Railways diversifies freight basket, lets fruits, grains, sugar hop on

The Indian Railways (IR) has started operating trains with names from your fruit basket: Banana Special, Mango Special and Sapota Special. No, this is not mere play on words, but the result of a new initiative by the national transporter to not only diversify its freight basket but also ensure that in these times of pandemic-induced logistical challenges, essential commodities reach markets. Some food grains such as millets and pulses are also now reaching the mandis via trains instead of trucks, with the IR offering attractive rates for these commodities and taking some business off road transporters. Ditto for the sugar industry, which has also taken its business to trains instead of trucks.

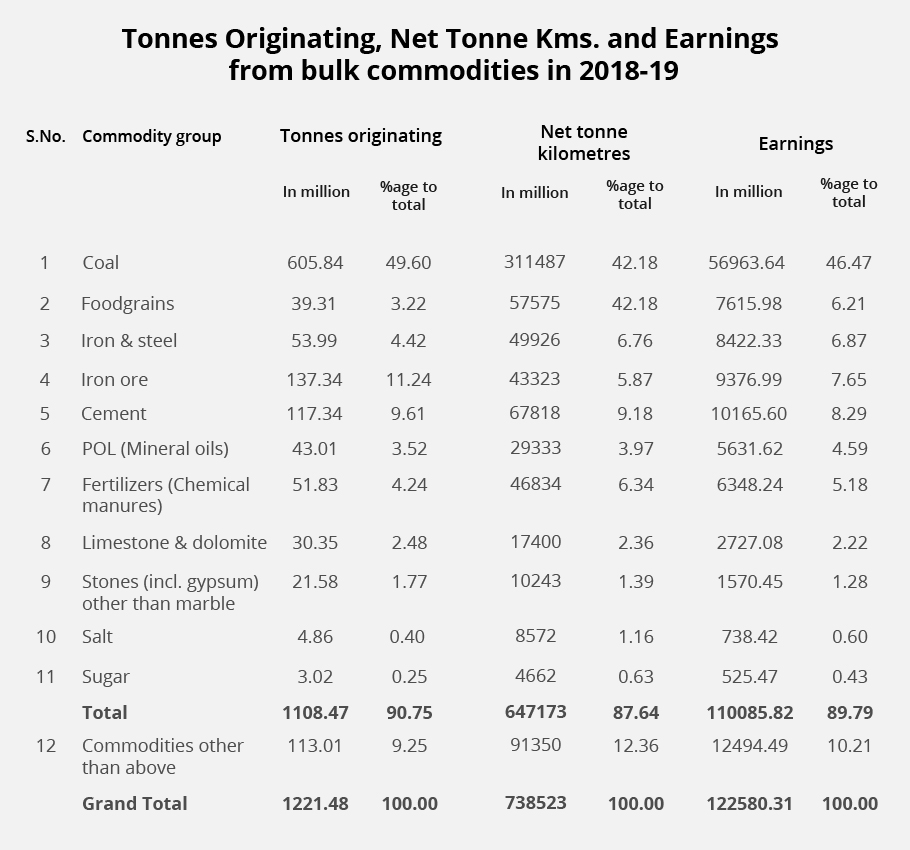

Through these initiatives, not only are commodities – which were earlier not seen on trains – reaching far and away across the country, the IR has also managed to enhance its overall freight earnings by diversifying the freight basket and reducing its over dependence coal. Here are some numbers to show why the Railways needs to further reduce its dependence on carrying coal: coal accounted for nearly half the total freight basket in 2018-19 and almost 47 paise of every rupee earned through freight carriage in the year.

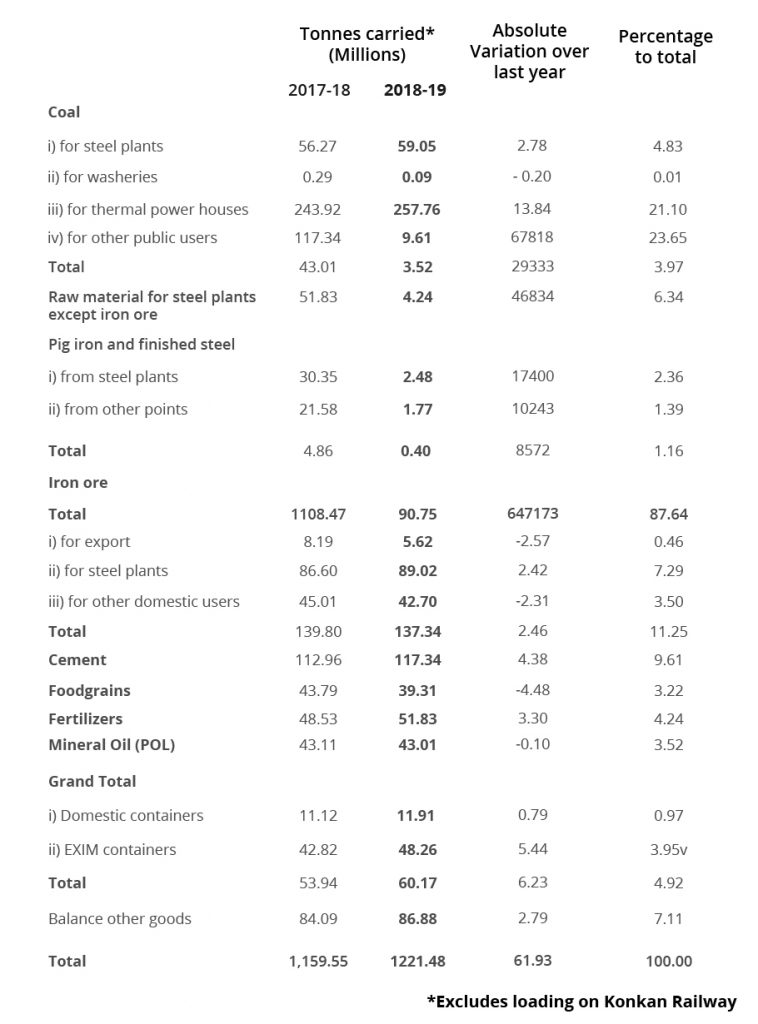

The predominance of coal in the basket can also be seen from this: the next biggest commodity that the IR was transporting was cement. But cement loading was just about 10 per cent of the basket and accounted for a mere 8 per cent of freight earnings. Food grain, a segment which has been the focus of the IR top brass during the current pandemic, accounted for just 3 per cent of the basket and 6 per cent of earnings. There were no special trains or corridors for fruits and vegetables and sugar accounted for just a quarter per cent of total freight carriage.

This significant attempt at diversifying the freight basket comes even as the IR has always known the criticality of freight earnings in keeping the system chugging but has been unable to take steps to attract more commodities till now.

Freight earnings have nearly always cross-subsidised earnings from the passenger business, where the IR books a loss in carrying each passenger. Now, the pandemic and resultant suspension of passenger services has further underlined the importance of increasing earnings from freight carriage. Besides, during the pandemic, smaller categories such as food grain, iron ore etc are the ones showing growth in earnings even as earnings from coal dipped.

Related news: CAG ‘exposes’ railways trick to hide revenue deficit

So just one example of a kisan train should suffice to showcase the changed perspective on freight operations. Anantapur has emerged as the ‘fruit bowl’ of Andhra Pradesh. Over 80 per cent of the 58 lakh MT of fruits and vegetables in the district are sold in other states, particularly in the North — in Delhi, Uttar Pradesh, Punjab and Haryana. The fruits and veggies were earlier being transported by road – which took longer and meant lower price realisation for farmers due to damage incurred while transporting in trucks. Now that the IR has begun running a special Kisan Train between the Anantapur Railway Station and Adarsh Nagar Station, New Delhi, farmers may earn as little more. The rake is loaded with 14 parcel vans and carries 332 tonnes of tomatoes, bananas, oranges, papayas, muskmelons and mangoes. The journey time is 40 hours

Railway Board Chairman, VK Yadav said earlier this week that “As soon as we get a request for Kisan Rail, we start the service in a day or two. We are getting requests regularly. The farmers have benefitted from this service and we will run more Kisan Trains depending on demand. The fourth Kisan Rail will ply between Nagpur and Delhi.”

On food grain, Yadav said there has been a “bumper loading” of food grain over the last few months. “In earlier years, we were unable to store and transport entire food grain stock on offer and a lot of it was being wasted. But now, 70 per cent of stock has been cleared from FCI as well as private godowns. And we do not see negative growth in food grain carriage even when government policies change. The food grain basket now includes millets and pulses which we were not able to carry earlier. India is second largest sugar producer; earlier all sugar was moving by road but now lot of traffic coming to IR. So we don’t expect food grain traffic to dip in coming time also.”

Related news: The math behind Railways’ privatisation project

Earnings from coal have dipped by almost ₹10,000 crore or by nearly a third year-on-year in the first half of the fiscal while those from food grain carriage have jumped by 60 per cent or nearly ₹2,000 crore. Latest data show that while overall freight earnings of the IR have been picking up since July end – due to a number of fare and other initiatives taken by the IR – they still remain about 17 per cent down year on year. Yadav had earlier spoken of a stiff target of raising freight earnings in 2020-21 by 50 per cent to tide over the drastic fall in passenger earnings during the year. Till date, passenger earnings remain lower by nearly 93 per cent compared to H1 last fiscal.

Already, a variety of concessions are on offer for train transport of bulk and even non-bulk commodities. Category-wise discounts, such as 40 per cent lower charge for fly ash bagged in an open wagon meant to attract freight from power houses and the cement sector, are on offer. A ‘long lead concession’ of up to 20 per cent for coal, iron ore and steel industries while an up to 50 per cent ‘short lead concession’ is being provided for all other sectors.

Besides, the IR has launched time-tabled parcel trains during the pandemic, catering to those customers who do not need to send items across the country in bulk. A senior IR official had said earlier that a consignment worth just ₹80 was also carried by one such train. The guiding principle in such parcel trains is offering passage to each and every item, however small in quantity. This endeavour will now continue, so that the IR can have a greater role in total goods transported across the country, away from roadways. The question is, will all these freight initiatives lead the IR to at least earn as much in 2020-21 as it did in the previous fiscal, despite the pandemic decimating passenger earnings?