COVID-triggered job uncertainty drives record investment in Atal Pension Yojana

The popularity of Atal Pension Yojana (APY), a government-backed pension scheme for the unorganised sector, has seen increased acceptance among youngsters, especially after the COVID pandemic stuck, shows data provided by the Ministry of Finance.

Interestingly, one third of its total enrolment happened after March 2020. Besides, the maximum enrolment happened in Uttar Pradesh, Bihar and West Bengal –– the states with maximum population of migrating labour. Also, nearly 44 per cent of the new subscribers belong to the age group of 18 to 25 years, an indication that pandemic has made the youngsters more cautious about where they invest for a more secured future.

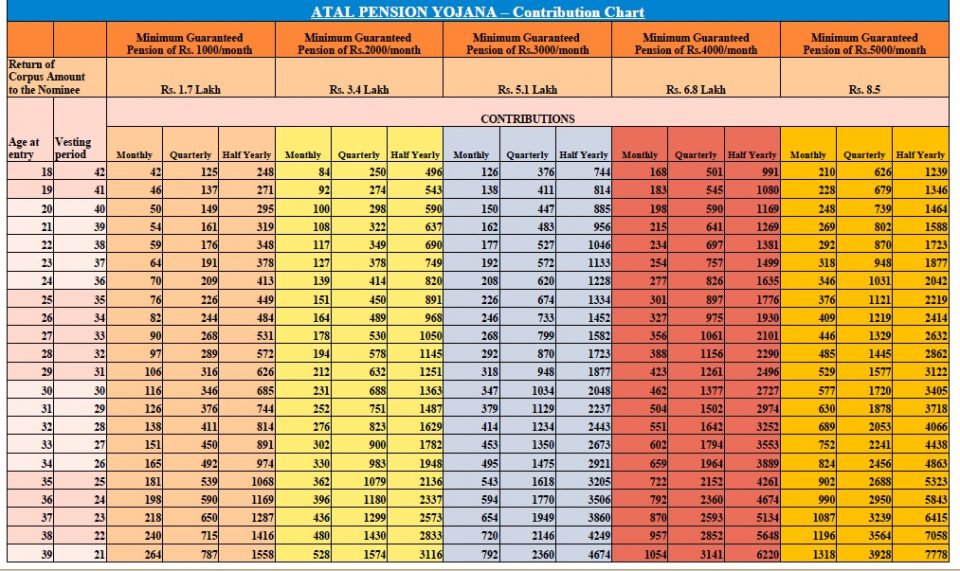

Under Atal Pension Yojana, any Indian national (in the 18 to 40 age bracket) can invest a specified sum to receive a pension between Rs 1,000 and Rs 5,000 after the age of 60 (see chart). The investment can be done through existing bank account.

The scheme was launched by Prime Minister Narendra Modi in 2016. However, it didn’t get much popularity in the early years. About 28 lakh people subscribed to the scheme in the first year. The pandemic, however, accelerated the pace of new enrolments to the APY.

Of the 3.30 crore enrolments as of August 25, about 1.07 crore enrolments happened between March 2020 and August 2021. Further, the share of younger population among new subscribers shows the increasing popularity of the scheme.

Shridhar Deshpande, a senior consultant working in the IT Industry, told The Federal, “I had enrolled in Atal Pension Yojana about a year back. As an individual I don’t have a significant or large corpus to invest every month. The premium is not too high and it offers rebate in income tax as well. I learnt about it through a government advertisement. I compared this pension scheme with other schemes to find it more beneficial. The uncertainty of private job makes Atal Pension Yojana a perfect investment option for me.”

Chinmay Tipnis is a sound engineer from Mumbai. “Since I work in one of the most volatile industries, I needed to have some back up plan for my future. Apart from short-term investments like mutual funds or stocks, I thought I need one long-lasting investment. And, Atal Pension Yojana is the best I found,” Chinmay said.

The state-wise data of Atal Pension Yojana shows that Uttar Pradesh is way ahead of other states with nearly 50 lakh enrolments happening over the last five years. It is followed by Bihar and West Bengal with 31.31 lakh and 26.18 lakh new enrolments for the same period respectively. All the three labor dominant states have seen the highest popularity of the scheme.

Maharashtra and Tamil Nadu have reported nearly 25 lakh enrolments each while Andhra Pradesh, Karnataka and Madhya Pradesh have enrolled about 20 lakh people each. Prime Minister Narendra Modi’s state Gujarat has 13.50 lakh subscribers to the scheme.

Praful Sarda, an entrepreneur from Pune, thinks that the scheme didn’t get enough publicity. He said, “Atal Pension Yojna started with good intentions, but lacked branding. The lack of awareness at the ground level is the major concern, I think.”