RBI raises repo rate to 4.4%; Sensex and Nifty tank

Inflation, geo-political tensions, high crude prices, global shortage of commodities impacting economy also behind increase.

The Reserve Bank of India (RBI) on Wednesday (May 4) raised key interest rate by 40 basis points to 4.40 per cent with immediate effect and revised the cash reserve ratio by 50 basis points.

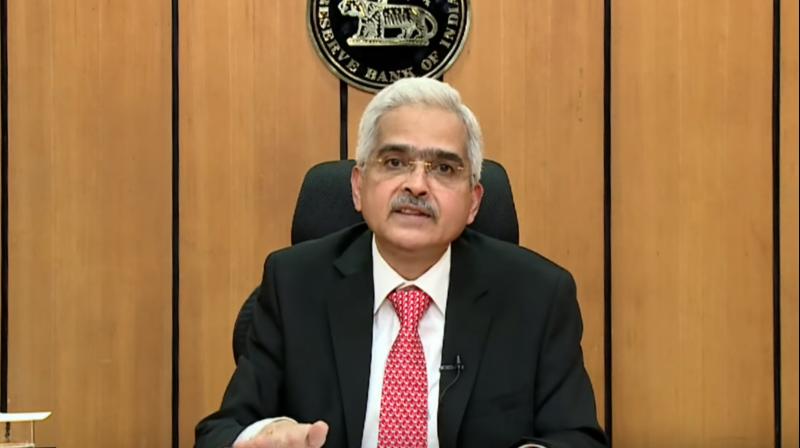

RBI Governor Shaktikanta Das said the decision to increase interest rate was taken mainly because of rising inflation, geo-political tensions, high crude oil prices and shortage of commodities globally, all of which have had negative impact on the economy.

Statement by Shri Shaktikanta Das, RBI Governor https://t.co/cktaninqLF

— ReserveBankOfIndia (@RBI) May 4, 2022

Equity markets fell sharply in late afternoon trade on Wednesday, with the Sensex crashing 1,060.64 points after the RBI increased the benchmark lending rate. The 30-share BSE benchmark tumbled 1,060.64 points or 1.86 per cent to 55,915.35 in late afternoon trade. The NSE Nifty also tanked 317.75 points or 1.86 per cent to 16,751.35.

End of easy money regime

Das said the RBI’s decision should be seen as part of the apex bank’s declaration in April of gradual withdrawal from easy money regime. “The decision today to raise repo rate may be seen as reversal of rate action of May 2020. In last month, we had set out a stance of withdrawal of accommodation. Today’s action need to be seen in line with that action,” he said.

Central banks in many countries are raising rates as inflation squeezes businesses and consumers. To counter that, regulators are gradually increasing costs for borrowing that had dipped to record lows during the pandemic.

The RBI’s decision had a negative impact on the markets. The BSE Sensex fell 461.6 points or 0.81% at 56514.3, and the Nifty was down 137.05 points or 0.8% at 16932.05. About 1,146 shares have advanced, 2,152 shares declined, and 121 shares are unchanged.