Amid COVID crisis, India-China stand-off a death blow to Indian startups

First came the economic downturn. Then the COVID-19 crisis. And then the Foreign Direct Investment (FDI) regulations. Now, the India-China border tension. The Indian startup ecosystem will see a slowdown in funding over the next few quarters as investors are cautious with uncertainty in the market.

While Chinese investors played a crucial role by making strategic investments in some of the leading startups in the country, the government’s recent FDI regulation and India-China border tensions could hamper the investment scenario.

Compared to the first half of 2019, the number of companies funded during the same period in 2020 dropped by 40 per cent and the net amount invested dropped by 20 per cent, as per the data provided to The Federal by Venture Intelligence, a firm that tracks private companies’ investments, financials and valuations.

During the said period last year, VCs funded 383 startups and deployed $4.3 billion. In 2020, only 244 startups raised funds to garner about $3.4 billion.

While it may not be prudent to compare month-on-month data, the slow down in funding is largely the effect of the economic downturn and COVID-19 crisis. The FDI regulations and border tension, which many see as a death blow to startups, will only reflect in the coming quarters.

“The trend is clear that it is not going to get any better. Chinese VCs (venture capitals) were among the strategic investors. At a time when startups need more funding support, closing investment avenues comes as a death blow,” Arun Natarajan, founder, Venture Intelligence said.

Majority of the PE (private equity) and VC funding came from LPs (limited partnerships — investors) who had exposure to the public market. But as the markets crashed post-March, the money at disposal for PEs and VCs got reduced. This eventually led to a slowdown in startup funding.

The investments that had come between April and June seem to be the fundings from existing investors to bail out their portfolio companies during the crisis.

Related News: China standoff: Fin Min proposes restrictions on foreign investment in pension funds

“Many Investors had to pivot from fresh investments to bail out rounds due to the lockdown and the impact of COVID-19 on their portfolio companies. The outlook on the early stage will remain dire for a few quarters as investors brace for the impact of the second wave on their portfolio firms,” Siddharth Pai, founding partner at 3One4 Capital said.

Siddarth and Pranav Pai, sons of former senior Infosys executive TV Mohandas Pai manage 3One4 Capital. The Bengaluru-based venture capital firm manages assets of about ₹800 crore. “Nobody is sure who can survive this COVID-winter. How will they (companies) come out of the crisis is what investors are also looking at. It will be a game of survival of the fittest,” Pai adds.

The government reviewed the Foreign Direct Investment (FDI) policy for curbing opportunistic takeovers/acquisitions of Indian companies due to the COVID-19 pandemic (referred to as Press Note 3 from Ministry of Industry and Commerce), in April this year.

Indian investors believe that many Chinese VCs had planned for mega deals before the “Press Note 3” and that some of them issued term sheets (a document that lays out the terms of the investment and collateral). All these now come crashing down with the tightening of regulations and India-China standoff along the Galwan Valley in Ladakh.

Indian investors are keen to see if the government would open up avenues for them and other (non-Chinese) foreign investors by liberalising certain policies.

Related News: Slow economic growth will drive customers towards value purchase: Walmart

On March 30, a representative group of startup founders and investors made a fervent appeal to Prime Minister Narendra Modi and ministers of finance, commerce and Information Technology to provide a robust relief package to deal with the financial devastation in the wake of economic downturn and blow caused by the pandemic.

The group said the COVID-19 crisis threatened to destroy all the progress and future potential of the startup ecosystem in a few short months. “Unfortunately, startup companies across the nation are inherently young, less resilient, and most vulnerable. Many likely face devastation during this extraordinary economic downturn,” the group noted in the letter to the PM.

Considering that India is the third-largest startup ecosystem in the world, the investment scene may differ in the long term. But how will they cope with the current crisis remains a big question.

Also, India is the next big market for Chinese investors, and they were most welcome until recently. But the current border tensions could alter the situation completely.

Chinese investors contributed to 20% of the overall investments in startups last year. According to a study, 18 out of 30 Indian “unicorn” companies have significant Chinese investment.

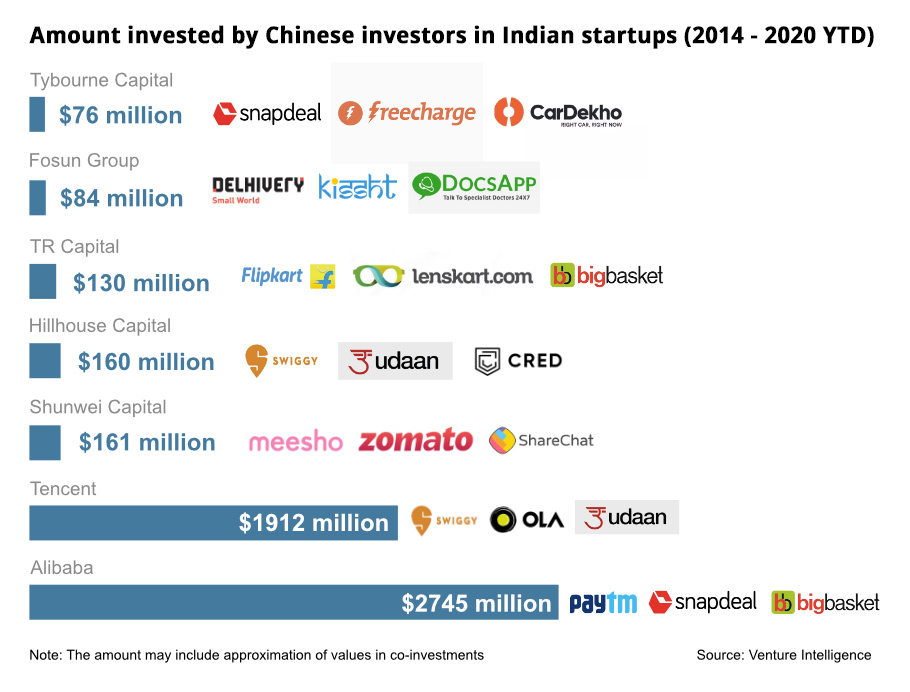

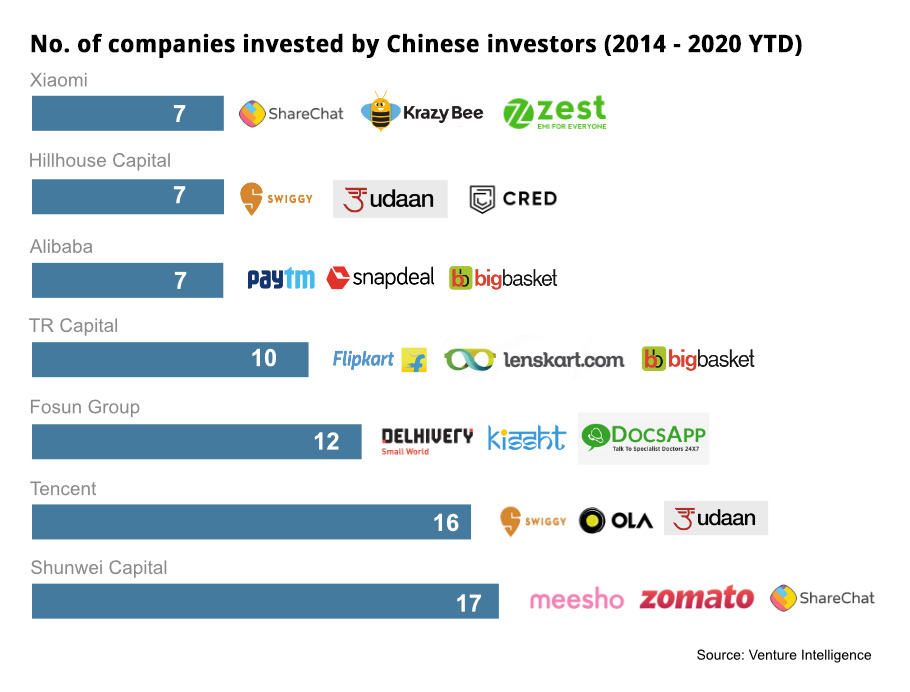

Indian companies such as Paytm, Flipkart, Big Basket, Zomato, Swiggy, Sharechat, Delhivery and Ola Cabs among others count China’s Alibaba, Tencent, Shunwei Capital, TR Capital and Fosun as strategic investors.

Compared to the Doklam standoff in 2017, the current border tensions will have a severe impact, many in the industry say.

“The startup wave that started in 2015 witnessed a mild depression for some time, but it picked pace after that. Now with the government clearly saying no to China, it would be very difficult for investors to make a call on investments,” said Divya Pranav, senior assistant vice president at Invest India, an investment vehicle backed by the Federation of Indian Chambers of Commerce and Industry.

Besides startups, China also invested across sectors in the country.

According to data from China Global Investment Tracker (CGIT), which tracks investments worth $100 million or more noted that from March 2007 to December 2019, Chinese companies invested $14.5 billion in India (excluding the construction contracts). Of 43 such deals, 23 of which are greenfield investments (FDI investments in foreign companies that establishes new facilities in India).

The majority of these investments were made in the energy, technology (telecom), consumer goods, metals, and real estate sectors. This is completely different from the India Trade Promotion Board which says we have got only $2.3 billion FDI.

Related Analysis: In line with Mukesh’s grand plan, Reliance is debt-free ahead of deadline

With Reliance Industries raising nearly $15 billion in two months, it shows there is no dearth of capital. However, it indicates that bigger companies will get to benefit and smaller ones will struggle.

Rahul Garg, Founder/CEO, Moglix, a Noida-based B2B startup which aims to become India’s Alibaba, says though India corporates showed interest in startups in the past, One has to wait and watch if the current crisis pushes them to invest more or partner with Indian startups.

Earlier VCs could support businesses which had cash flow negative. But now they may look at more sustainable options. Besides, with the current crisis, startups may lose bargaining power as they would be keen to just survive than focus on how much stake to dilute.

This would essentially make investors behave like sharks to gobble up startups that have the potential to go big, but currently face fund shortage.

“The search has pivoted from the search for unicorns to the search for cockroach or tardigrade companies (those who can survive whatever is thrown at them). These companies will emerge as winners and attract big funds once they stabilise operations by September,” Pai says.

(With inputs from Venkataraghavan Srinivasan)