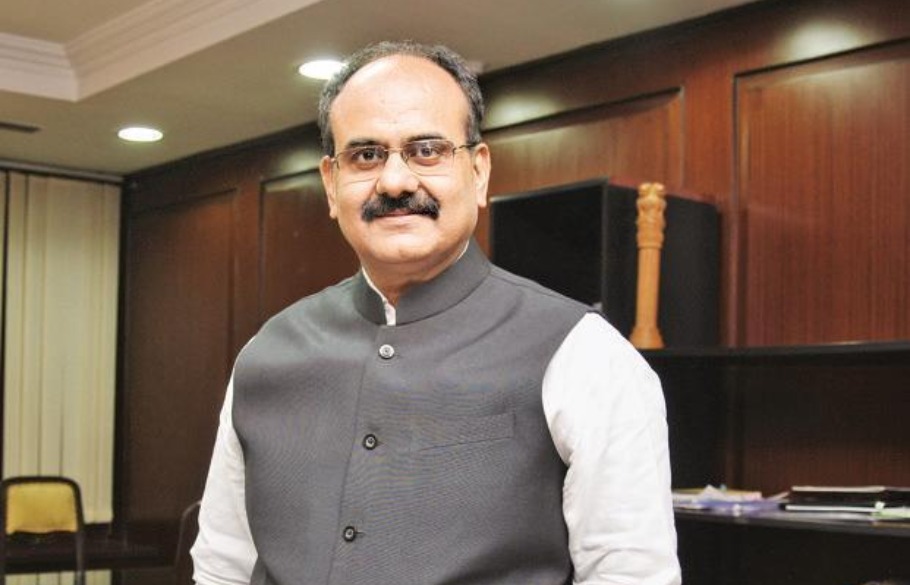

ACC appoints Ajay Bhushan Pandey as new finance secretary

The Government of India on Tuesday (March 3) appointed revenue secretary Ajay Bhushan Pandey as the finance secretary, a post in which he will continue to head the revenue department.

The Government of India on Tuesday (March 3) appointed revenue secretary Ajay Bhushan Pandey as the finance secretary, a post in which he will continue to head the revenue department.

A 1984-batch Maharashtra cadre IAS will be the top bureaucrat of the ministry. He is one of the few senior officials in the government who simultaneously headed three important institutions, including the Department of Revenue, the Goods and Services Tax Network (GSTN), and the Unique Identification Authority of India (UIDAI).

“The Appointments Committee of the Cabinet (ACC) has approved designating Dr. A.B.P. Pandey, lAS (MH:1984), Secretary, Department of Revenue, Ministry of Finance as Finance Secretary,” a notification issued by the ministry of personnel, public grievances and pensions said.

The ACC headed by the Prime Minister of India designated Pandey for the post looking at his previous achievements such as him helping the government in providing digital identity Aadhaar to more than 124 crore Indian residents as the CEO of UIDAI (until October 22, 2019).

He successfully explained Aadhaar, its benefits and the underlying technology to the five-judge Constitution bench in the Supreme Court through his two-day long power point presentation that helped the government in successfully defending 37 anti-Aadhaar petitions, one finance ministry official told the Hindustan Times requesting anonymity.

“He is the only non-lawyer person and bureaucrat to have been ever allowed to address the Supreme Court Constitution Bench for six hours spread over two days,” the official said.

As the revenue secretary, Pandey has also brought about significant taxation reforms, making taxations easy and transparent via technology and revenue growth with data triangulation and analytics without any overreach.

He has been instrumental in the sharp reduction in corporate tax rate which led to the government slashing taxes for domestic manufacturers from 30% to 22%, while for new manufacturing companies from 25% to 15%, provided they do not claim any exemptions.

He was also a key member in introducing faceless e-assessment, faceless e-appeal, Document Identification Number (DIN) system, pre-filled income tax returns, and quick income-tax refunds. It was under his watch that the government sought to put higher income-tax burden on top earners while providing relief to taxpayers at the bottom of the pyramid.

In his previous profile, Pandey worked towards the reversal of a declining trend in GST revenue, which led to rise in the indirect tax mop up that has been more than ₹1 lakh crore for last four consecutive months despite economic slowdown.

The Indian economy grew at 4.7% in the quarter ending December 2019. GDP growth had been falling continuously for six quarters since June 2018.

After heading UIDAI for more than nine years, he helped in scaling up Aadhaar in delivery of government subsidies and benefits which saved more than ₹1,40,000 crore so far by eliminating ghosts and duplicates and ensuring that the benefits reach the real and deserving beneficiaries, the official said.

Pandey is responsible for the revenue department since December 1, 2018. He also holds the position of the chairman, GSTN [since September 2017] and chairs the Inter-Ministerial Co-ordination Committee (IMCC) to prevent money-laundering activities.