Households expect inflation to rise over 3 months and 1 year

Indian households expect inflation to rise over the next three months and also in a year from now, according to the Reserve Bank of India’s Households’ Inflation Expectations Survey amid concerns over India’s growth and even fears of stagflation.

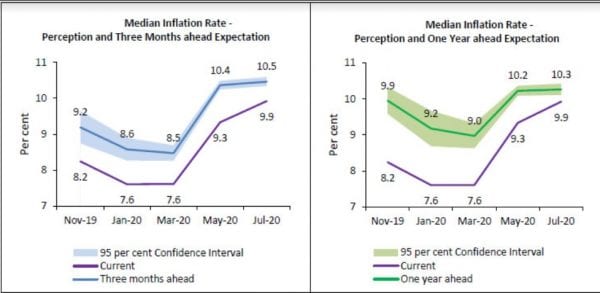

Households’ median inflation perception increased by 60 basis points in July as compared with May, the RBI’s bi-monthly survey said.

Inflation expectations for both three-month and one-year horizons increased by 10 basis points each over the previous survey. The three-month-ahead inflation expectations climbed to 10.5 per cent in July, a level last seen in 2015.

The Consumer Price Index (CPI) inflation stood at 6.09 per cent in June.

For the second consecutive period, the three months ahead median inflation expectation (10.5 per cent) was higher than for one year (10.3 per cent).

The higher expectation of food prices over three months than over one year resulted in the higher short-term inflation expectations, the RBI survey said. At the aggregate level, households’ expectations on price changes are aligned with those of food products and cost of services.

The survey in 18 major cities from July 1-12 was conducted through telephonic interviews in view of the Covid-19 pandemic and the results are based on responses from 5,411 urban households.

The survey is considered important as it provides directional information on short-term inflationary pressures the respondents expect, giving hints about their own consumption patterns.

Inflation expectation details are important for the RBI to frame its policies, because these expectations affect consumer behaviour.

In the last monetary policy announcement last week, RBI governor Shaktikanta Das, while refraining from providing a growth forecast, had said that the real GDP growth is expected to contract.

In the press conference following the MPC meet, he had said that economic activity was recovering from the weak levels seen in April and May on account of Covid lockdown. However, a resurgence in infection cases could result in the revival tapering down, he had warned.

Global brokerage Nomura has indicated India could face stagflation. However, this may be transitory because of supply-chain disruptions during the pandemic and, hence, only likely to be temporary, it said.

Stagflation occurs when economic output stagnates even as inflation rises. It indicates that the economy is heading towards unemployment and low consumer demand.

How expected inflation affects actual inflation

Firms and households take into account the expected rate of inflation when making economic decisions, such as buying a product, salary negotiations or pricing a product. All of these decisions, in turn, feed into the actual rate of increase in prices. Given that central banks are concerned with price stability, policymakers pay attention to inflation expectations in addition to the actual inflation.

What is the problem now?

The objective of the monetary policy committee (MPC) of the Reserve Bank of India is to have inflation in the range of 2-6 per cent; inflation around this level is associated with good economic performance in the country. A higher inflation rate could prevent the public from making accurate longer-term economic as well as savings and financial decisions.