Fiscal discipline: Centre harsh on states, lenient on itself, says Thomas Isaac

Even as the Union government imposes a bunch of restrictions on states regarding off-budget borrowings, the the latest CAG report reveals the Centre has little discipline on its own extra budget resources

On the one hand, the Union government pressurises states to reduce their off-budget borrowings and on the other hand, it has little discipline on its own extra budget resources, according to a CAG report.

Off-budget borrowings are a way for governments to finance their expenditures while keeping the debt off the books — so that it is not counted in the calculation of fiscal deficit.

The latest report of the Controller and Auditor General (CAG) on the compliance of Fiscal Responsibility and Budget Management (FRBM) Act by the Union government, in fact, reveals serious fallouts – including the concealment of Extra Budget Resources (EBR) amounting to ₹1. 7 lakh-crore and undisclosed under Statutory Statement 27.

From fiscal 2019-20 onwards, the government started to disclose the amount of EBRs in the budget documents by means of inserting a new Statement 27, as a part of the expenditure profile. This statement shows EBRs financed by all ministries/departments through government fully-serviced bonds, NSSF loans and other resources)

Aviation, railway borrowings

According to the CAG, the EBRs arranged on government guarantees raised by Air India Asset Holding Ltd, Indian Railway and the National Highway Authority of India, as well as the liability of the outstanding fertiliser subsidies, are not disclosed under statement 27, as stipulated by the rule of law.

Also read: Isaac urges ED to recall summons on KIIFB transactions; not to join probe

According to CAG’s report, the Ministry of Civil Aviation did not disclose ₹14,985 crore (arranged on government guarantee) raised by Air India Asset Holding Ltd (AIAHL) under its jurisdiction, in the notes below Statement 27. Air India Asset Holding, a special purpose vehicle (SPV) formed under the Aviation Ministry, does not run any business of its own but raises the off-budget funds for aiding projects under the ministry.

Similarly, borrowings of ₹36,440 crore by Indian Railway Finance Corporation (IRFC) for funding the projects of the Indian Railways were not disclosed in Statement 27. The IRFC, a wholly government owned PSE under the administrative control of the Railway Ministry, has been mobilising market borrowings to finance capital expenditure in the railways since 1987-88.

According to CAG, in the financial year 2019-20, IRFC under its funding programme ‘Extra-Budgetary Resources Institutional Finance (EBR-IF)’ raised ₹36,400 crore, including ₹2,500 crore for ‘national projects’ for funding railway projects and the same is not reflected in Statement 27.

Further, there were instances of EBRs excluded from Statement 27, including the carry forward liability of ₹43,483 crore by the end of 2019-20, on account of outstanding fertiliser subsidy and funds of ₹74,988 crore raised by NHAI.

‘Two sets of standards’

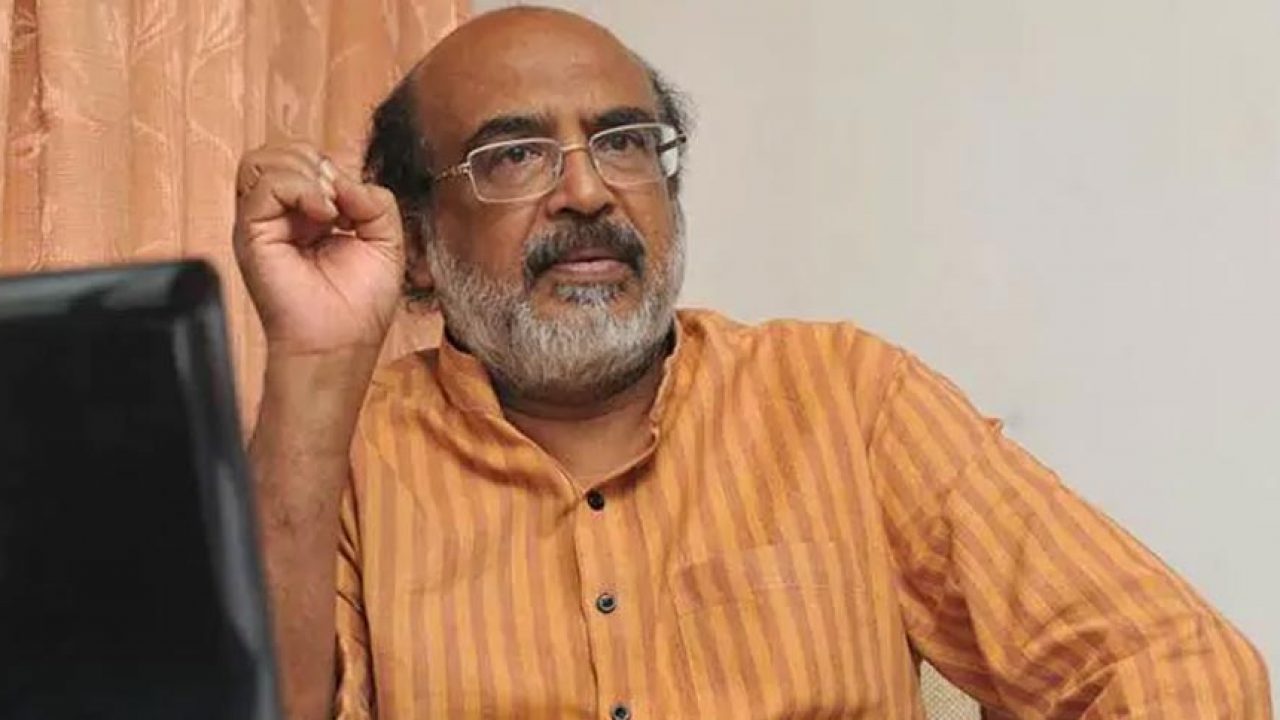

In a chat with The Federal, Dr Thomas Issac, former finance minister of Kerala, said: “The Union government applies two sets of standards, one for themselves and another for the states.” It doesn’t adhere to its own laws for fiscal discipline, he added. In fact, the Centre, which is going for off-budget borrowings through different SPVs, is trying to restrict states’ freedom to do the same, he further said.

Also read: Why Kerala thinks Centre’s fiscal policy is stifling state’s coffers

Recently, Kerala Finance Minister KN Balagopal wrote a letter to the Centre, asking the latter to review its decision to cut down the net borrowing limits of the state. He alleged that the state’s financial health has been seriously affected by a reduction in the revenue deficit grant to the tune of ₹7,000 crore this year.

Additionally, the Union Finance Ministry, in the name of off-budget borrowing, made a reduction of ₹4,000 crore in the net borrowing limits of the state. Like many other states, Kerala is also badly hit by the loss due to the stoppage of GST compensation which amounts to ₹12,000 crore.

Further, Issac said, “Over the past 10 years, the states have gradually brought down the revenue deficit to keep it within the statutory limit. On the contrary, the Union government has never been able to keep the revenue deficit within the limits prescribed by the FRBM Act.”

Revenue deficit

According to him, most states successfully keep the revenue deficit less than 3 per cent, which is the prescribed limit under FRBM Act. According to the Act, the external borrowing of the government cannot exceed 3 per cent of the GDP. “This has consistently been high for the Union government as between 3.5 to 5 per cent. Many states could reduce it to 2 per cent and less,” he said.

“The Central government is demanding that the off-budget borrowings of the SPVs in Kerala, including that of KIIFB have to be included in the general debt of the state government. The Centre is clearly applying a different set of rules for the states,” pointed out Issac.

According to the CAG report, the Central government debt in 2019-20 was 52.30 per cent of the GDP, which indicates an increase of 12.62 percentage points against 49.33 per cent of GDP in 2018-19.