RBI projects FY24 inflation at 5.2%, says fight against it is far from over

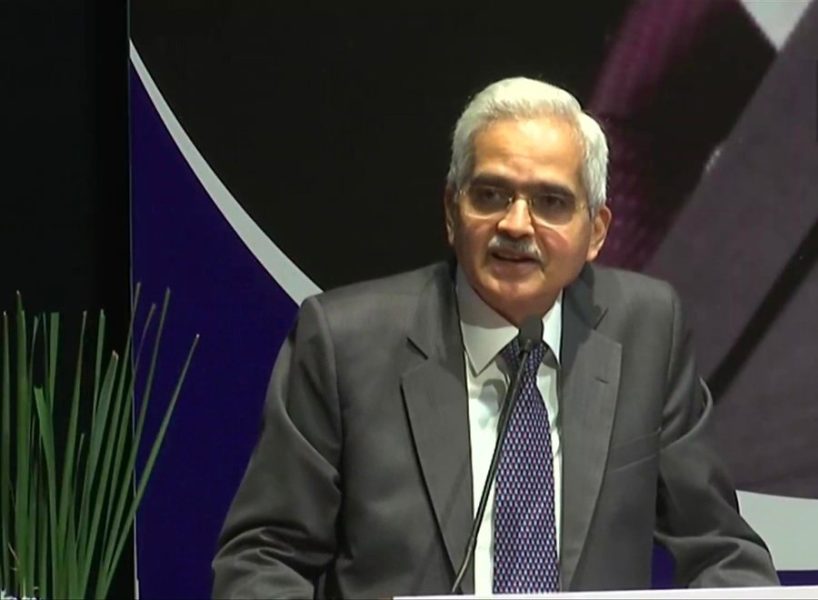

The Reserve Bank on Thursday (April 6) projected marginal easing in retail inflation to 5.2 per cent in the current fiscal. RBI Governor Shaktikanta Das, however, cautioned that the fight against inflation is far from over as the inflation outlook remains dynamic amid the recent hike in crude oil prices due to OPEC (Organisation of Petroleum Exporting Countries)‘s decision to cut output.

Das while announcing the first bi-monthly monetary policy for current financial year 2023-24, said taking into account a crude oil price of USD 85 per barrel and a normal monsoon, the retail inflation in the current fiscal is projected to be 5.2 per cent with risks evenly balanced.

The retail inflation for the June quarter is projected at an average of 5.1 per cent.

Also read: Inflation matters: Why RBI cannot afford to pause repo rate hikes

It is expected to rise to 5.4 per cent each in the September and December quarter. Das said the retail inflation will likely go down to 5.2 per cent in the March 2024 quarter.

In the monetary policy statement, the RBI governor said the said the central bank’s war against inflation will continue the figures are brought down to target level.

The RBI has the mandate of keeping inflation at 4 per cent, with a band of (+/-) 2 per cent on either side. Retail inflation has remained above the RBIs upper tolerance level of 6 per cent for two months and in February it was 6.44 per cent.

‘CAD to remain moderate, eminently manageable’

Das also exuded confidence that the current account deficit (CAD), a key external sector indicator, is likely to remain moderate in the January-March quarter of 2022-23 and also eminently manageable going forward.

The CAD for the first three quarters of 2022-23 stood at 2.7 per cent of GDP. In the October-December quarter, CAD narrowed significantly to 2.2 per cent from 3.7 per cent in the preceding three months on account of lower merchandise trade deficit and robust growth in services exports.

“Overall, our external sector indicators have improved significantly. Foreign exchange reserves have rebounded from USD 524.5 billion on October 21, 2022 and now stand in excess of USD 600 billion taking into account our forward assets,” he added.

Stating that the country’s export services have grown at a healthy pace in the first two months of 2023, Das said better growth prospects of the gulf cooperation council (GCC) countries are expected to keep remittances robust. In fact, inward gross remittances touched an all-time high of USD 107.5 billion during calendar year 2022, he said.

Watch | WPI inflation eases to 4.73 pc in Jan

“The CAD is expected to remain moderate in Q4:2022-23 and in the year 2023-24 at a level that is both viable and eminently manageable.”

Portal for unclaimed deposits

The RBI governor also announced the central bank’s decision to set up a centralised portal to access details of unclaimed deposits by depositors or their beneficiaries across various banks.

“About ₹35,000 crore unclaimed deposits as of February 2023 were transferred to RBI by public sector banks (PSBs) in respect of deposits which were not operated for 10 years or more. In order to improve and widen the access of depositors or beneficiaries, it has been decided to develop a web portal to enable search across multiple banks for possible unclaimed deposits,” Das said.

Also read: RBI hikes repo rate to 6.5%; projects inflation to fall to 5.3% in FY24

State Bank of India tops the chart of unclaimed deposits worth ₹8,086 crore followed by Punjab National Bank at ₹5,340 crore, Canara Bank at ₹4,558 crore and Bank of Baroda at ₹3,904 crore.

(With inputs from agencies)