Govt concedes economy slump; blames shrinking pvt consumption, dull exports

An outgoing government has quietly acknowledged at the fag end of its term that the Indian economy is slowing down. It is another matter that the same government maintained a studied silence over any economic achievements in the last five years, throughout a prolonged campaign to get re-elected. This description sums up the state of the world’s fastest growing major economy in a single sentence. India remains the fastest growing among major world economies but is now in the grip of a slowdown as the Modi government ends its term.

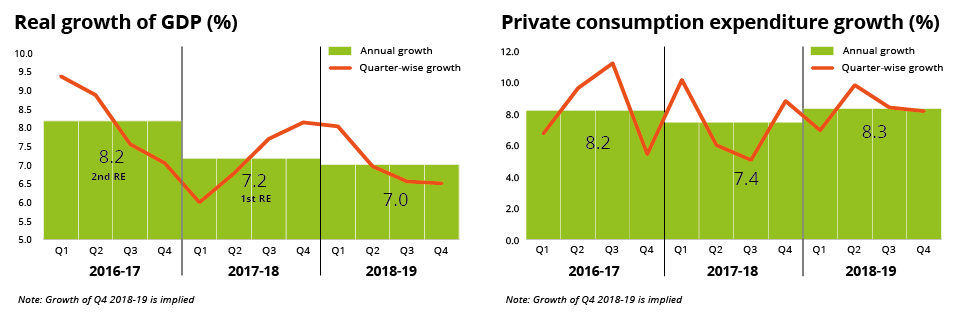

The latest monthly report released by the Finance Ministry says “India’s economy appears to have slowed down slightly in 2018-19” and blames declining private consumption, muted exports and tepid increase in fixed investment for this slowdown.

What does a decline in private consumption mean? Slowing private consumption has been evident for some months though the government has acknowledged it only now. Indians have been cutting back on their monthly purchase of daily essentials like soap, hair oil, detergents and even bread.

An analysis by Kotak Institutional Equities (report attached) shows Hindustan Unilever (the country’s largest FMCG company selling soaps, detergents, hair oils and toothpaste) posted the lowest volume growth in six quarters in Q4FY19 at 7% after growing at over 10% for the previous five quarters.

Bread and biscuit maker Britannia also slowed to its lowest volume growth in six quarters at 7% while its dairy and international business reported historic de-growth. Dabur’s (hair oils etc) domestic volume growth was lowest in six quarters at just 4.3% and GCPL’s (Godrej Consumer Products Ltd) soap business reported a seven-quarter low at just 2%.

Vinod Karki, Head Strategy for ICICI Securities explained that slowing private consumption “reflects weak consumer sentiment which is driven by expectations of income growth and inflation. Consumption showdown is in line with the general economic slowdown.”

The single biggest reason for a cutback in private consumption seems to be a slowing rural economy. Rohit Chordia, Jaykumar Doshi and Aniket Sethi of Kotak have explained this in the context of the demand slump at HUL: “Demand environment has moderated in the near term led by rural slowdown. Rural growth has decelerated to 1.1 times urban growth as compared to 1.3 times in the previous quarters. Slowdown accentuated in the months of February and March as compared to January 2019. The management expects near-term demand for FMCG industry to be soft in view of weak macro.”

Obviously, there is just not enough rural income growth to sustain previous growth rates in FMCG volumes. This consumption slowdown has lead HUL to reduce prices of marquee soap brands Lux and Lifebuoy; GCPL has also cut prices of its soap brands.

People are not just cutting back on daily essentials, demand for big-ticket items like cars and bikes is also flagging. Maruti Suzuki India, which sells every second passenger vehicle (cars, SUVs and vans), saw dispatches drop by a fifth this April at nearly 20%. And Hero MotoCorp, the biggest two-wheeler maker, reported over 17% decline. Mowtown has been slowing down for almost the entire second half of 2018-19; the slowdown got accelerated in Q4.

Data from the Society of Indian Automobile Manufacturers (SIAM) show dispatches of PVs grew 7% in H1 of FY19 but declined by a percent in H2 and in Q4, fell by 2%. Passenger car dispatches were growing at 6% in H1 but fell by 3% in H2 and by 5% in Q4. Two-wheeler dispatches were down 9% in Q4 from a growth of 10% in H1. Vehicle purchase is slowing due to not just political headwinds but also a slowing rural economy. Even for FY20, vehicle makers are none too sanguine: SIAM forecast shows PV volumes may grow 3-5% and two wheelers by 5-7%.

Besides elections, other factors which contribute to slowing vehicle sales are the rising cost of ownership and sub-optimal monsoon rains affecting rural buying sentiment. Tepid rural buying is a big dampener: almost 40% of Maruti’s sales come from rural markets; every second two wheeler is also bought in rural markets. Urban markets are already facing issues of congestion, ride-sharing options and with rural markets also slowing down, low single digit growth in automobile sales may be the new normal.

Not just falling private consumption, low growth in fixed investments is also contributing to the economic slowdown. Karki of ICICI Securities said “While GFCF (gross fixed capital formation) growth has been strong (at least until Dec’18), we have seen very low participation by the private sector in Fixed Capital formation – Indian private corporates (ex-Reliance Industries) increased their Net Fixed Assets only by 4.9% in the year ending September 2018”.

As for exports, growth has remained weak since November, but recovered in March to $32.5 billion. “A scenario of global trade war doesn’t bode well for global demand, and therefore Indian exports,” Karki said, perhaps referring to the ongoing tussle between USA and China.

At the end of a long election campaign when the Centre has practically remained in statis, all eyes now are now on the incoming government. Experts expect renewed focus on kick-starting consumption. Karki said, “As the economy picks up and subsequently wages and consumer confidence picks up, consumption could improve. In the short run, increase in public spending could boost consumption. However, it will have fiscal implications.”