Who pays for UPI transactions? Banks, PSPs want their share of penny

The recent announcement by the Union Finance Ministry that there is no consideration in the government to levy any charges for United Payments Interface (UPI) has put the focus back on the tussle between banks and services Payment Service Providers (PSPs).

On Sunday (August 21), the Finance Ministry tweeted, “UPI is a digital public good with immense convenience for the public & productivity gains for the economy. There is no consideration in Govt to levy any charges for UPI services. The concerns of the service providers for cost recovery have to be met through other means.”

“The Govt had provided financial support for #DigitalPayment ecosystem last year and has announced the same this year as well to encourage further adoption of #DigitalPayments and promotion of payment platforms that are economical and user-friendly,” it added.

Also read: Paytm official digital payments partner for PMs’ museum

The government has mandated a zero-charge framework for UPI transactions from January 1, 2020. This means that charges in UPI are zero for users and merchants alike.

The ministry’s clarification came after the Reserve Bank of India’s (RBI) discussion paper on charges in the payment system suggesting that UPI payments might be subject to a “tiered charge” based on various amount brackets.

PCI seeks compensation

After the ministry’s tweet, the Payments Council of India (PCI) said that the support money provided by the government has been appropriated by banks.

“All the support money provided by the finance ministry has been appropriated by the banks only (no single bank has even a significant single digit volume in upi)… none of the payment aggregators or facility provider received anything,” PCI Chairman Vishwas Patel tweeted in reply to ministry’s announcement. (sic)

Support for Digital payment ecosystem 😀😀.. all the support money provided by the finance ministry has been appropriated by the banks only ( no single bank has even a significant single digit volume in upi)… none of the payment aggregators or facility provider received anything

— Vishwas Patel (@vishwaspatel) August 21, 2022

According to reports, the PCI has no sought an increase in the total compensation amount for UPI and RuPay debit cards to ₹8,000 crore.

Also read: India has eliminated all queues by going online: PM

Payment industry executives said banks have received the subsidy amount for three months, which works out to roughly ₹900 crore. The understanding between banks and other service providers was that once the subsidy came in, entities on the merchant acquiring side would get 0.1% and those on the issuing side would get 0.15%. Payment aggregators and facility providers were expecting 0.05% from what acquirers got, a Financial Express report said.

“If we compare UPI and RuPay debit cards to MasterCard and Visa debit card MDR (merchant discount rate) as prescribed by the RBI, the total subsidy required to be paid by the finance ministry should be ₹6,000 crore for UPI and ₹2,000 crore a year for RuPay debit card,” Patel told the newspaper.

As per the report, PhonePe and Google Pay account for over 80% of all UPI transactions. Before the government abolished the MDR on UPI and RuPay debit card transactions in January 2020, UPI transactions of over ₹100 attracted an MDR of 0.3%, capped at ₹100.

Govt’s incentive scheme

In December 2021, the Union Cabinet approved a ₹1,300 crore incentive scheme to promote digital transactions using UPI and Rupay debit cards.

Electronics and IT Minister Ashwini Vaishnaw said that the government will reimburse transaction charges levied on digital payments made by persons to the merchant as part of the merchant discount rate (MDR).

“MDR is the charge recovered by the acquirer from the final recipient of money (merchant). It is levied as a discount to the transaction amount and usually recovered during settlement of the payment transaction. It is the most preferred way of recovering costs incurred in a merchant payment system.

“MDR collected by the acquirers is used to compensate the PSPs (including acquirers) and the intermediaries in the payment system. The distribution among the three PSPs – card issuer, acquirer and card network (i.e. PSO) – is based on the rules prescribed by the Payment System Operators (PSOs), and the distribution between the acquirer and the intermediary is decided based on their mutual agreement,” according to RBI.

The approved scheme will cover reimbursement on digital transactions of up to ₹2,000, using Rupay debit cards and BHIM-UPI.

Patel questioned the government over subsidising transactions of big merchants like Amazon and Flipkart.

“Payment aggregators have spent nearly ₹25,000 crore over the last five years to grow the UPI acceptance base, change consumer behaviour and encourage users to transact more. Payment aggregators have done the hardest work and we are not getting anything,” Patel told Inc42.

“Why is taxpayers’ money being used to subsidise transactions of big merchants such as Amazon and Flipkart?…If big merchants are paying RBI’s prescribed MDR on Mastercard debit cards and Visa debit cards, then why should the government use taxpayers’ money to subsidise UPI and RuPay transactions for medium to large merchants… Funding in the fintech sector is also drying up. How can we keep the UPI growth going considering the growing infrastructure costs?,” he added.

RBI’s argument for UPI charges

In its discussion paper, RBI said, “UPI as a funds transfer system is like IMPS. Therefore, it could be argued that the charges in UPI need to be similar to charges in IMPS for fund transfer transactions. A charge could be imposed based on the different amount bands. Merchant payments using UPI do not require installation of costly infrastructure by merchants as UPI QR codes are used. The cost of merchant infrastructure for UPI is lower as compared to the cost incurred in a card-based acceptance infrastructure.”

“In any economic activity, including payment systems, there does not seem to be any justification for a free service, unless there is an element of public good and dedication of the infrastructure for the welfare of the nation. But who should bear the cost of setting up and operating such an infrastructure, is a moot point,” it added.

Also read: Govt announces more incentives for businesses embracing digital payments

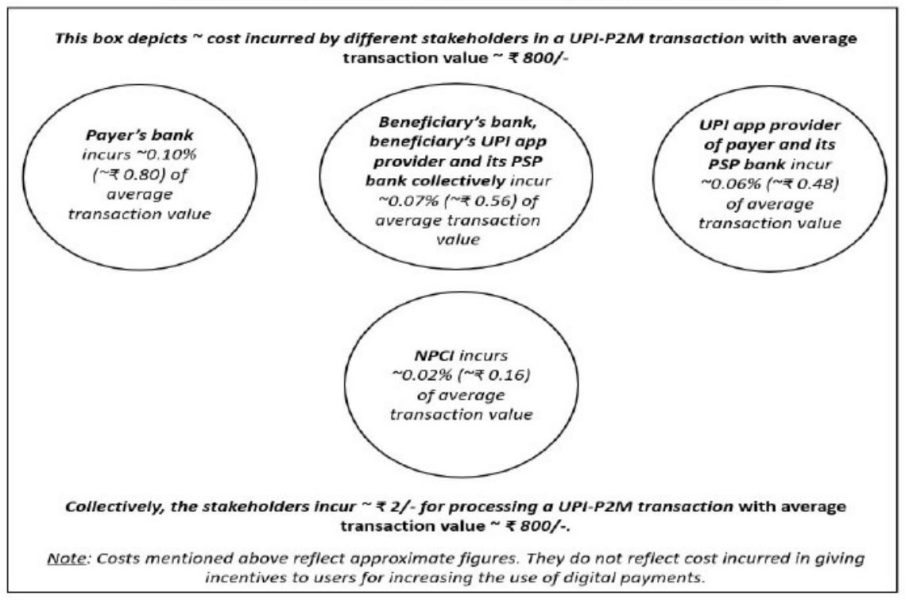

UPI is both a funds transfer as well as a merchant payment system. The various participants in UPI include payer PSP, payee PSP, remitter bank, beneficiary bank, NPCI, bank account holders (payer and payee/merchants) and Third Party Application Providers (TPAPs). The system facilitates settlement of payment transactions using a combination of these participants.

RBI said it has not issued instructions regarding charges for UPI transactions.

The central bank stated that “PSPs in any payment system should earn income for continued operations of the system to facilitate investments in new technologies, systems and processes. This is applicable irrespective of the system being operated by a public sector or a private sector entity.”

It said the stakeholders incur ₹2 for processing a UPI-P2M (Person-to-Merchant) average transaction value of ₹800.