Gold prices are sparkling; read this before you rush to buy some

Gold can be a part of a well-thought-out portfolio, as a hedge against inflation, but never more; it is a myth to claim that gold always gives positive returns;

Over recent days, gold prices have been climbing steadily and hitting record highs.

On an upward trajectory, in Chennai, the price of 24-karat gold touched a high of ₹7,610 per gram last week. While investors who are holding gold either in physical form or through other investment avenues like gold bonds or exchange-traded instruments are celebrating, others are wondering whether they have missed the bus.

Gold price projections

The World Bank forecasts an average gold price of $1,950 per ounce in 2024 (approximately ₹5,736.71 per gram, at the rate of USD 1 = INR 83.4), there is the possibility of an increase in the future. The IMF expects an average gold price of $1,775 per ounce (approx ₹5,231 per gram) in 2024, based on global economic activity, inflation expectations, and financial market conditions.

Goldman Sachs and JPMorgan Chase & Co have made gold price estimates at $2,133 per ounce (approx ₹6,286 per gram) and $2,175 per ounce (approx ₹6,410 per gram), respectively, for this year. When this piece was written, the price of 24-carat gold was $2,337 per ounce (approx ₹6,887.4 per gram). (One ounce is 28.3495 gram).

If the IMF and World Bank’s predictions are right, then the price of gold might fall in the coming months, as the present price is far above the average price predicted.

Parallel highs

So, should you increase your investments in gold?

Any investment should be fundamentally based on one’s risk appetite and return expectation to reach the financial goal set for him or her. Any systematic investment should also be based on an asset allocation plan.

But most investors forget the asset allocation plan when they see a particular asset performing well over other assets. When gold prices increase they get lured to invest in gold, and when the equity market is hot, they get attracted to stocks.

Now, surprisingly, the Indian equity market is seeing new heights and, at the same time, we see the gold price also witness new peaks.

Apple to apple

Let us compare the return on equity investment and gold investment over the years.

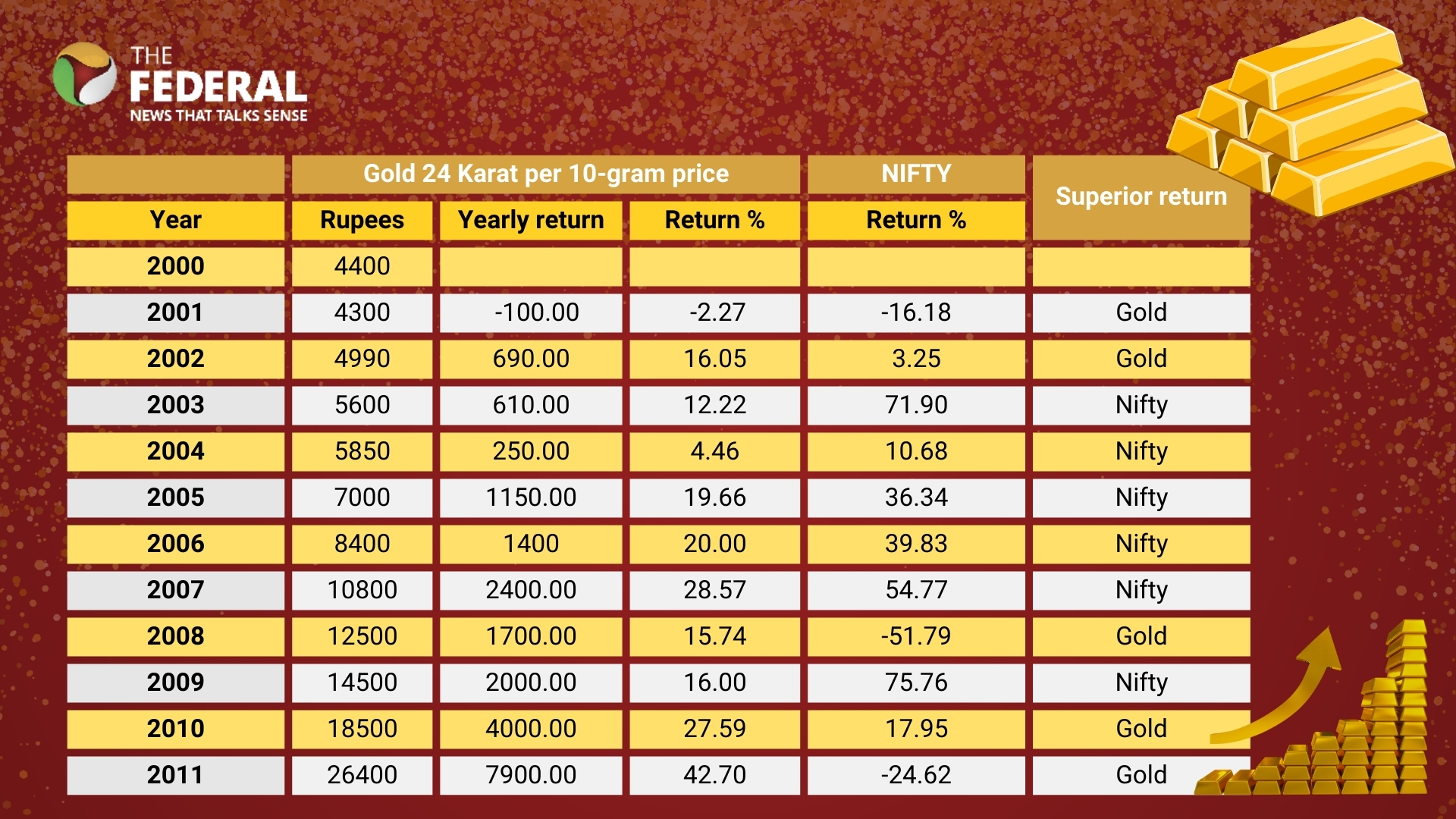

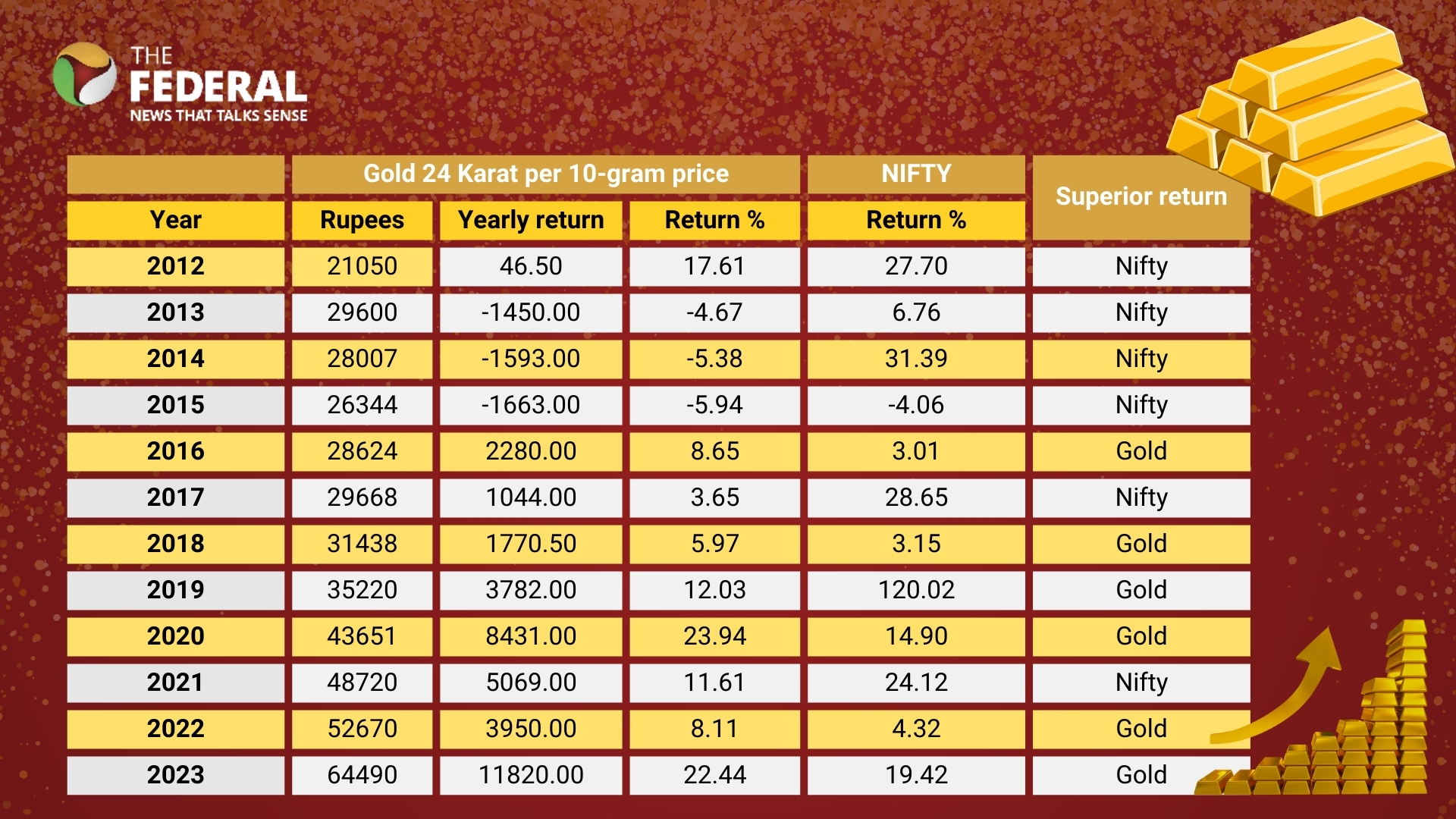

The following tables provide the return on gold investment of 24-karat gold, and on Nifty, from the year 2000.

From the above, we can observe that for 11 years, gold gave better returns, and for 12 years, Nifty performed better. Nifty gave the highest return of 75.76 per cent in 2009 and the lowest return of minus-51.79 per cent in the previous year, 2008.

Gold gave the highest return of 28.57 per cent in 2007 and the lowest return of minus-5.94 per cent in 2015.

It is a myth to claim that gold always gives positive returns. One can see that for three continuous years, from 2013 to 2015, gold gave negative returns.

CAGR values

The compounded annual growth rate (CAGR) is the mean annual growth rate of an investment over a specified period of time longer than one year. It represents one of the most accurate ways to calculate and determine returns for individual assets, investment portfolios, and anything that can rise or fall in value over time.

The following tables provides the 20-year CAGR for Nifty50 and gold for the past four years. By and large, one can see superior returns by Nifty50.

Geopolitical trends

Gold is considered a safe investment option during periods of economic uncertainty or geopolitical turmoil. For investors who seek stability, gold is a good option. It is considered a hedge against inflation. When the value of the rupee diminishes due to inflationary pressures, the relative worth of gold tends to increase.

One of the factors attributed for the current spike in gold prices is the heavy demand in China for the metal. It is reported that China's gold buying spree has been going strong for 16 consecutive months and the People's Bank of China added roughly 390,000 troy ounces of the key metal in February, according to government data. (A troy ounce is about 31.1 gram.)

The sudden spike in gold prices is attributed to geopolitical tensions, ongoing conflicts, and a pessimistic economic outlook, combined with uncertainties regarding US Federal Reserve rate adjustments.

Unproductive asset

However, the fact remains that as gold cannot produce anything, it is termed an unproductive asset. Its growth in terms of value depends on the belief that someone else will pay more for it in the future.

If any investment is made in shares or debt instruments, it contributes to the productivity and economic growth of the country.

A pile of gold will stay the same pile of gold no matter how much time passes. The only exception is when it is used in a small way in some industrial production.

The takeaway

One can stick to the asset allocation plan and whatever investment projected for gold under it can be maintained.

One must remember that there is a possibility of price correction in the remaining part of the year, making the IMF/World Bank projection become true.

Retail investors are often better off taking a long-term investing approach rather than chasing the market and attempting to capture gains on short-term trends.(The views expressed here are the author's, and do not constitute investment advice.)