GST: As Centre dithers over compensation extension, states face fiscal abyss

Several states have been demanding that the current compensation regime be extended for another five years, till June 2027

With the Centre remaining non-committal to extend the GST compensation regime beyond June 2022, states are staring at a drastic fall in revenue that will significantly hurt their overall fiscal health.

Several states, including West Bengal, have been demanding that the current compensation regime be extended for another five years, till June 2027, to enable their economies to recover from the impact of the COVID pandemic.

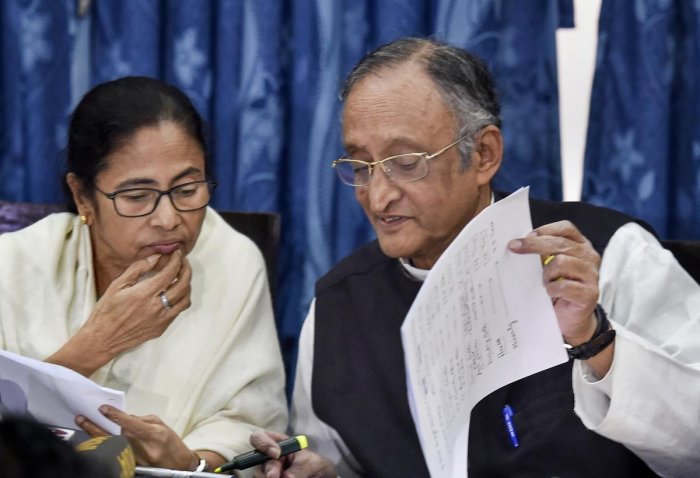

“When it was decided that the GST compensation period would be for five years (starting 2017), did we know that there would be a worldwide pandemic?” asked former West Bengal finance minister Amit Mitra, who is now a special advisor (finance) to Chief Minister Mamata Banerjee. “Three years have lost to the COVID. So we have been urging the Centre to extend the compensation period. The Chief Minister herself has written to the Prime Minister (Narendra Modi) and Finance Minister (Nirmala Sitharaman) to extend the compensation period by three to five years.”

“I have also taken up the matter with the Centre… All the states will be impacted (if the compensation is stopped after June). Yet, we have not received any response from the Centre. Just look at their anti-federalist mentality,” he added.

Also read: Centre enhances its spending on flood management and border area projects

Union government’s stand

In a written reply in the Lok Sabha, Sitharaman said the Centre is committed to giving GST compensation to states/UTs for five years as per the constitutional provision, while admitting that many states have requested an extension of the compensation period during the deliberations in GST Council and in letters addressed to the Centre.

Though she has not categorically ruled out extension of the compensation period, by reminding that the Centre’s commitment as per the constitutional provision is only for five years, the Finance Minister dropped a broad hint about the Union government’s stand on the issue.

When the GST regime was introduced in July 2017, the states were guaranteed to be compensated, during the transition period of five years, if they failed to register a 14 per cent growth in GST revenue collection over the base year of 2014-15.

Since its launch in 2017, most of the states relied on the compensation to achieve the GST revenue growth of 14 per cent. However, the revenue gap only increased over the years. In 2018-19, states collectively could achieve 88 per cent of the targeted growth on their own, leaving a shortfall of only 12 per cent to be compensated by the Centre. Yet, the gap increased to 23 per cent in 2019-20, and to 36 per cent in 2020-21.

A similar shortfall has been witnessed even in the 2021-22 fiscal, as is evident from the details of the GST compensation furnished by Sitharaman in Parliament earlier this week. The shortfall shot up to more than ₹3.09 lakh crore from ₹1.1 lakh crore in the previous fiscal.

Of the current shortfall, ₹96,576 crore has been released to states and UTs as compensation and another ₹1.59 lakh crore has been disbursed as loans to meet the compensation shortfall. A compensation amount of ₹53,661 crore is pending.

Worst affected states

The compensation figures showed that states such Maharashtra, Punjab, Delhi, Gujarat, Karnataka, Uttar Pradesh, Rajasthan and West Bengal faced severe revenue shortfall on account of insufficient GST collection.

Also read: NRC comes back to haunt Assam, long ordeal awaits residents

“Based on the current trend, it can be deduced that if the compensation is stopped, the state (West Bengal) will incur a GST revenue loss of anything between ₹10,000 crore and ₹15,000 crore,” said a senior official of the West Bengal finance department. “This will severely impact the overall economy as the preference of the present BJP government at the Centre to raise money through cess and surcharge, which are not shared with the states, has already reduced overall tax devolution to states. The end of the GST compensation regime will be double whammy for the states.”

The share of cess and surcharge in the Centre’s gross tax revenue increased from 9 per cent in FY13 to 17 per cent in FY 20, according to a study by PRS Legislative Research, an independent not-for profit group.

“As per the 15th Finance Commission estimates, untied funds [tax devolution + revenue deficit grants] in central transfers are estimated to be 29.5 per cent of the Centre’s gross revenue receipts during 2021-26. This is notably less than the same during 2015-20 [32.4 per cent]. Due to the declining share of states in the Centre’s gross tax revenue, the share of tax devolution is estimated to decline in the central transfers,” the PRS study said.

Rise in deficit feared

West Bengal’s revenue deficit to GSDP ratio increased to 2.15 per cent from 0.94 per cent in 2018-19, the official said. “The end of compensation regime will further increase the deficit, which in turn will compel the state to reduce the fiscal space for capital outlay,” he added.

Already, West Bengal’s capital outlay is expected to be 41 per cent lower than the budget estimates in 2021-22.

The state’s capital outlay in sectors like rural development, welfare of SC, ST, OBC and minorities, education, sports, arts and culture, social welfare and nutrition and police has seen significant reduction as per the revised estimate of 2021-22.

In such a scenario, any revenue uncertainty from the GST will have a severe negative impact on public service delivery.