Should you book profit without dividend, or book loss after getting dividend?

When a company declares a small amount as dividend, people may not spend much time to know its effect on taxation. But when the number of shares held by a person is substantial or when the dividend declared by a company is significant, it is better to understand the taxation effect on such dividends.

Mr Devan has recently noticed that Vedanta Limited has been frequently announcing dividends for its shareholders. Since May 22 onwards, the company has declared dividends of Rs 101.50. The latest dividend is Rs 20.50. Mr Devan bought the share at Rs 273 (including cost) just before declaration of the recent dividend. The shares became ex-dividend from April 6, and the closing price was Rs 286 on April 5.

So, on April 5, he had an option to either sell the shares and book a profit of Rs 13 (minus cost) per share or hold on to the shares and receive a dividend of Rs 20.50. When the market trades on April 6, the price will be dividend-adjusted and it should be ideally less by Rs 20.50, and if the price is different, it should be taken as that day’s variation in price.

Also read: Tax debate: Does a housing loan amount to savings?

So, what is the best option in such a situation? Should one book the profit without getting the dividend or should one wait for the dividend and book a loss?

Let us work out which is ideal for him from a taxation point of view.

Details

1,000 shares bought at Rs 273 before ex-dividend date (April 5)

Closing price on April 5 is Rs 286.50

The dividend is Rs 20.50

Open price on April 6 is Rs 266

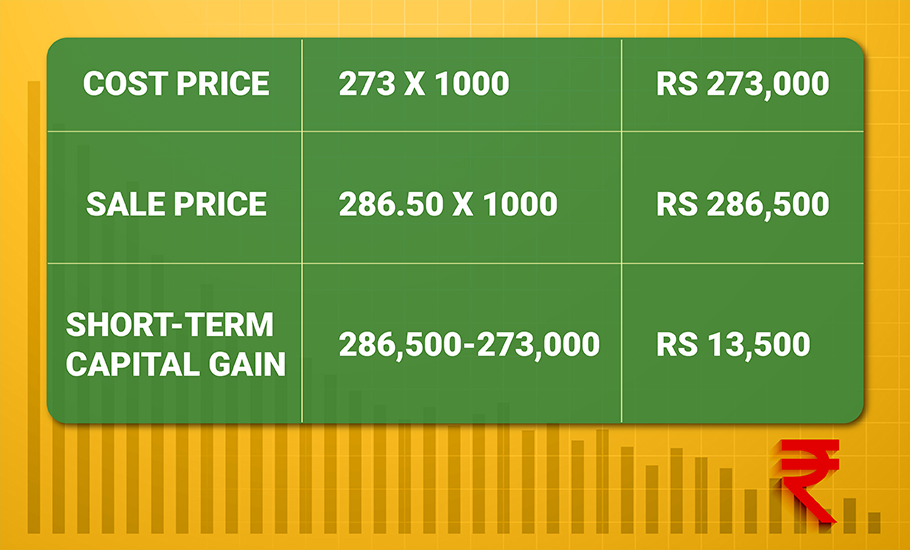

Scenario 1: Booking profit without dividend

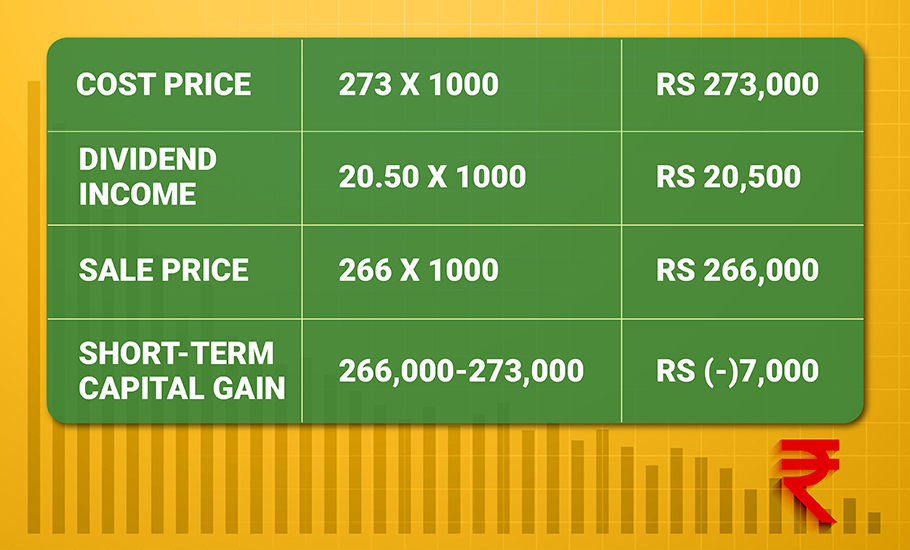

Scenario 2: Selling after dividend

Analysis

In the first scenario, he will get a short-term capital gain of Rs 13,500, whereas, in the second scenario, he will get a dividend income of Rs 20,500, and he can also book a short-term capital loss of Rs 7,000. Though in terms of the total amount, both look alike, the impact will be different based on one’s situation.

Dividend income will be added to the total income and it is fully taxable. Hence, it gets taxed at the slab rate applicable for the individual. So, one must estimate his total income and his slab rate to decide on this. Based on his total income, one may pay zero tax on this income or pay even up to 30% as tax.

If one chooses to book short-term capital loss, this loss can be used to set off against short-term capital gain. So, if one has other short-term capital gains, it can be used to offset the same. The gain will be 15% taxation on STCG plus surcharge. There is also a provision to carry over unadjusted capital loss to subsequent years (subject to conditions).

Also read: What makes Senior Citizen Savings Scheme the best option for elders

Interim or final dividend matters

The taxability of dividend income is based on whether it is a final or interim dividend. Section 8 of the Income Tax Act provides that the final dividend, including deemed dividend, shall be taxable in the year in which it is declared, distributed or paid by the company, whichever is earlier. An interim dividend is taxable in the previous year in which the amount of such dividend is unconditionally made available by the company to the shareholder. In other words, an interim dividend is chargeable to tax on a receipt basis.

No more dividend stripping

Until some years ago, people were using the method of dividend stripping to save tax. In a nutshell, the dividend striping method is buying some stocks before the record date for dividend payment and selling it ex-dividend. The dividend used to be tax-free income, and the fall in price of the stock ex-dividend was used to book negative short-term capital gains. This negative short-term capital gain could be used for other positive short-term capital gain. Taxation on dividend has closed this chapter. Still, one can work out benefits based on individual cases as explained above.

Tax Deducted at Source

Ten per cent TDS is applicable for dividend income paid in excess of Rs 5,000. There is provision to submit Form 15G and Form 15H, wherever applicable, to avoid TDS.

Also read: These 6 new financial rules from April 1 will affect you as taxpayer/investor

Claim expenses against dividend

One can claim interest expense incurred against dividend income, and such deduction should not exceed 20% of dividend income received.

Not to miss

Finally, one must remember that a dividend declared and paid by any company is out of its earnings and it is a wealth distribution. To the extent of flow of dividend money from the company to the shareholders, the intrinsic share value of the company will also come down at that point of time.

(The writer is a retired banker. The views expressed here are his own, and do not constitute investment advice.)