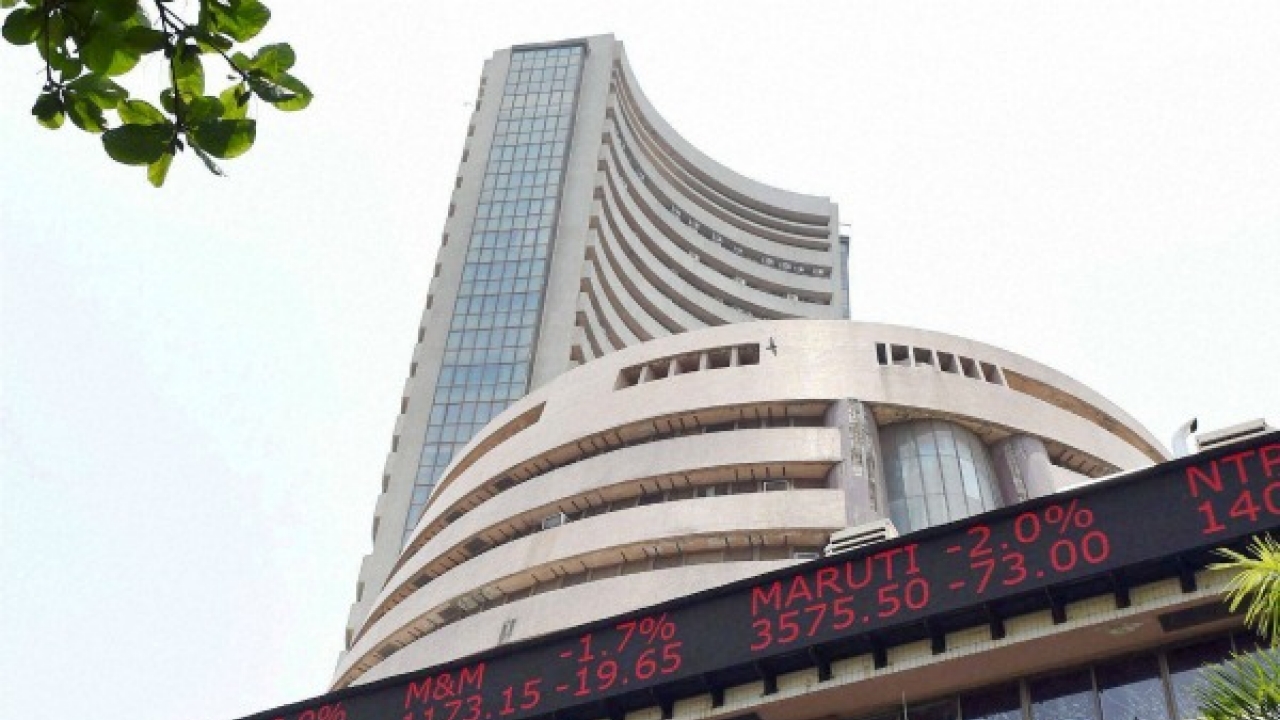

Sensex soars over 350 pts; Nifty near 11,800

Domestic equity benchmark BSE Sensex rallied over 350 points Wednesday driven by gains in banking and IT stocks, amid positive cues from global markets ahead of US Fed policy outcome.

The 30-share index was trading 367.24 points, or 0.94 per cent, higher at 39,413.58 at 0930 hours. Similarly, the broader NSE Nifty was quoting 104.75 points, or 0.90 per cent, up at 11,796.25.

In the previous session Tuesday, the BSE gauge settled 85.55 points, or 0.22 per cent, higher at 39,046.34, while the Nifty closed 19.35 points, or 0.17 per cent, higher to end at 11,691.50.

Top gainers in the Sensex pack in early trade included Tata Steel, Kotak Bank, Vedanta, Tata Motors, Axis Bank, Yes Bank, SBI, IndusInd Bank, Maruti, HDFC twins and RIL, rising up to 3.46 per cent.

While, Bharti Airtel and Hero MotoCorp were the only losers in index, shedding up to 0.35 per cent.

Global equities are witnessing a liquidity-fuelled rally as comments from central banks globally hinted at a rate cut, said Sunil Sharma, Chief Investment Officer, Sanctum Wealth Management.

“In a scenario of slowing global growth and benign crude prices, policymakers are reverting to easy monetary policy and lowering the cost of capital,” he added.

Investors across the globe are awaiting the outcome of US Federal Reserves policy, scheduled to be announced later in the day.

Elsewhere in Asia, Shanghai Composite Index, Hang Seng, Nikkei and Kospi were trading significantly higher in their respective early sessions.

Bourses on Wall Street too ended in the green on Tuesday.

Meanwhile, on a net basis, foreign institutional investors bought equity worth Rs 31.73 crore, while domestic institutional investors purchased shares to the tune of Rs 181.03 crore, provisional data available with stock exchanges showed on Tuesday.

On the currency front, the Indian rupee appreciated 16 paise to 69.53 against the US dollar.

The global oil benchmark Brent crude futures were trading 0.03 per cent lower at 62.12 per barrel.