Quarterly earnings to steer markets this week: Analysts

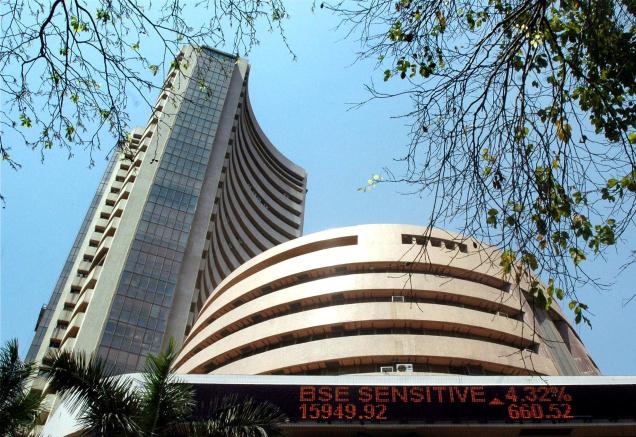

Stock market sentiment this week would be largely guided by the ongoing fourth quarter results season, with a host of front-line companies slated to come out with their financial report cards, say analysts.

Besides, global crude oil movement, rupee and investment trend by overseas investors would keep influencing trading, they added. “In the near-term investors’ focus will be on Q4 earnings and elections. For the week ahead, results from key index heavy weights including large corporate banks will set the tone for earnings season. “Continuity in FIIs flows and corporate earnings coming in-line with expectation will keep market afloat,” said Vinod Nair, Head of Research, Geojit Financial Services.

Bourses may also witness bouts of volatility till clarity emerges on the political front post elections, experts added. “Markets are expected to remain subdued and under pressure at least till the election season is over. However, volatility will continue to remain on the higher side as knee-jerk reactions are expected due to the ongoing results. The financial services industry will be on this week’s radar as important results of companies such as Indiabulls Housing Finance, Yes Bank, M&M Financial, Axis Bank, SBI Life are going to be announced,” said Jimeet Modi, Founder & CEO, SAMCO Securities & StockNote.

“After a period of significant momentum ahead of the general elections, the market may take a pause in some kind of an interim profit-booking,” said Joseph Thomas-Head Research, Emkay Wealth Management. The scenario of a slowdown in global growth as also the definitive prospects of higher fuel prices and a weaker currency may also be working on the minds of the market participants at this juncture, he added. Among other major companies slated to announce their financial numbers this week are Maruti Suzuki India and Hero MotoCorp. Over the last week which had two market holidays, the Sensex rose 373.17 points, or 0.96%.

On April 22, movement may be seen in index heavyweight Reliance Industries and HDFC Bank which announced their March quarter earnings over the extended weekend. Reliance Industries on April 18 posted the highest quarterly net profit by any Indian private sector firm with a 9.8% rise in earnings in the period ended March 31 after robust business in retail and telecom sectors offset a dip in oil refinery margins. The oil-to-telecom conglomerate reported a consolidated net profit at ₹10,362 crore, or ₹17.5 per share. Private lender HDFC Bank on April 20 reported a 23% jump in its net profit to ₹5,885.12 crore for the March quarter on a healthy growth in its net interest income. Jet Airways would also remain in focus amid a slew of negative news surrounding the firm.