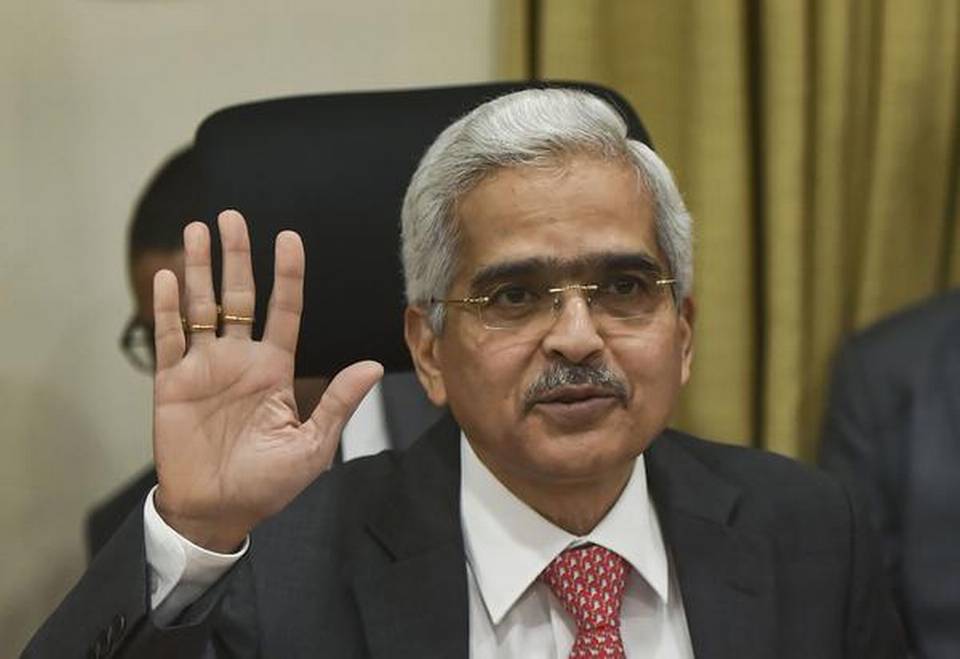

Room for more rate cuts as govt’s hands are tied, says RBI governor

After surprising everyone with four successive rate cuts this year, governor of Reserve Bank of India Shaktikanta Das said on Thursday (September 19) that there was more room to do so given the growth deceleration and stable inflation that is likely to stay below target for a year or so.

However, Das said there was little fiscal space for the government to unveil any countercyclical measures to boost the sagging growth and the only way to revive the growth engine is to front-load the budgeted capex, hinting that only an easy money policy can help salvage the situation.

Also read: Ground reports of a downturn

Since assuming charge mid-December, Das-led rate-setting panel has delivered four successive rates cuts, with the fourth one last month being the most surprising and unconventional one as he chose to deliver a 35 bps repo cut. With that the RBI has delivered a cumulative 110 bps repo reduction since February, yanking down the key benchmark rate to a nine-year low of 5.40%.

“When we see that the price stability is maintained and inflation is much below the 4% mandate and is expected to be so in the next 12 months horizon, there is a room for more rate cuts especially when growth has slowed down,” Das told Bloomberg India Economic Summit.

On the shrill calls from industry for fiscal measures in the form of tax cuts, Das said, “The government must front-load the budgeted spending as it has t little fiscal space for any countercyclical measures to boost growth.”

Also read: Eight core sectors’ growth slows to 2.1% in July

Stating that there is little space for fiscal expansion, Das added, “So far as the fiscal side is concerned, the government has by and large remained prudent. They have not announced any countercyclical measures that would have led to fiscal expansion. Most of these things announced are non-fiscal. I think the fiscal space is very limited. Fiscal deficit at 3.3% borrowings by PSUs both put together there is very little space. But what is the internal position of the government with regard to tax collection, how much expenditure is likely to be materialised, that is something the government has to view,” Das said.

Indicating deepening crisis in the economy, which is partly cyclical and more structural, the government had more bad news pouring in in recent days. While advance tax mop-up missed the target by a wide margin inching up by a paltry 4.7% in for the first half against a target of 17.5% at ₹5.50 lakh crore up from ₹5.25 lakh crore a year ago.

The first quarter GDP slowed to a six-year low of 5% and last month for the first time exports grew. Every industry, be it auto or FMCG, is gasping for breath as consumer demand has slumped. That tax revenue was not robust was clear when the government said it had used up as much as 77% of the fiscal deficit or market borrowing by July end. The July budget had set a direct tax mop-up target of 17.5% for the full year, while the same for indirect taxes are set at 15%.