structure explains why agents are reluctant to sell term insurance policies.

Funds for insurers

For insurance companies also, policies other than term insurance provide large funds. These funds are available for the long term. This enables them to get far superior returns from the market; what they share with policyholders in turn is not much.

When we look at the summarised results of LIC of India for the year 2020-21, the following emerges: LIC has paid ₹1,67,549 crore as claim on maturity, ₹23,777 crore as claim on death, ₹14,571 crore as annuities and ₹80,986 crore as surrenders. The total is ₹2,86,883 crore.

This shows that hardly 8.38 per cent of their payments are towards death claims. This must include not just death on term policies but death on all policies. Hence the percentage of term policies issued by LIC of India should be negligible.

So, the reluctance of insurance companies and agents to offer term policies is understandable. It is similar to a restaurant which may offer all the dishes but would be more interested to sell those that give maximum profit — they would accordingly showcase such items.

Policyholder reluctance

While we can explain the reluctance of insurance companies and agents towards term policies, it is difficult to comprehend why policyholders are also reluctant to go for them. Partly it may be because of ignorance. Actually, insurance should be perceived as a risk management exercise and what one gets out of any insurance product is indemnity from the loss that may occur.

Term insurance is the most basic and cheapest life insurance policy. It also provides similar coverage like endowment policies. But term insurance does not have any maturity payment. It does not have a cash value and the amount of insurance is payable only on the death of the insured.

As there is no maturity benefit, people consider that the money spent on term policies is an expenditure and the amount spent as lost. Even after risk cover, they want some maturity amount, as over the years they pay a premium.

They do not want to treat the payment of the premium as expenses but to treat it as investment. They are not aware that while taking endowment policies also, part of the premium is used for risk coverage and this is expenditure for the policyholder. Only the balance amount is invested and returned to the policyholder by way of bonus etc. on maturity.

Fundamental error

There is also a fundamental error here. The business of insurance is to provide risk coverage. There are other avenues such as banks, mutual funds and equity markets for the purpose of investment. When it is important to cover one’s life with insurance, one need not combine risk coverage and investment.

In the given example, Mohan can have some alternative plan if he wants to have maturity value also. He can take a term policy for the same sum assured. The amount of premium saved every year can be conveniently deployed in any equity scheme of a mutual fund.

If he takes an endowment policy, the maturity value would be around ₹2.42 crore. This gives him an annual return of 7.7 per cent on his investment.

If the premium saved every year by opting for term policy (₹1,26,863) is deployed in the equity scheme of any mutual fund, it may give far superior returns.

If it is assumed that equity gives a return of 12 per cent, then the maturity value of such a scheme will be ₹6.14 crore. With 15 per cent return, it will be ₹12.86 crore. Purveyors of equity products often suggest that over the long term an investor in a portfolio of Indian equities may expect 12-15 per cent annualised returns. Hence, the returns from a term policy plus MF investment are far greater.

(The writer is a retired banker.)