Economic Survey LIVE | 'India must prioritise investment in grid infra, critical minerals'

Fundamentals of domestic economy remain robust, with strong external account, calibrated fiscal consolidation and stable private consumption, says Survey

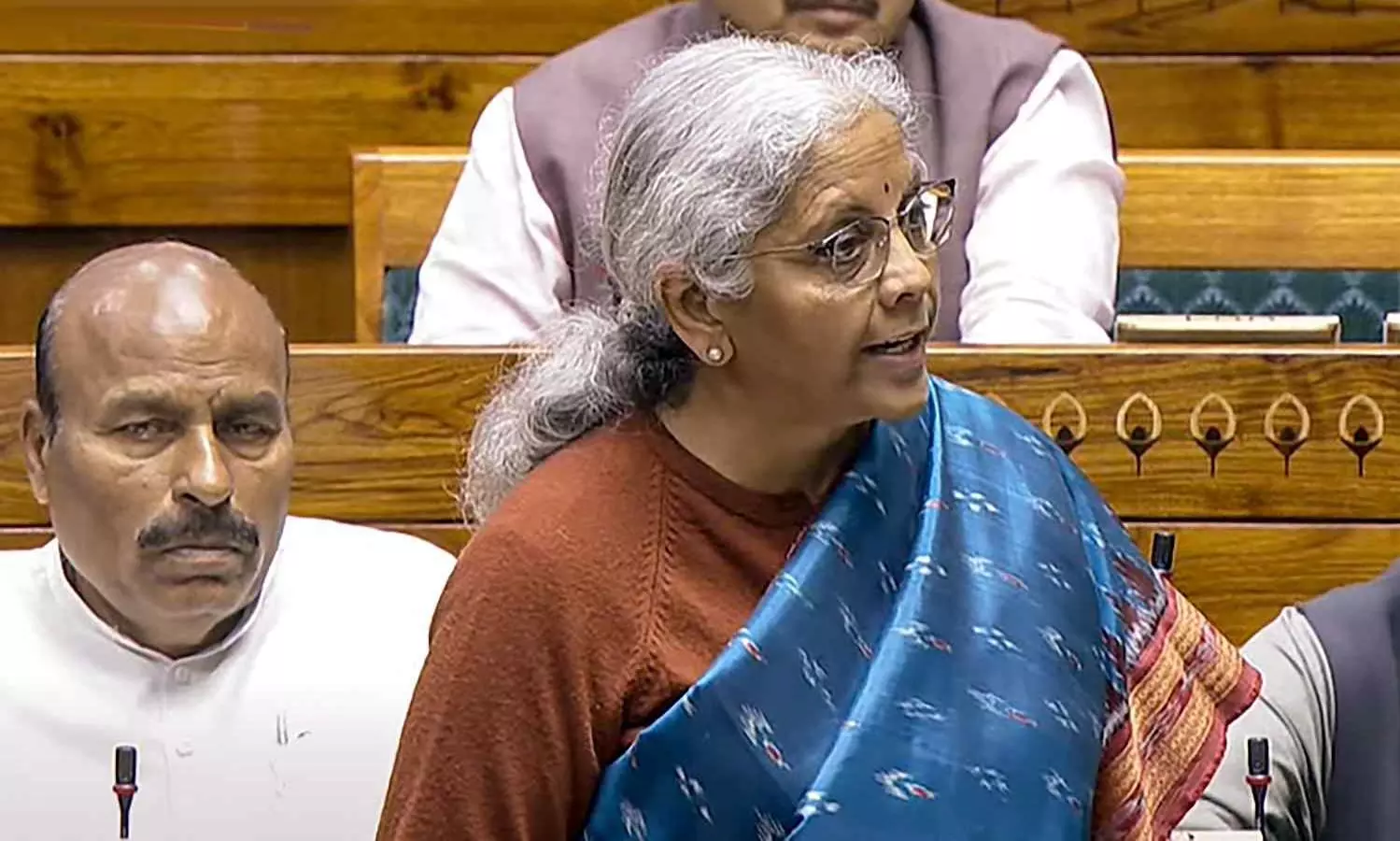

Union Finance Minister Nirmala Sitharaman on Friday (January 31) tabled the Economic Survey 2024-25 in the Lok Sabha. The pre-Budget document projected GDP growth of 6.3 to 6.8 per cent for FY26, saying: "The fundamentals of the domestic economy remain robust, with a strong external account, calibrated fiscal consolidation and stable private consumption."

After several quarters of high food inflation, the Survey predicted that food inflation is "likely to soften" in Q4.

Also read | Economic Survey | Paradox: India Inc profits soar, but wage growth dips

Touching upon Ease of Doing Business 2.0, the document said: "The government should be ‘getting out of the way’ and allow businesses to focus on their core mission."

Renewable push

India must prioritise investment in extensive grid infrastructure improvements and secure sourcing of critical minerals to strengthen its renewable energy initiatives, suggested the Survey.

The document tabled in Parliament on Friday noted that despite being one of the world’s lowest greenhouse gas emitters per capita, India has made notable strides in reducing the emissions intensity of its energy consumption. This progress is largely due to the increased deployment of renewable energy sources alongside a suite of energy conservation measures, it also noted.

Also read | Economic Survey | Slowing growth presents reality check for Viksit Bharat

Budget Session begins

The Budget Session of the Parliament began earlier today with President Droupadi Murmu addressing the joint sitting of the two Houses.

The government has listed 16 Bills, besides the financial business, for the Budget session which will be held from January 31 to February 13 before breaking for recess to examine the Budget proposals. The session will reconvene on March 10 and continue till April 4.

Read updates here:

Live Updates

- 31 Jan 2025 2:32 PM IST

Summary of 13th and final chapter of the Economic Survey 2024-25

Here is a summary of Chapter 13 of the Economic Survey 2024-25, titled "Labour in the AI Era: Crisis or Catalyst?", highlighting key points and figures:

Impact of AI on Labour Markets:

Technological Advancements:

Rapid progress in artificial intelligence (AI) has led to concerns about its potential to disrupt labour markets.

AI systems are increasingly capable of performing tasks traditionally handled by humans, including complex decision-making in sectors such as healthcare, education, and financial services.

Potential for Economic Displacement:

The integration of AI into various industries raises concerns about economic displacement, particularly for entry-level positions.

There is a risk that AI adoption could exacerbate existing social and economic inequalities if not managed responsibly.

Barriers to AI Adoption:

Challenges Identified:

Current obstacles to widespread AI adoption include concerns over reliability, resource inefficiencies, and infrastructure deficits.

These challenges, along with the experimental nature of AI, provide a window of opportunity for policymakers to implement proactive measures.

India's Position and Opportunities:

Demographic Advantage:

India's young population and diverse economic landscape position it uniquely to benefit from AI advancements.

Investment in Education and Skilling:

Significant investments in education and workforce skilling are essential to prepare the labour force for AI-driven changes.

Developing enabling, insuring, and stewarding institutions can help workers adapt to evolving demands while providing necessary safety nets.

Policy Recommendations:

Inclusive Institutions:

Historical parallels with previous technological revolutions highlight the importance of inclusive institutions in managing disruptions and ensuring equitable outcomes.

Collaborative Approach:

Fostering collaboration between policymakers, the private sector, and academia is crucial to align AI-driven innovation with societal goals.

Strategic Planning:

Robust institutional frameworks and strategic planning can transform AI from a potential crisis into a catalyst for equitable economic transformation.

The chapter concludes that with proactive measures, AI can serve as a catalyst for positive change, positioning India to thrive in an increasingly automated world.

- 31 Jan 2025 2:31 PM IST

Summary of Chapter 12 of the Economic Survey 2024-25

Here is a summary of Chapter 12 of the Economic Survey 2024-25, titled "Employment and Skill Development: Existential Priorities", highlighting key figures and statistics:

Demographic Advantage:

Young Population:

India has approximately 26% of its population in the age group of 10-24 years, presenting a significant demographic opportunity.

Median Age:

The median age in India is around 28 years, making it one of the youngest nations globally.

Dependency Ratios:

Declining Total Dependency Ratio:

The total dependency ratio has decreased from 64.6% in 2011 to 55.7% in 2021 and is projected to fall further to 54.3% by 2026.

Labour Market Indicators:

Unemployment Rate:

The unemployment rate has significantly declined over time, indicating improvements in the labour market.

Labour Force Participation Rate (LFPR):

There has been a positive trend in the LFPR, reflecting increased engagement of the working-age population in the labour market.

Worker Population Ratio (WPR):

The WPR has shown an upward trend, indicating a higher proportion of the population being employed.

Skill Development Initiatives:

Government Focus:

The government is prioritizing reskilling, upskilling, and new-skilling to align the workforce with global demands, enhancing both domestic and international employability.

Policy Recommendations:

Simplifying Compliances:

Reducing regulatory burdens to promote labour flexibility and strengthen workers’ welfare is vital for sustainable job growth.

Lowering Fixed Costs:

Deregulation efforts aimed at lowering the fixed costs of doing business can create room for enterprises to hire more employees.

Boosting Female Workforce Participation:

Targeted skill development and entrepreneurial support are being pursued to increase women's participation in the workforce.

Emerging Employment Sectors:

Digital Economy and Renewable Energy:

Sectors like the digital economy and renewable energy offer vast potential for creating high-quality jobs, which is essential for achieving the vision of a developed India (Viksit Bharat).

The chapter emphasizes the importance of leveraging India's demographic dividend by creating quality employment opportunities and aligning skill development initiatives with evolving global demands. It highlights the need for policy interventions to simplify business compliances, promote labour flexibility, and support emerging sectors to drive sustainable job growth.

- 31 Jan 2025 2:30 PM IST

Summary of Chapter 11 of the Economic Survey 2024-25

Here is a summary of Chapter 11 of the Economic Survey 2024-25, titled "Social Sector: Extending Reach and Driving Empowerment", highlighting key figures and statistics:

Social Services Expenditure:

Overall Increase:

The general government's expenditure on social services has risen from ₹14.8 lakh crore in FY21 to ₹25.7 lakh crore in FY25 (Budget Estimates), reflecting a Compound Annual Growth Rate (CAGR) of 15%.

As a Percentage of Total Expenditure:

Social services expenditure as a share of total government expenditure increased from 23.3% in FY21 to 26.2% in FY25 (BE).

Sectoral Allocations:

Education:

Expenditure on education grew from ₹5.8 lakh crore in FY21 to ₹9.2 lakh crore in FY25 (BE), achieving a CAGR of 12%.

Health:

Health expenditure increased from ₹3.2 lakh crore in FY21 to ₹6.1 lakh crore in FY25 (BE), marking a CAGR of 18%.

Consumption Patterns and Inequality:

Urban-Rural Consumption Gap:

The urban-rural gap in Monthly Per Capita Consumption Expenditure (MPCE) has declined from 84% in 2011-12 to 70% in 2023-24, indicating improved consumption in rural areas.

Gini Coefficient:

The Gini coefficient, a measure of income inequality, improved in both rural (from 0.266 in 2022-23 to 0.237 in 2023-24) and urban areas (from 0.314 to 0.284), suggesting reduced inequality.

Public Distribution System (PDS) Impact:

Coverage:

In 2022-23, 84% of the population had access to a ration card, with 74% actively consuming food rations through the PDS or PMGKAY schemes.

Welfare Gains:

The market-equivalent value of the PDS/PMGKAY subsidy equated to 4% of nominal MPCE on average, with higher benefits observed among lower consumption groups.

Education Sector Insights:

Enrollment and Infrastructure:

India's school education system serves 24.8 crore students across 14.72 lakh schools, with government schools accounting for 69% of the total.

Gross Enrollment Ratio (GER):

GER is near-universal at the primary level (93%), with ongoing efforts to bridge gaps at the secondary (77.4%) and higher secondary levels (56.2%).

Dropout Rates:

Dropout rates have declined to 1.9% for primary, 5.2% for upper primary, and 14.1% for secondary levels.

Health Sector Developments:

Total Health Expenditure (THE):

THE as a percentage of GDP increased from 3.2% in FY19 to 4.1% in FY22.

Government Health Expenditure (GHE):

GHE as a share of THE rose from 29% in FY15 to 48% in FY22, while Out-of-Pocket Expenditure (OOPE) declined from 62.6% to 39.4% during the same period.

Health Insurance Coverage:

Government health insurance schemes constitute 5.87% of healthcare financing, with social insurance schemes accounting for 3.24% and government-supported voluntary insurance schemes like Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) making up 2.63%.

The chapter underscores the government's commitment to enhancing social sector spending, with significant investments in education and health. It highlights improvements in consumption patterns, reduced inequality, and the positive impact of welfare schemes like the PDS. The focus remains on empowering citizens through better access to education, healthcare, and social security, aiming for inclusive growth and development.

- 31 Jan 2025 2:28 PM IST

Summary of Chapter 10 of the Economic Survey 2024-25

Here is a summary of Chapter 10 of the Economic Survey 2024-25, titled "Climate and Environment: Adaptation Matters", highlighting key figures and statistics:

India's Commitment to Sustainable Development:

Per Capita Emissions:

India's per capita carbon emissions are approximately one-third of the global average, underscoring its relatively low contribution to global emissions despite rapid economic growth.

Adaptation Expenditure:

Increase in Spending:

Adaptation-related expenditures have risen from 3.7% of GDP in FY16 to 5.6% in FY22, reflecting the country's prioritization of building resilience against climate change impacts.

Challenges in Renewable Energy Deployment:

Storage Technology and Mineral Access:

India faces challenges in scaling renewable energy due to a lack of viable storage technologies and limited access to essential minerals necessary for renewable infrastructure.

Lifestyle for Environment (LiFE) Initiative:

Promoting Sustainable Practices:

The LiFE initiative encourages sustainable consumption and production, aiming to transform development processes through environmentally friendly practices and the promotion of a circular economy.

International Climate Finance:

Inadequate Support:

Global financial flows for climate action remain insufficient, with a significant bias towards mitigation over adaptation.

Developed countries have fallen short of their Nationally Determined Contributions (NDCs) by about 38%, highlighting a gap between commitments and actual support.

Key Statistics:

International Finance Flows (2021-22):

Multilateral Development Banks (MDBs) provided USD 30.4 billion for mitigation and USD 19.6 billion for adaptation.

Bilateral climate finance amounted to USD 16.4 billion for mitigation and USD 10.5 billion for adaptation.

Multilateral climate funds contributed USD 1.1 billion for mitigation and USD 0.6 billion for adaptation.

The chapter emphasizes the critical importance of adaptation strategies in India's climate policy, given the nation's vulnerability to climate change. It calls for enhanced international support and underscores the need for a fundamental shift towards sustainable consumption and production to achieve long-term environmental and economic goals.

- 31 Jan 2025 2:27 PM IST

Summary of Chapter 9 of the Economic Survey 2024-25

Here is a summary of Chapter 9 of the Economic Survey 2024-25, titled "Agriculture and Food Management: Sector of the Future", highlighting key figures and statistics:

Agriculture's Economic Contribution:

GDP and Employment:

In FY24, the 'Agriculture and Allied Activities' sector contributed approximately 16% to India's GDP at current prices.

The sector supports about 46.1% of the country's population.

Growth Trends:

Recent Performance:

From FY17 to FY23, the agriculture sector exhibited robust growth, averaging 5% annually.

In the second quarter of FY25, the sector recorded a growth rate of 3.5%, recovering from previous quarters where growth ranged between 0.4% and 2.0%.

Production Highlights:

Kharif Foodgrain Production:

The 2024 kharif foodgrain production is projected at 1,647.05 Lakh Metric Tonnes (LMT), an increase of 89.37 LMT compared to the previous year and 124.59 LMT above the average kharif output.

Income Growth:

Agricultural Income:

Over the past decade, agricultural income has increased at an annual rate of 5.23%, compared to 6.24% for non-agricultural income and 5.80% for the overall economy.

Sectoral Composition:

Diverse Growth Rates:

Between 2011-12 and 2021-22, the Compound Annual Growth Rate (CAGR) in the value of output varied across sub-sectors:

Cereals: 2.0%

Pulses: 5.0%

Fruits and Vegetables: 3.5%

Oilseeds: 1.9%

Livestock: 5.8%

Fisheries: 8.7%

Milk: 5.8%

Meat and Eggs: 7.5%

Condiments and Spices: 6.7%

Global Standing and Productivity:

Cereal Production:

India contributes 11.6% to the world's total cereal output.

Despite this significant share, the country's crop yields remain lower than those of other leading producers, indicating potential for productivity enhancements.

Emerging Sectors:

Floriculture:

India's floriculture industry has emerged as a "sunrise industry" with 100% export orientation, driven by increasing global demand for flowers.

Challenges and Recommendations:

Climate Variability:

The sector faces challenges from climate variability, affecting productivity and income stability.

Diversification and Allied Activities:

Promoting allied activities such as animal husbandry, fisheries, and agroforestry can help farmers mitigate risks associated with climate variability.

Government Initiatives:

Various government programmes aim to enhance productivity, support sustainable practices, and increase farmers' incomes.

The chapter emphasizes the importance of diversifying income sources and adopting sustainable practices to ensure the resilience and future growth of India's agriculture sector.

- 31 Jan 2025 2:26 PM IST

Summary of Chapter 8 of the Economic Survey 2024-25

Here is a summary of Chapter 8 of the Economic Survey 2024-25, titled "Employment and Skill Development: Towards Quality", highlighting key figures and statistics:

Labour Market Indicators:

Unemployment Rate:

The unemployment rate in India declined to 3.2% in 2022-23, indicating an improvement in the labour market over the last six years.

Urban Unemployment:

The quarterly urban unemployment rate for individuals aged 15 years and above decreased to 6.7% in the quarter ending March 2024, down from 6.8% in the corresponding quarter of the previous year.

Workforce Participation:

Youth and Female Participation:

There has been a notable increase in both youth and female workforce participation, presenting opportunities to leverage demographic and gender dividends.

Skill Development Initiatives:

Government Programmes:

The government has implemented various skill development programs aimed at enhancing the quality of the workforce to meet industry demands.

Challenges and Recommendations:

Quality of Employment:

Despite improvements in employment rates, challenges remain in ensuring the quality of employment, including aspects such as job security, earnings, and working conditions.

Policy Focus:

The survey emphasizes the need for policies that not only create jobs but also enhance the quality of employment through skill development and education.

The chapter underscores the importance of continuous efforts in skill development and the creation of quality employment opportunities to sustain economic growth and harness the potential of India's demographic advantages.

- 31 Jan 2025 2:25 PM IST

Summary of Chapter 7 of the Economic Survey 2024-25

Here is a summary of Chapter 7 of the Economic Survey 2024-25, titled "Industry: All About Business Reforms", highlighting key figures and statistics:

Global Manufacturing Landscape:

Shift in Manufacturing Share:

Over the past decade, high-income countries have seen a decline in their share of global manufacturing output.

Upper middle-income countries, particularly China, have increased their share significantly.

India's share in global manufacturing has improved, currently standing at 2.8%, while China's share is 28.8%.

Domestic Industrial Performance:

Sectoral Growth:

Industries such as steel, cement, chemicals, and petrochemicals have stabilized industrial growth.

Consumer-focused sectors like automobiles, electronics, and pharmaceuticals have emerged as key growth drivers.

Challenges and Opportunities:

Global Challenges:

Persistent geopolitical tensions, aggressive industrial and trade policies, supply chain disruptions, and a global trade slowdown have posed challenges to export demand for India's manufactured products.

Domestic Opportunities:

Strategic emphasis on public capital formation and significant logistic improvements have underpinned India's achievements in the manufacturing sector.

Fostering R&D investments, innovations, and enhancing the growth and formalization of smaller manufacturers are identified as key drivers for future growth.

State-Level Business Reforms:

Impact on Industrial Development:

State-level analysis indicates that business reforms in states are likely to foster industrial development.

Achieving India's ambition of becoming a strong manufacturing power necessitates sustained and coordinated efforts from all tiers of government, the private sector, the skilling ecosystem, academia, and R&D institutions.

Policy Recommendations:

Enhancing Competitiveness:

The survey emphasizes the need for continued business reforms to enhance competitiveness in the industrial sector.

It advocates for reducing regulatory burdens, improving ease of doing business, and fostering innovation through supportive policies.

The chapter concludes that, despite global challenges, India has significant opportunities to strengthen its manufacturing sector through strategic reforms and coordinated efforts across various stakeholders.

- 31 Jan 2025 2:24 PM IST

Summary of Chapter 6 of the Economic Survey 2024-25

Here is a summary of Chapter 6 of the Economic Survey 2024-25, titled "Investment and Infrastructure: Keeping It Going", highlighting key figures and statistics:

Government Initiatives and Investments:

Capital Expenditure Growth:

The Union Government's capital expenditure on major infrastructure sectors increased at a trend rate of 38.8% from FY20 to FY24.

National Infrastructure Pipeline (NIP):

Launched with a projected infrastructure investment of around ₹111 lakh crore from FY20 to FY25.

Currently encompasses over 9,766 projects across 37 sub-sectors.

National Monetisation Pipeline (NMP):

Identified potential core assets with an indicative value of ₹6.0 lakh crore for FY22 to FY25.

From FY22 to FY24, transactions worth ₹3.86 lakh crore were completed against a target of ₹4.30 lakh crore.

For FY25, the aggregate monetisation target is set at ₹1.91 lakh crore.

Sectoral Developments:

Railways:

Achieved a freight loading of 1,512 million tonnes during April–November 2024, a 6.6% increase over the same period in the previous year.

Capital expenditure for railways increased from ₹1.5 lakh crore in FY20 to ₹2.4 lakh crore in FY24.

Roads:

The length of national highways expanded from 1.32 lakh km in FY20 to 1.47 lakh km in FY24.

Average daily construction of national highways was 28.6 km per day during FY24.

Ports:

Cargo traffic at major ports increased to 720 million tonnes in FY24 from 704 million tonnes in FY23.

The average turnaround time at major ports improved to 2.48 days in FY24 from 3.44 days in FY20.

Airports:

Passenger traffic reached 341 million in FY24, recovering from the pandemic-induced decline.

The number of operational airports increased to 148 in FY24 from 103 in FY20.

Power:

Installed power capacity reached 409 GW by December 2024.

Renewable energy sources now constitute about 47% of India's total installed capacity.

Digital Connectivity:

By October 31, 2024, 5G services were launched in all states and union territories, with services available in 779 out of 783 districts.

Over 4.6 lakh 5G Base Transceiver Stations (BTSs) have been installed nationwide.

Challenges and Recommendations:

Private Sector Participation:

The survey emphasizes the need for increased private participation in infrastructure by improving project conceptualization, risk and revenue-sharing mechanisms, contract management, conflict resolution, and project closure.

Sustainable Practices:

There's a growing focus on sustainable construction practices across various sectors, including highway development, waterway projects, power capacity addition, and waste management.

Future Investment Needs:

To achieve the goal of Viksit Bharat@2047, continued and increased infrastructure investment is essential, with a significant role for public-private partnerships.

The chapter underscores the importance of maintaining momentum in infrastructure development through innovative financing and enhanced private sector involvement to meet India's long-term development goals.

- 31 Jan 2025 2:22 PM IST

Summary of Chapter 5 of the Economic Survey 2024-25

Here is a summary of Chapter 5 of the Economic Survey 2024-25, titled "Medium Term Outlook: Deregulation Drives Growth", highlighting key figures and statistics:

India's Economic Aspirations:

Growth Target:

To achieve the status of 'Viksit Bharat' (Developed India) by the centenary of independence in 2047, India aims for an average growth rate of around 8% at constant prices over the next two decades.

IMF Projections:

GDP Growth:

The International Monetary Fund (IMF) projects India's GDP to reach USD 5 trillion by FY28 and USD 6.3 trillion by FY30.

This implies an annual nominal growth rate of approximately 10.2% in USD terms from FY25 to FY30.

Historical Context:

Between FY94 and FY24, India's GDP in USD terms grew at a compounded annual rate of 8.9%.

The IMF's projection suggests an acceleration to a 10.2% growth rate in the upcoming five years.

Currency and Inflation Expectations:

Rupee Depreciation:

Historically, the Indian Rupee depreciated by 3.3% annually against the USD up to FY24.

The IMF anticipates a milder depreciation of about 0.5% per annum from FY25 to FY30, reflecting confidence in India's economic prospects.

Inflation Convergence:

The projection assumes a convergence of India's inflation rate with that of the United States, contributing to the expected currency stability.

Current Account Deficit (CAD):

Projected Trends:

India's CAD is expected to gradually increase to 2.2% of GDP by FY30, indicating manageable external imbalances in the medium term.

Policy Recommendations:

Deregulation Emphasis:

The survey underscores the importance of reducing regulatory compliance burdens to enhance economic freedom for individuals and small businesses.

Streamlining regulations is identified as a key driver for sustaining high growth rates in the medium term.

Domestic Growth Levers:

Focusing on internal economic drivers, such as boosting private investment and fostering innovation, is deemed crucial for achieving the desired growth trajectory.

The chapter concludes that, despite global economic uncertainties, strategic domestic policy interventions, particularly in deregulation and enhancing economic freedoms, can position India to achieve its medium-term growth objectives.