A feel-good Budget that skirts around some critical areas

Budget 2022-23 chalks out a blueprint for India@100; FM has good news for farm sector and India Inc, but little for salaried class

Yogakshema, the good governance concept attested by the Mahabharata, is what her government draws wisdom from, said Finance Minister Nirmala Sitharaman on Tuesday. Her fourth Union Budget — read out in a 90-minute speech that was her shortest so far — sticks closely to the theme.

Budget 2022-23 sets an ambitious 25-year blueprint for India’s Amrit Kaal as it marches toward its 100th year of Independence. This growth would emanate from the four pillars of development, said the Finance Minister: the PM Gati Shakti (for infrastructure); inclusive development; productivity enhancement and investment, energy transition, and climate action; and financing of investments.

Among the key announcements is the rollout of a digital currency by the Reserve Bank of India (RBI), initiatives to uplift the agriculture sector, extended support for India Inc, digital support proposals for education, 100% core banking for Post Office Savings Bank, rollout of e-passports with embedded chips, support measures for MSMEs and start-ups, and schemes for the clean energy sector.

For a pandemic-hit nation that lost lakhs of lives last year, apart from crores of livelihoods, all that the Budget offers in terms of healthcare support is near-radio silence. For the cash-crunched salaried Indian eagerly awaiting income-tax breathers, the FM had a vote of thanks for paying their taxes dutifully.

Also read: Here’s what’s cheaper and what’s costlier

Surprisingly, the Budget does not have any particular ‘election flavour’, considering Assembly elections to five States including Uttar Pradesh are just a week away. All that it has is a development scheme for the North-East, of which poll-bound Manipur is a constituent.

35% jump in capital expenditure

Sitharaman began her speech with good news on the economy front. “The overall, sharp rebound and recovery of the economy is reflective of our country’s strong resilience,” she said. “India’s economic growth in the current year is estimated to be 9.2%, the highest among all large economies.”

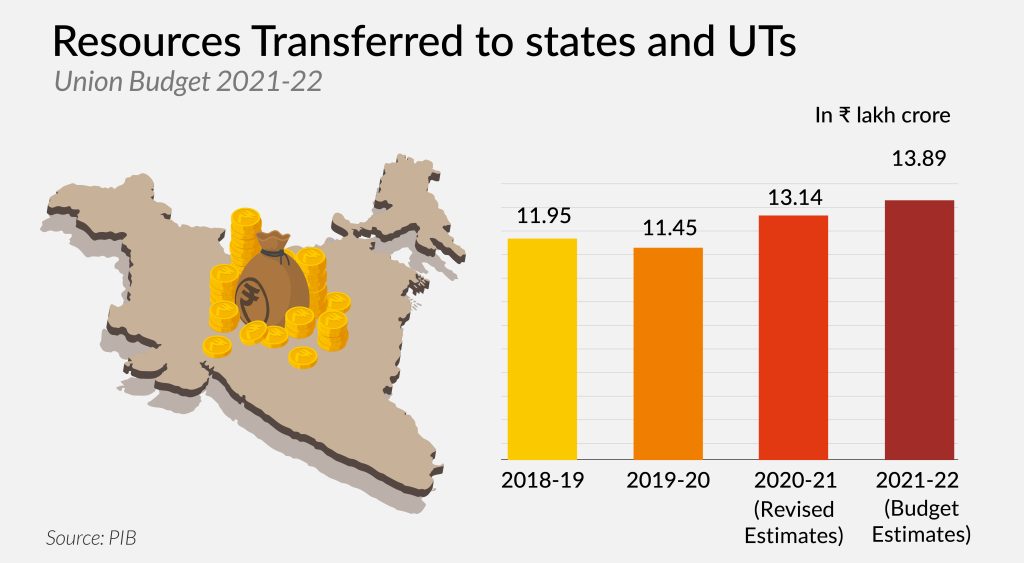

To support the growth, the Centre is planning a capital expenditure of ₹7.50 lakh-crore for FY23, a 35.4% jump from the current fiscal’s ₹5.54 lakh-crore. This is over 2.2 times the expenditure of FY20. “The capital expenditure for FY23 will be 2.9% of the GDP and the effective capex of the Central government is estimated at ₹10.68 lakh-crore, which will be 4.1% of the GDP,” said the FM, emphasising on the need for public investment to work in tandem with private investment.

This capex, together with the provision for the creation of capital assets through Grants-in-Aid to States, makes the ‘effective capital expenditure’ of the Union government ₹10.68 lakh-crore in FY23, which is around 4.1% of the GDP.

The outlay for the Scheme for Financial Assistance to States for Capital Investment is being enhanced from ₹10,000 crore in the Budget Estimates to ₹15,000 crore in the Revised Estimates for FY22, said Sitharaman. For FY23, the allocation is ₹1 lakh-crore. “These 50-year interest free loans are over and above the normal borrowings allowed to the States,” the FM emphasised word-by-word amid some murmurs from the Opposition benches.

Fiscal deficit on downward march

In the light of numerous proposals to boost growth, Sitharaman has pegged the nation’s fiscal deficit for FY23 at 6.4% of GDP. Last year’s Budget had pegged fiscal deficit at 6.8% of GDP and subsequently it was revised to 6.9%. In an indication that the Centre is tempering the urgency to bring down the fiscal deficit, the FM said the target now is to bring it below 4.5% of GDP by FY26.

In charts: FM pegs fiscal deficit for 2022-23 at 6.4% of GDP

States, meanwhile, are being allowed a fiscal deficit of 4% of GSDP in FY23.

Extension of credit guarantee scheme for corporates

The Union Budget brings some cheer to Corporate India, from micro, small and medium enterprises (MSMEs) to start-ups to cooperative societies.

MSMEs are getting an extension of the Emergency Credit Line Guarantee Scheme (ECLGS) till March 2023. Further, the Centre has extended the guarantee cover by another ₹50,000 crore, taking the total cover to ₹5 lakh-crore. The additional amount is exclusively earmarked for the distressed hospitality and related segments. Also, the Credit Guarantee Trust for Micro and Small Enterprises scheme is set to be revamped with additional fund infusion.

The FM’s speech was peppered with the term ‘start-ups’ — these enterprises are being entrusted with helping the nation on the digital path, and bringing down the unemployment rates. Start-ups up to five years old are eligible for a tax benefit scheme that has now been extended for an additional year. For cooperative societies, the Centre plans to trim the minimum alternative tax (MAT) from the current 18.5% to 15%, on par with private companies.

Also read: Major push for solar energy & EVs, little for climate change, forests

Also on the cards are changes to IBC (Insolvency and Bankruptcy Code) rules that would make winding up a company easier and quicker, with fewer legal hassles. The Centre also plans to establish an international court of arbitration in GIFT City, Gandhinagar.

Little on offer for income-tax payers

The current tax slabs and exemption limits were set in 2014, and a raise was eagerly anticipated, but the Budget has none to offer. Apart from some relief for persons with disabilities, and a higher NPS-related exemption limit for State government employees, the Budget has little to say on income-taxes.

Offering some respite, those filing revised Income Tax Return (ITR) now allowed a two-year window from the year of assessment, in case of less filing of tax. This is expected to help taxpayers correct errors, and improve compliance.

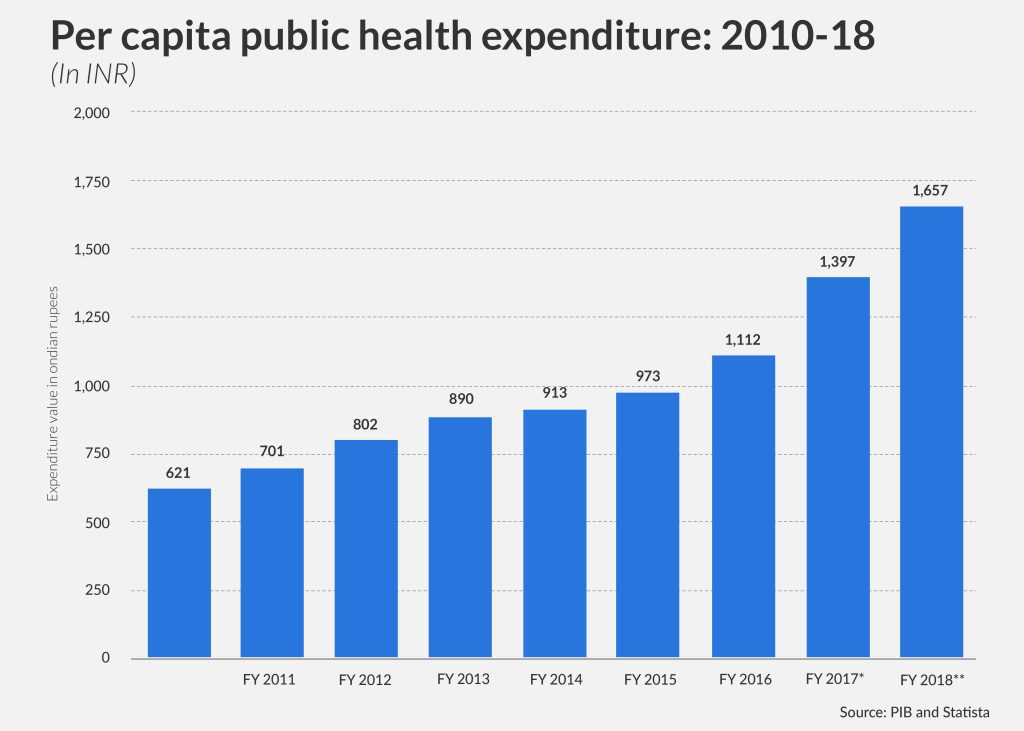

Healthcare takes a backseat

Most analysts thought major budgetary announcements on healthcare are a given, considering the nation is in the midst of the third wave of a virulent pandemic. The Omicron spread has emphasised the need for booster shots, which means crores of Indian will need to be vaccinated again next fiscal. However, the Budget makes no announcement on this.

What Sitharaman did announce are a National Digital Health Ecosystem, and a National Tele Mental Health Programme that would have Nimhans, Bengaluru as the nodal centre and take tech support from IIIT-Bangalore.

Leg-up for rural and agriculture sectors

In the midst of widespread rural distress, the Union Budget has rolled out several initiatives to boost farm income. The FM said 1,208 lakh tonnes of wheat and paddy will be procured from 163 lakh farmers, and ₹2.37 lakh-crore will be the direct payment of minimum support price (MSP) value to their accounts.

Apart from that, the budgetary announcements are mostly designed for the long-term welfare of the sector, such as increased research and development on crops, adoption of ‘kisan drones’ and other tech-enabled farming models, and the establishment of sustainable, profitable farming.

Also on the cards are a revision of agriculture syllabi to include modern methods, and support for agri-tech start-ups to be involved in farming in a bigger way.

Digital assets make it to Budget

After several years of policy yo-yoing, digital currencies and non-fungible tokens (NFTs) finally made it to the Union Budget. In a much-anticipated move, Sitharaman said the RBI intends to introduce its own digital currency.

While the Indian ‘Bitcoin’ is not likely to make waves immediately, it clearly signals the intent of the government — to remove cryptos from the grey area and bring them under regulatory purview. Cementing the stance, the FM said income from the transfer of virtual digital assets will attract a tax of 30%.