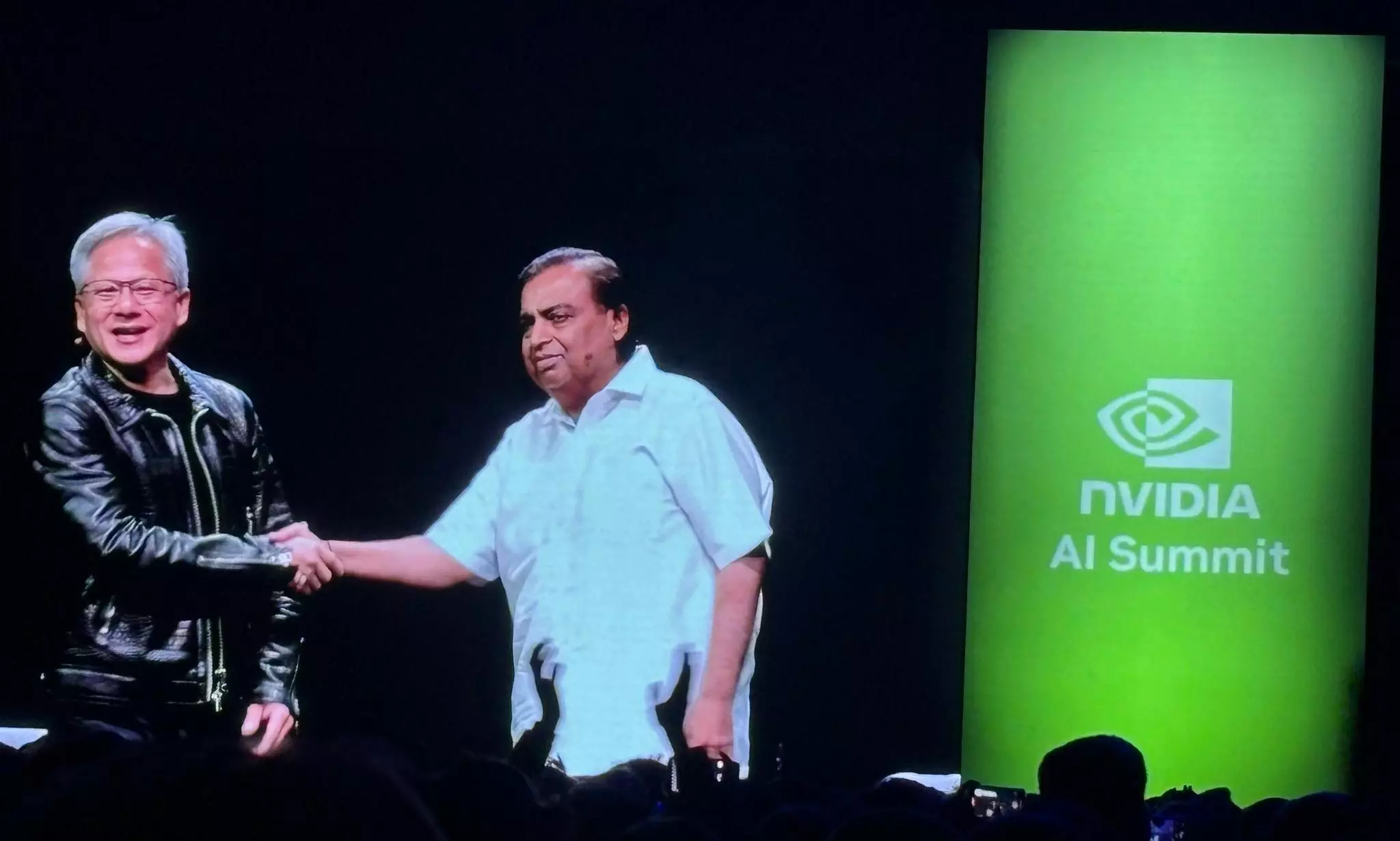

Nvidia-Reliance deal | Will India’s AI push outpace its readiness?

While new jobs will be created, there are doubts about how quickly India can cultivate advanced talent needed to sustain AI ecosystem envisioned by Huang-Ambani

The Nvidia-Reliance partnership announced on Thursday comes at a time when India is eager to position itself as a serious player in artificial intelligence (AI) and advanced computing.

While details about the partnership have not been announced so far, the announcement itself is seen as the first step towards creating an AI infrastructure to develop India’s supercomputing capabilities and a large language model (LLM) tailored for Indian languages.

While the initiative sounds promising on paper, critics are still determining whether India, despite its ambitions, has the infrastructure, workforce, and demand in place to justify this partnership.

What are LLMs?

But first, how useful are LLMs, which will be one of the outcomes of this partnership?

LLMs are a type of artificial intelligence (the capability of machines and computer systems to perform tasks that typically require human intelligence) that helps computers understand and work with human language, like how we talk or write.

Also Read: Here are six things that AI chip giant Nvidia proposes to do in India

They are trained by feeding them huge amounts of text from things like books, websites, news articles, and social media. This training helps them learn patterns in how words are used together.

Predictive tool

Think of an LLM as a brilliant predictive text tool on your phone. When you start typing, your phone suggests the next word based on what you have written. LLMs do the same thing but on a much larger scale.

They use special math techniques called neural networks that mimic how the human brain works, allowing them to predict words and generate sentences that sound natural — like they were written or spoken by a person.

This is what makes LLMs so valuable. They can write essays, answer questions, translate languages, chat like a virtual assistant, and even summarise long texts. However, they don’t truly “understand” language like humans do — they just follow patterns learned from the massive amount of text they were trained on.

Making AI tools accessible

LLMs could transform a linguistically diverse country like India. Currently, several existing AI models focus heavily on English or other major global languages, leaving a gap for regional languages.

Training LLMs to understand Indian languages like Tamil, Kannada, Hindi, Telugu, or Marathi would make AI tools more accessible across different parts of the country, where local languages are the primary means of communication.

Also read | Kerala school teachers all set to take the AI plunge

This could empower sectors like healthcare by enabling AI-powered consultations in regional languages; education by offering personalised learning through local language content; and governance by improving access to government services with chatbots in native languages.

Challenges galore

However, building LLMs for Indian languages is challenging. It requires high-quality datasets, computing power, and expertise in NLP (Natural Language Processing, which bridges the gap between how humans naturally communicate and how machines process information) for underrepresented languages — areas where partnerships like Nvidia-Reliance aim to make a difference.

The plan to build data centres powered by NVIDIA’s cutting-edge Grace Hopper Superchips (designed to handle the heavy workloads required for AI and high-performance computing) and cloud computing systems sounds impressive, but executing it is another matter.

Reliance is targeting 2,000 MW of AI-ready data centre capacity — an enormous task. Data centres of this magnitude require hardware and real estate, seamless integration with power grids and cooling systems, and a highly specialised workforce to maintain and scale the operation. Such infrastructure projects often encounter delays, and there’s little clarity on whether Reliance can meet these ambitious targets within a reasonable timeframe.

Also read | High time India went for a regulatory sandbox for Artificial Intelligence

Rapid infra push needed

Without rapid progress on infrastructure, the partnership risks being stalled at the starting gate.

The collaboration’s focus on developing LLMs for Indian languages recognises the country’s linguistic diversity. However, building AI models that understand and cater to these languages isn’t as straightforward as feeding data into algorithms (step-by-step instructions used to solve a problem or perform a specific task).

Although large and relatively experienced, India's tech workforce may still lack the specific skills required for cutting-edge AI research, particularly in natural language processing and high-performance computing.

While new jobs will inevitably be created, there are doubts about how quickly India can cultivate the advanced talent needed to sustain the kind of AI ecosystem Nvidia and Reliance envision. It is one thing to generate jobs, but another to ensure that the workforce is ready to fill them with the necessary expertise.

Are Indian markets ready?

Scepticism also exists about the readiness of Indian markets to absorb and implement the advanced AI solutions this partnership aims to deliver. Many sectors, including agriculture, healthcare, and manufacturing, have only begun experimenting with AI. The question isn’t just whether these industries can benefit from AI but whether they are prepared to invest in and integrate such technologies meaningfully.

Also read | Will AI snatch human jobs or trim workload? Here’s what Microsoft says

Assuming demand for AI solutions needs to materialise at the scale expected, there’s a real risk that the infrastructure being built will be underutilised, making the project a costly experiment rather than a transformative leap.

The partnership also exposes India’s continuing dependence on foreign technology. While the government has emphasised the need for technological self-reliance, relying on Nvidia’s superchips and cloud services reflects how India remains tethered to international technology providers.

This dependency raises concerns about whether India can develop and manufacture its advanced computing hardware in the future. In the short term, Nvidia gains significant access to India’s market and data landscape, further embedding itself into its digital infrastructure. The collaboration may offer Reliance a technological edge, but it does little to reduce the nation’s dependency on external suppliers for core technology.

Aiming for long-term returns

Nvidia and Reliance are likely looking at long-term returns, but whether those returns will benefit India more broadly is an open question.

Also Read: How Satya Nadella intervened to resolve 'chip feud' between Nvidia and Microsoft

For Reliance, the partnership represents a way to expand beyond its core telecom business, positioning itself as a central player in India’s AI ecosystem. However, whether the move pays off will depend on more than just technological ambition. Nvidia, meanwhile, benefits from expanding its presence in a growing market and accessing India’s data and talent, solidifying its global dominance in AI.

Analysts say while the government has backed AI and semiconductor initiatives, hoping to boost domestic manufacturing and reduce reliance on imports, the partnership itself demands coordinated execution across industries, sustained investment in talent development, and infrastructure beyond urban centres. Without these elements, the partnership risks widening existing inequalities, with the benefits of AI concentrated in a few areas while the rest of the country struggles to catch up.

Ultimately, the Nvidia-Reliance collaboration has the potential to create jobs and attract further investment, but only if the companies can align infrastructure development with market readiness and workforce capability.