Why LIC IPO may not be as attractive as it's made out to be

The price earnings ratio and price-to-book value are much higher when compared to its listed peers; besides, political interference in LIC's functioning is a concern

The public issue of life insurance behemoth Life Insurance Corporation of India (LIC) opens on May 4 and closes on May 9. From the number of demat accounts opened with depository participants, the enthusiasm among retail investors is palpable as they ready themselves to subscribe for the initial public offering (IPO).

While the IPO looks attractive, it is important we read the offer details and analyse LIC’s financials vis-à-vis other insurance players in the market.

IPO details

The Government of India has fixed a price band of Rs 902-949 per equity share. Retail and eligible employees will get a discount of Rs 45 per equity share while LIC policyholders will get a concession of Rs 60. Eligible employees who are also policyholders may get only Rs 60 as discount and not Rs 105.

The Centre is selling its shareholding to raise Rs 21,000 crore through a 100 per cent offer for sale (OFS); that is, no fresh shares are being floated.

One lot of the public issue comprises 15 shares and the applicant can apply for a minimum of one lot and maximum of 14 lots. The shares will be listed on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), most probably on May 17, 2022.

As per reports, there is a premium of Rs 20 or Rs 25 per share in the grey marker.

What investors should look into

Any prospective investor should look at the price that he is going to pay for an investment and the expected returns in the future. The investor should also be comfortable with the line of business the company is undertaking. After all, any investment in company shares is an investment in that particular business.

For a very long time, the life insurance business in India was monopolised by LIC, which is seen as one of the reasons for low life insurance penetration in India. That was among the reasons why the industry was opened up to the private sector. Now we have 24 life insurance companies operating in the Indian market – all approved and recognised by the Insurance Regulatory and Development Authority of India (IRDA).

Despite privatisation, India’s life insurance penetration in the financial year 2021-22 stood at just 3 per cent. Penetration rate indicates the level of development of the insurance sector in a country, and it is measured as the ratio of premium underwritten in a particular year to the GDP.

In this backdrop, prospective investors may view the life insurance business as a great opportunity in the future.

Valuation metrics

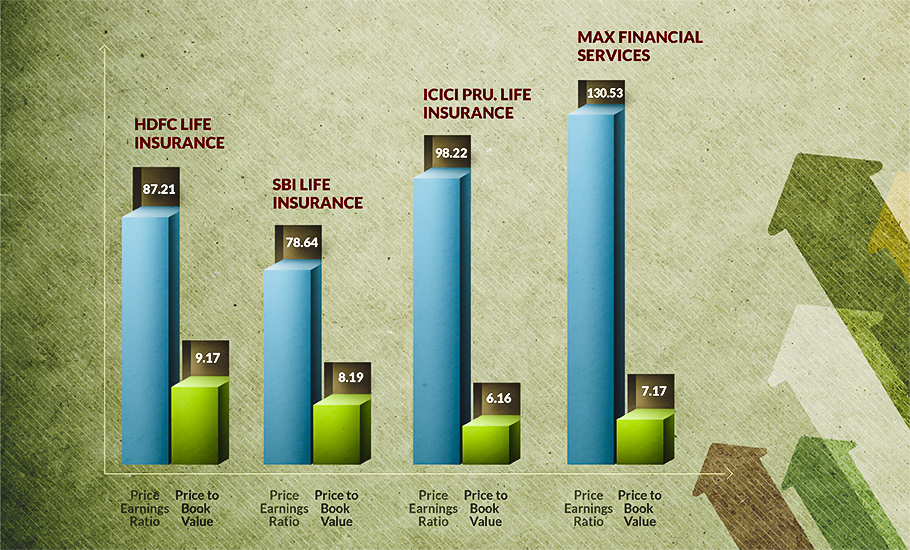

There are other life insurance companies whose shares are already traded in the market. For comparison’s sake, the following chart displays the share price of such companies. (The price earnings ratio, or PE, is the ratio for valuing a company that measures its current share price relative to its earnings per share.)

On comparing the issue price of LIC with the already listed entities, we see the following details.

The earnings per share of LIC of India was Rs 4.70 in FY 2021. The same was Rs 4.29 and Rs 4.15 in FY 2020 and FY 2019, respectively. If the issue price of Rs 949 (upper band) is taken into account, the PE ratio will be 202. The valuation will be more than double those of the other listed life insurance companies. So, the investor has to ponder over whether it is wise to pay double the price for this issue.

Also read: LIC IPO, India’s biggest ever, opens on May 4; price band ₹902-949 per share

LIC has a capital reserve of Rs 6,360.69 crore as of March 2021. When the LIC Act was amended to “consolidate or reduce the nominal or face value of the shares”, with the Centre’s approval, it was decided to stick to the current face value of shares at Rs 10 without splitting the existing 6.32 billion shares. So, presently, the number of shares is 6.32 billion with a face value of Rs 10. This gives us a book value of Rs 10.06 per share.

If the issue price is taken as Rs 949, the price-to-book value will work out to 94. When we compare this with the listed life insurance companies, it is far higher.

Functioning of LIC

Even without much penetration of life insurance, LIC is an institution with huge financial resources. But its efficiency has always been questionable. Very often the funds available with the insurance behemoth were used for purposes other than policyholders’ interests. Successive governments have used LIC funds to prop up the share market.

People used to call LIC the ‘investor of last resort’ for the government. A recent example is the bailing out of IDBI Bank using LIC funds. LIC had a total investment of Rs 36.76 lakh-crore as on March 31, 2021, and the profitability of the institution depends on how efficiently this is deployed.

Being wholly owned by the government, LIC’s functioning is at the whims and fancies of the political bosses. With just a small dilution of the government’s holding, this culture may not change in the near future.

LIC had an income of first year premium of Rs 29,356 crore in 2019-20, which came down to Rs 27,576 crore in 2020-21. This means there is negative growth in its new business. Moreover, LIC had approximately 64 per cent of the market share of the sector’s total insurance premium in the financial year 2021. This means that other private life insurance companies are gaining market share slowly.

Considering all these aspects, the LIC IPO does not look like a very attractive or once-in-a-lifetime opportunity, as has been made out by market pundits. At the end of the day, it is for the individual investor to take a call based on his or her risk perception and risk-bearing capacity.

(The writer is a retired banker)