Akshaya Tritiya: Why buying jewellery is not the same as investing in gold

In 10 years till 2022, gold price grew at a CAGR of 5.4%; even bank FDs may give better returns

The print and online media are replete with huge advertisements from jewellery shops, inviting the public to celebrate Akshaya Tritiya. Gold prices, however, have risen sharply in the past six months as the 10-gm price of the metal with 99.9% purity, which was at Rs 50,600 during Dhanteras on October 22, 2022, has now reached Rs 60,446.

Many are lured to buy gold ornaments on this auspicious occasion. Leaving aside the sentiment attached with buying gold on a particular day or period, is it a good investment? Many people think that buying gold jewellery is like investment in gold. This though is far from the truth.

Also read: 65% women prefer investing in real estate, 20% stocks, 8% gold: Survey

Is the return on gold attractive?

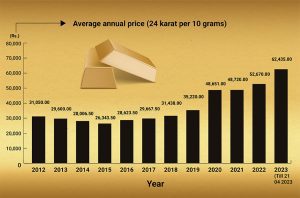

First, let us see whether investment in gold gives better return. Let us take the average price of 24 karat gold for the past 10 years.

By taking the 2012 price of RS 31,050 and the 2022 price of Rs 52,670, the compounded annual growth rate (CAGR) for the 10-year period (2012 to 2022) works out to 5.43 per cent. This cannot be considered as an attractive return on investment when we compare with other investment options. Even bank FDs could have given better returns.

Of course, there is a sudden jump now in the price during the last six months. When there is inflation all over the world, people perceive investment in gold as a hedge against inflation and the present increase in price may be on account of this. Also, when there is uncertainty — for example, the situation arising out of war in Ukraine war — people look for investment in gold.

As gold has always played a hedge against inflation, one can have a portion of it under asset allocation and it may depend on one’s risk perception and return expectation.

Buying gold jewellery

Gold jewellery is a different thing altogether. The price one pays for jewellery is not only for its gold content, but also for other ‘expenses’ like jeweller’s making charges, wastage, tax, etc. These expenses should not be considered an investment.

The price of any gold jewellery is arrived at as follows:

Price of gold jewellery = gold price per gram of a specific purity x weight of gold jewellery x making charges per gram + GST.

We thus can understand that investment in gold jewellery is not exactly equivalent to investment in gold.

Making charges

As ornamental gold is converted into gold jewellery, it involves the work of some artisans and hence it attracts making charges. But when a jewellery is sold back, there is no way to claim these charges. Hence, this portion is a direct loss to the buyer whenever he wants to sell. Also, there cannot be any appreciation for this portion of the expense.

Wastage

This is another expense paid by the buyer and traders offer so many explanations on this, but nothing can be convincing.

The process of making gold jewellery includes melting, cutting, and moulding, which may result in some wastage when the pieces are linked together to produce a single piece of jewellery. Traditional jewellers thus used to claim wastage charges. Nowadays, gold ornaments are made in hi-tech machines and nothing really goes waste. However, the tradition of calculating ‘wastage’ continues, is expressed in terms of ‘percentage’, and is charged to the customer.

Also, gold is not something that will evaporate; any gold dust will be collected by the jeweller and thus there cannot be loss of gold on account of this.

Wastage charges typically vary from 10 per cent to 18 per cent in most shops. But, it’s quite possible for them to go as high as 20 per cent or 24 per cent, or even as low as 8 per cent. The amount paid for ‘wastage’ is again not an investment.

Taxation

When gold is bought, GST is paid on it. Gold was earlier subject to a fixed 3 per cent GST, plus an additional 8 per cent tax on charges. In response to objections voiced by various parties, the tax on the making charge was subsequently decreased to 5 per cent. You won’t have to pay tax, though, if you sell your old gold jewellery and buy new jewellery at the same time.

Capital gains

If you sell gold jewellery within three years of purchase, then Short Term Capital Gain tax will be applicable. When the holding period is more than three years, Long Term Capital Gain tax will be applicable.

Also read: Govt plans to make hallmarking of gold bullion mandatory: BIS chief

Takeaway

If you want to make an investment in gold, consider gold bonds or gold ETF. If you buy jewellery, deduct expenses like making charges, wastage and GST to arrive at the value of your investment and do not consider the total sum paid as investment. Holding jewellery also involves safe keeping and a cost attached to it. The intrinsic value of gold jewellery is thus always less than the price you pay.

(The writer is a retired banker. The views expressed here are his own, and do not constitute investment advice.)