Government to infuse ₹3,000 crore into state-run general insurance firms

State-owned general insurance companies will receive an infusion of ₹3,000 crore from the government this quarter.

State-owned general insurance companies will receive an infusion of ₹3,000 crore from the government this quarter.

Last year, the Union Cabinet cleared proposal to provide more capital support to the firms in order to shore up their position. The companies were bleeding even before the pandemic hit.

The Cabinet decided to increase the authorised share capital of National Insurance Company Limited (NICL) to ₹7,500 crore and that of United India Insurance Company Limited (UIICL) and Oriental Insurance Company Limited (OICL) to ₹5,000 crore each to give effect to the capital infusion.

Recently, the government received parliamentary permission for gross additional expenditure of ₹6.28 lakh crore for 2020-21 as part of second and final batch of supplementary demands for grants. This included ₹3,000 crore for insurance companies.

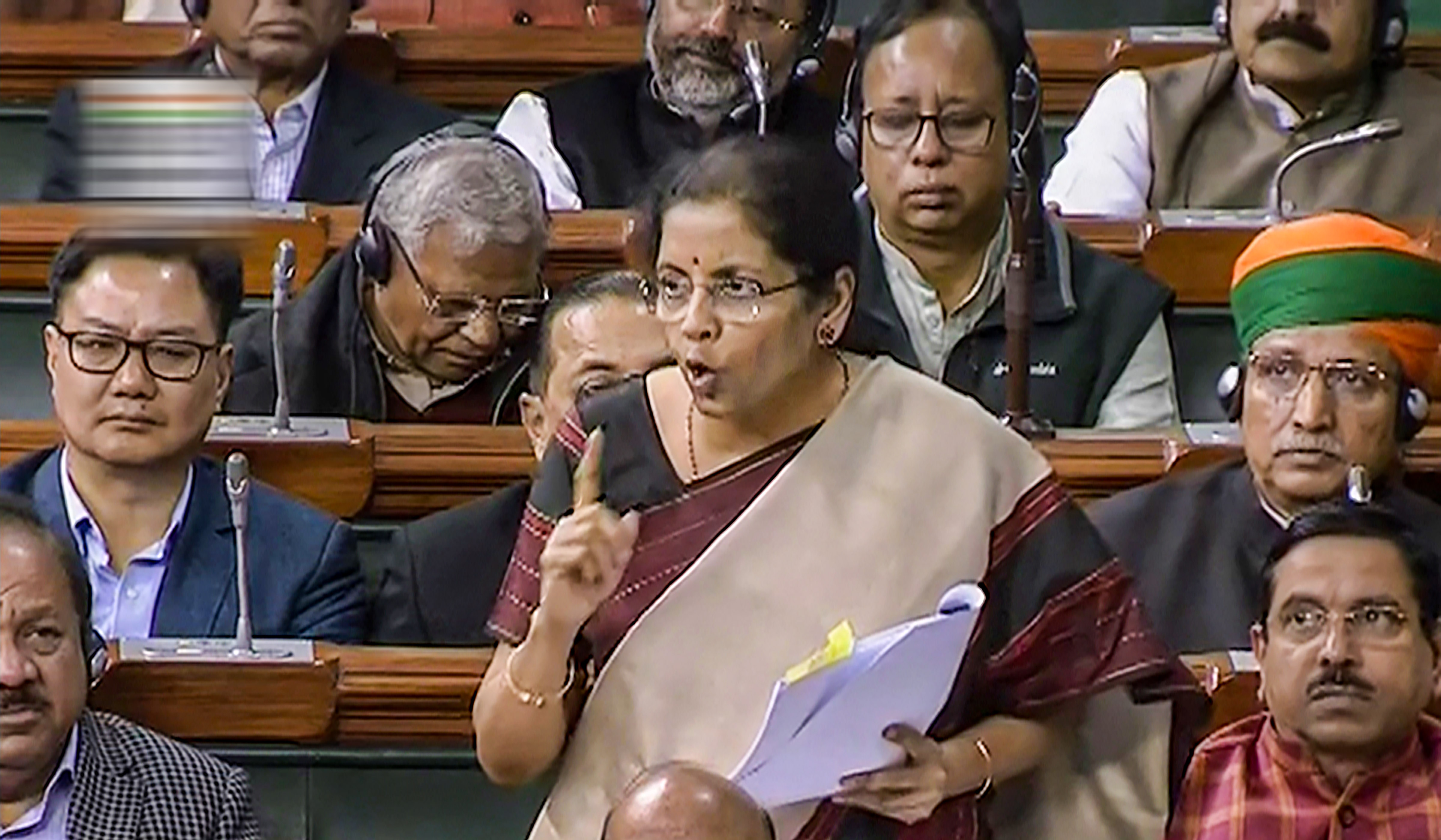

In her latest budget, Finance Minister Nirmala Sitharaman said the government would privatise two public sector banks and one general insurance company in 2021-22. In 2017, state-owned companies New India Assurance Company and General Insurance Corporation of India listed on the stock exchange.