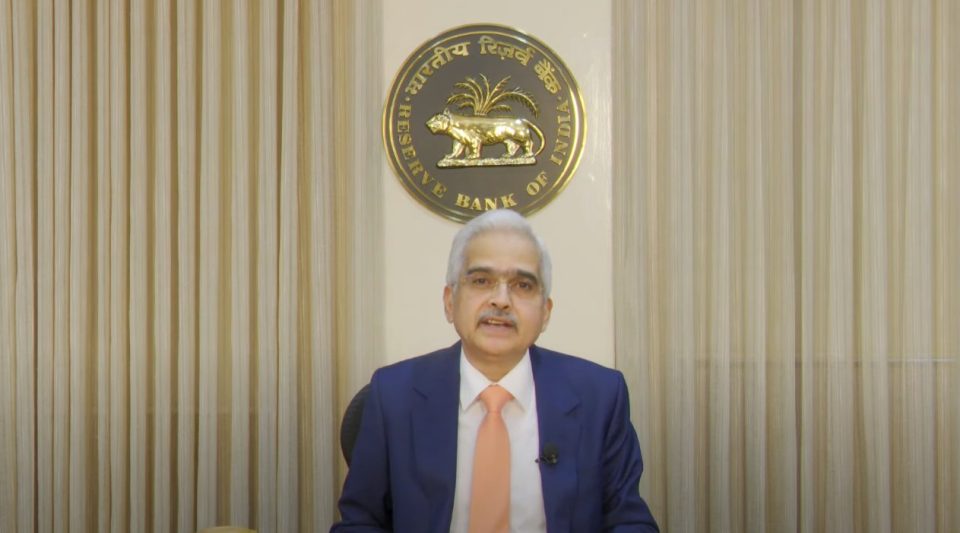

Shaktikanta Das on RBI repo rate decision: "It's just a pause, not a pivot'

RBI keen to assess the cumulative impact of the rate actions done till now, says Governor

The surprise decision to hold the repo rate should not be seen as an indicator of similar moves in the future, and the Reserve Bank of India (RBI) will “not hesitate” to take further action on rates if needed, said RBI Governor Shaktikanta Das on Thursday.

“If I have to characterise today’s monetary policy in just one line…it’s a pause, not a pivot,” Das said in the customary interaction with reporters after the announcement of the policy review.

Earlier in the day, the six-member Monetary Policy Committee (MPC) unanimously decided to pause after repeated rate hikes over the last 11 months, surprising analysts who were expecting the central bank to make a final 25 basis points hike before opting to pause. The benchmark policy rate (repo rate) is 6.5 per cent.

Price stability

Das said the job of decisively bringing down inflation is “not yet finished”, and the RBI’s policy priority continues to be price stability. The RBI is keen to assess the cumulative impact of the rate actions done till now, he said. There has been a cumulative hike of 250 basis points since May 2022.

Also read: RBI projects FY24 inflation at 5.2%, says fight against it is far from over

In his statement while announcing the policy review, Das pledged to hike interest rates again if needed, saying the decision to pause was “for this meeting only”. Speaking to reporters, Das said the RBI’s target is to bring headline inflation to 4 per cent from the current levels of 6 per cent, and the monetary policy will be working towards progressively aligning with the target.

Deputy Governor Michael Patra said RBI has marginally increased its FY24 growth estimate to 6.5 per cent primarily on the assumption of a decline in the average oil price to $85 per barrel from $90 per barrel earlier.