Budget 2023-24: Good for small taxpayers, not for HNIs

The Budget doesn't augur well for the super rich as there is an attempt to plug loopholes on many tax avoidance measures

Finance Minister Nirmala Sitharaman presented the Union Budget 2023 on Wednesday. While the small taxpayers eagerly anticipate favourable announcements on the tax front before the budget, they usually come back empty handed. Not this time. The Union Budget 2023 turned out to be an action-packed affair. There were many announcements, both positive and negative.

Positive for the small taxpayers as the government has tried to simplify and reduce taxes for the small taxpayers. Negative for the High Networth Individuals (HNIs) as there is an attempt to plug loopholes on many tax avoidance measures commonly used by HNIs.

Strong incentive for the new tax regime

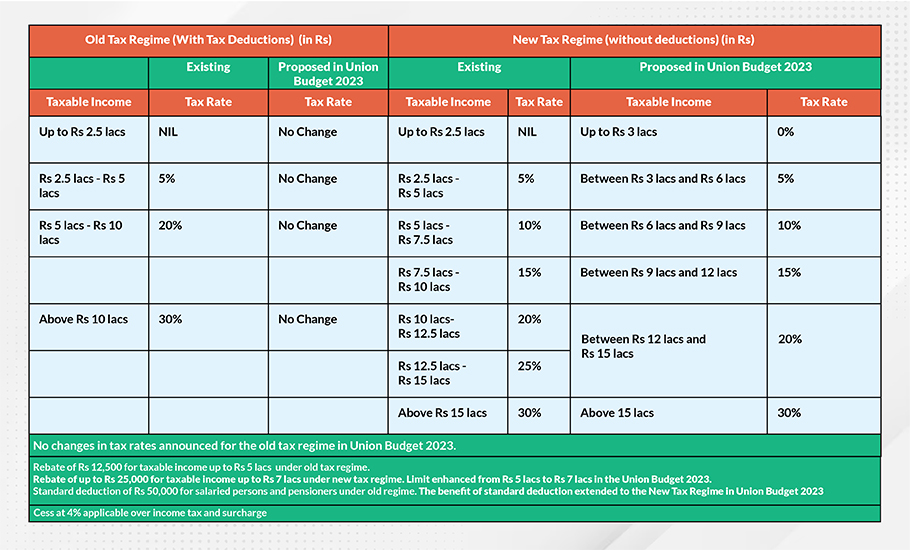

The new tax regime was introduced by the government in the Union Budget 2020. The new tax regime is simpler and has concessional tax rates but does not allow deductions. However, there were not many takers for the new regime since there was not much difference in tax liability between old and new regimes.

In the Union Budget 2023, the government has gone all out to incentivize the new tax regime. The tax slabs have been rationalised and tax rates lowered. Salaried persons and employees have been allowed standard deduction of Rs 50,000, a benefit which was allowed only under the old tax regime.

The cap on total income for eligibility of rebate under Section 87A has been enhanced from Rs 5 lakh to Rs 7 lakh under the new regime. This cap remains Rs 5 lakh under the old regime.

To attract high earners to the new regime, the surcharge on tax for taxpayers with income above Rs 5 crore has been reduced from 37% to 25%, effectively bringing marginal tax rate for such taxpayers from 42% to 39%. Going forward, the new tax regime shall be the default option but you can opt for the old tax regime if you want.

Also read: Budget 2023-24: Income-tax relief, small saving sops a year before elections

How much do you save?

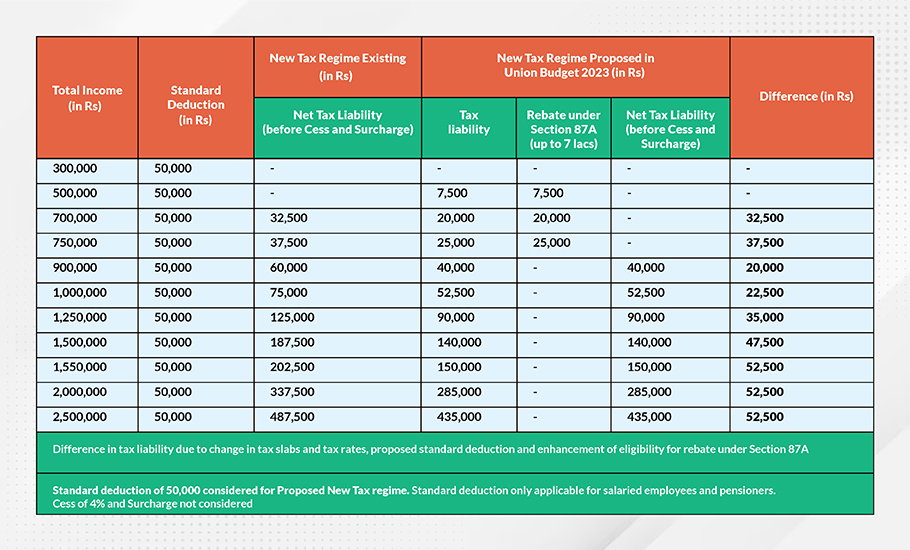

If you are already using the new tax regime, the savings are impressive. For a salaried employee with an annual income of Rs 7 lakh, the proposed changes translate to savings of Rs 32,500. For incomes of Rs 10 lakh and Rs 20 lakh, this translates to savings of Rs 22,500 and Rs 52,500 respectively.

Huge savings, but are you better off than old regime?

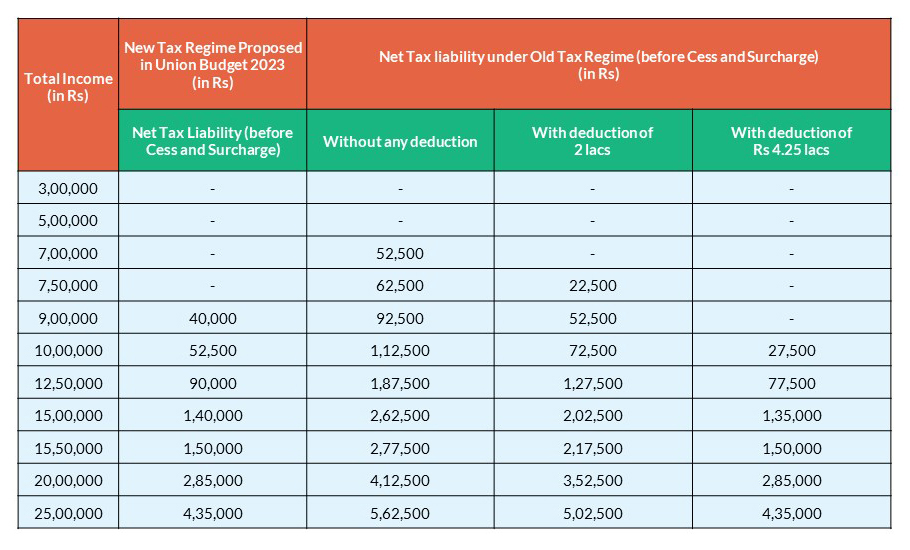

This question does not have a generic answer because taxpayers will have different levels of tax deduction. 80C, 80D, HRA, Section 24 etc. However, we can compare the proposed new regime with the old regime with deductions of Rs 1.5 lakh under Section 80C, 50,000 under Standard Deduction, Rs 25,000 for health insurance premium under Section 80D, and Rs 2 lakh for home loan interest. A total deduction of Rs 4.25 lakh. Let’s also consider cases with zero deductions and deduction of Rs 2 lakh.

Clearly, if you have higher deductions to set off, the old tax regime might still be a better choice.

Tax haven of insurance plans is over

For a long time, the taxpayers, especially high net worth individuals, have used insurance plans to generate tax-free returns/income. The government does not like this and brought ULIPs with annual premiums exceeding Rs 2.5 lakh under the tax net in 2021. The traditional plans still escaped the tax net.

In this budget, the government has brought high premium traditional plans into the tax net too. If you purchase a traditional plan or multiple plans with aggregate annual premium of Rs 5 lakh, the maturity proceeds from such plans will be taxable at your marginal rate. You can take deduction for the premiums paid if you didn’t tax benefit for such premium paid under Section 80C. The death benefit under all kinds of life insurance plans continues to be exempt from tax.

This move will not affect small taxpayers much and is likely to impact HNIs more. This is clearly not good news for the insurance companies.

Also read: Budget 2023-24: Proposals on Direct Taxes Code that can benefit taxpayers

Benefit under Section 54 and Section 54F

It is common for taxpayers to purchase a house to avoid paying tax on long term capital gains on sale of residential property (Section 54) and LTCG on sale of any other capital asset (Section 54).

While the aim of the provisions was to increase house ownership, The government believes that these sections have been abused by HNIs to avoid paying tax on LTCG by purchasing expensive residential properties. To set things right, the government has proposed to cap the deduction under these sections to Rs 10 crore.

Therefore, even if the taxpayer purchases property of Rs 15 crore, the cost of this new asset shall be considered only Rs 10 lakh.

The impact is bigger on those seeking benefit under Section 54F since it considers sale consideration of the old assets, which includes capital gains. Section 54 considers only the long-term capital gains. Again, this affects HNIs. The small taxpayers are not affected by this change.

Clarity over including home loan interest in cost of acquisition

Taxpayers get tax benefits for interest payment on home loans under Section 24 of the Income Tax Act. While this is common knowledge, the government has stated that a few taxpayers have tried to take dual benefit from this interest payment. First, by taking tax benefit under Section 24 and then by adding the interest paid to the cost of acquisition. In the budget proposal, the government has clarified that you can’t avail both.

Thus, you can add only such interest to the cost of acquisition that has not been utilised to avail tax benefit under Section 24. This is a useful clarification.

Enhancement of limit under Senior Citizens Savings Scheme

Senior Citizen Savings Scheme (SCSS) is a popular investment product among senior citizens to generate risk-free income during retirement. The investment limit in SCSS has been enhanced from Rs 15 lakh to Rs 30 lakh, benefiting senior citizens.

The subscription limit for the Monthly Income Scheme has also been enhanced from Rs 4.5 lakh to Rs 9 lakh for single accounts and from Rs 9 lakh to Rs 15 lakh for joint accounts.

A new small savings scheme targeted at women, Mahila Samman Savings Certificate, has been launched. The deposits under the scheme can be opened by/for women and minor for a period of 2 years and will earn interest rate of 7.5% p.a. While this makes for good optics, in the absence of any tax benefits, there is nothing special about the product since the bank fixed deposits are currently yielding 7% p.a.

Making foreign remittances more taxing

Residents can remit money up to USD 250,000 per financial year under Liberalised Remittance Scheme (LRS). While the Budget has left this limit untouched, it has increased the tax collection at source (TCS) rate on all remittances except education and medical treatment from 5% to 20%. This high rate applies also to overseas tours and remittances for investments abroad.

Additionally, the threshold for TCS applicability has been reduced from Rs 7 lakh to zero. While you can claim back the excess TCS paid at the time of filing income tax returns, this causes friction. So, if you are planning to invest in Google, Amazon, Tesla, and Microsoft, your life has become a little more difficult.

In addition, the budget has proposals that make the taxation of REITs/InVITs and market linked debentures more adverse.

As mentioned in the beginning. An action-packed budget. Positive for the small taxpayer, but negative for high networth individuals (HNIs) as the government tries to plug loopholes for tax avoidance.

(Deepesh Raghaw is a SEBI Registered Investment Adviser and writes at www.PersonalFinancePlan.in)