Most states oppose hike in GST despite slowdown, low revenues

Most of the states opposed change in slabs or hike in GST during the crucial GST Council meeting on Wednesday arguing an increase in the levies would have adverse implication for the economy facing slowdown, said sources.

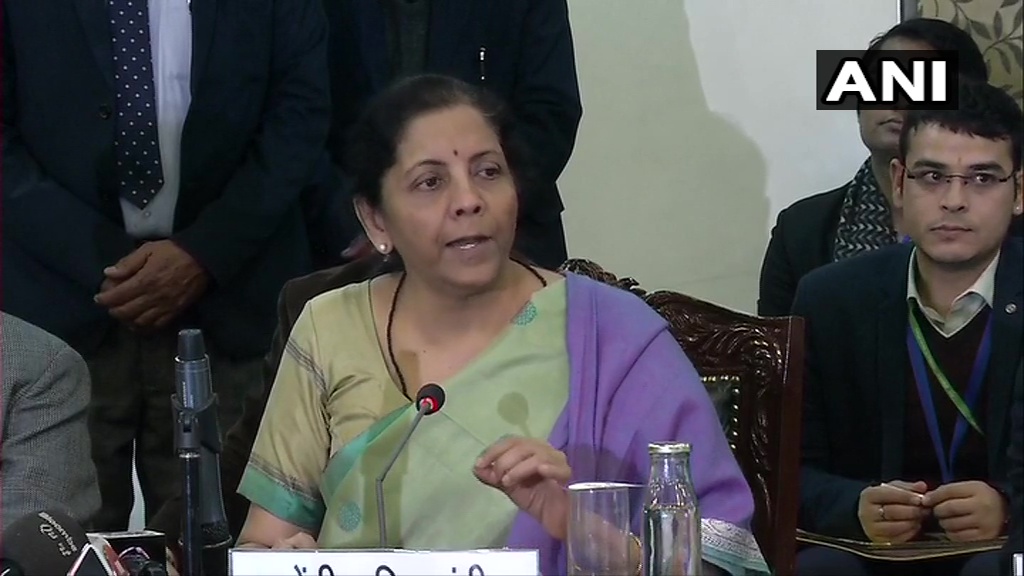

The GST Council, comprising state finance ministers and headed by Finance Minister Nirmala Sitharaman, is the highest decision-making body on the indirect tax rates.

As consensus eluded, the Council for the first time exercised the option of voting to decide on the GST rate on lottery as the economy is in downturn.

State finance ministers also expressed concern over a decline in revenue collection and delay in payment of GST compensation.

Sources said state ministers pointed out that moderation in revenue collection through GST was due to economic slowdown and not because of lower GST rate.

“The rate enhancement or slab change at the moment would be a knee-jerk reaction. States were of the view that first plug all the loopholes that are there in the system and improve compliance”, Delhi Deputy Chief Minister Manish Sisodia said coming out from the 38th GST Council meeting here.

A committee of officials on revenue augmentation has submitted report which has suggestions with regard to slab change and rate enhancement.

Also read | Non-payment of GST dues by Centre put states in a spot

During the pre-Budget consultation with the Union finance minister, West Bengal Finance Minister Amit Mitra said states pointed out that social expenditure is coming down phenomenally.

“The upcoming Budget cannot have social expenditure decline which is like punishing the common people. Stagflation is knocking at our door and we are concerned that next Budget will not be able to address it,” Mitra said.

He further said it appears from the Centre’s presentation during the meeting that by February next year, there will be no money with the Centre to pay compensation

Punjab Finance Minister Manpreet Singh Badal said the key concern as far as the states are concerned was whether they would be getting compensation at time.

He said they were aware that revenue position was grim but “were not aware” that it was grim to an extent where the Union finance minister could not give an assurance in the Council whether states would be paid on time or not.

“As far as I am concerned, I think it is just close to a sovereign default where the Government of India is unable to pay its constitutional obligation. It is a sad day,” he said.

Badal, however, added that it was not situation to get into panic mode.

“Things can be fixed. I want to say they need to be fixed quickly,” he said.

Addressing media after five-hour long meeting, Sitharaman said the presentation made was based on discussions in the committee of officers of state and the Centre on revenue augmentation.

“They have just come up with one first shot of data since the time GST has been implemented till today and based on different options of if the growth rate is this or if the growth rate to something else, how will it be and gave a first picture and the Council and the ministers agreed that on this, they have mull over for some time and then come back,” she said.

So, this was the first presentation, which is a preliminary presentation, with the no indirect or direct suggestion, on rate increase or rate reduction, she said.

Sitharaman also said the additional information that they have asked all put together in the next meeting, there will be a detailed discussion. “So, first thing was this presentation of the committee of secretaries officers did not suggest, directly or indirectly increase or decrease as a proposal.”

“It was matter of fact presentation of data and data alone. And based on that some projection on revenue collection and on compensation cess collection. And that’s about it. I hope that’s clear,” she added.