Grossly undervalued, LIC’s IPO is the most controversial ever

As India’s capital market remains agog, waiting for its biggest-ever Indian IPO on May 4 for retail investors, the pricing of the issue remains its most controversial element. Opinion on the pricing of the LIC share is sharply polarised. This is reflected in the media coverage that is almost wholly focused on the “attractive” valuation of the price of the LIC share being offered in the IPO. The countervailing narrative, that this “attractive” price necessarily implies huge losses to not just the government but to millions of policyholders, has been drowned in the garrulous cacophony.

At one end of the pole are investors — small as well as institutional — who are salivating at the prospect of acquiring the shares at a deep discount. At the other end, LIC’s employees as well as those who care about the integrity of India’s biggest and pioneering insurance company — actually among the biggest in the world — argue that this is a huge scam. This is “perhaps the biggest in the annals of privatisation in India,” observed the People’s Commission on Public Sector and Public Services, a civil society group that has explored the contours of India’s privatisation drive since last year.

Also read: Centre selling LIC shares at throwaway prices: Congress

Since the heart of the controversy lies in the pricing of the LIC share, let us dive right into that aspect of the IPO. First, the facts: The IPO is priced at ₹902-949/share. The lower bound can be safely ignored because it is inconsequential, as has been proved by the fact that most acceptances by “Anchor Investors” (who were offered shares on May 2) were apparently at the upper end of the price band. Retail investors and LIC employees get to pay a max of ₹902/share and policyholders pay ₹889/share. All other investors would pay ₹949 per share in the IPO that closes on May 9.

The pitfalls of EV as a valuation tool

Now, let us get to the meat of the matter. In February, when the LIC filed its Draft Red herring Prospectus (DHRP), its Embedded Value (EV) was estimated at ₹5.40 lakh crores. A bit about the EV is in order, because it is critical to not just the pricing of the LIC share in the public issue but for its implications for the government’s mop up of resources through the IPO.

Broadly, there are two broad sets of issues about the EV that are germane to the issue here. First, the EV is NOT the value of a life insurance company; instead it merely reflects the present value of future income streams that would be available to shareholders. Thus, the EV does not take into account either LIC’s “goodwill” — remember, it is India’s most valuable brand by some distance — or the earning potential in the future.

But even more importantly, Milliman Advisors, the actuarial consultancy engaged by the government to estimate LIC’s EV, omits the valuation of the LIC’s substantial real estate assets. Given that the LIC is India’s biggest realtor, with landmark assets in not just the country’s metros but across the length and breadth of India, this results in a significant undervaluation of the LIC as an institution. Most importantly, the fact that the “new” shareholders (as well as the government as a shareholder) would enjoy a claim on the LIC’s assets means that they would own a portion of the assets for which they have contributed nothing, even as policyholders, who have contributed to the acquisition of these assets, would get nothing at all.

The usage of the EV as a conceptual measure of a life insurance company’s worth is of recent vintage, particularly after the global financial crisis of 2008, which resulted in a wave of mergers and acquisitions in the global life insurance business, following the collapse of several insurance companies. Basically, the limited purpose of the EV is to provide a summary measure of how much a life insurer’s potential return is worth to an acquirer of the business. Researchers and actuaries across the world have pointed to the pitfalls of relying too much on EV as a measure of an insurance company’s true worth.

Shortchanging policyholders

The second aspect of the EV, as estimated by Milliman pertains to the fact that LIC’s EV increased from ₹0.96 lakh crore in March 2021 to ₹5.40 lakh crore in September — a whopping increase of about 465 per cent over the short span of six months. How did this magical increase happen? This was almost entirely due to the fact that the consolidated Life Fund of the LIC was bifurcated into two portions in September 2021 — those from Participatory Policyholders and Non-Participatory Policyholders, as a result of the amendments to the LIC Act, through the Finance Act of 2021. Critics allege that the passage of these amendments as a Money Bill was entirely aimed at avoiding negotiating through parliamentary scrutiny and debate.

Prior to these amendments Participatory Policyholders were entitled to 95 per cent of the surplus emanating from Non-Participatory policies. This was only logical because Participatory Policyholders, as the term indicates, participate by providing the risk capital for the Non-Participatory policies; in fact, they were exposed to the risk of losses, if any, on such policies. Following the bifurcation, all of the surplus from the Non-Participatory policies are now made available to shareholders — and zilch to the Participatory Policyholders as has been the case for decades.

Significantly, almost one-third of the total life Life Fund of ₹36.67 lakh crore, amassed over years, now become available to the shareholders (the government as well as the new ones after the IPO), at the expense of policyholders who had built this corpus over the years. Indeed, the massive increase in EV has been made possible by the large-scale misappropriation of funds that truly belong to generations of policyholders of the LIC.

This issue may appear to be a digression, but stay with me and you will realise its central importance to this IPO. The issue is of critical importance because of the unprecedented step the government has taken in reserving a portion of the IPO for policyholders. If policyholders are merely “customers” of the LIC, as the government appears to be claiming now, is it not striking that the government seems to be conceding that they have special claims and rights? Can you think of a single IPO, anywhere in the world, where a portion of the offer has been reserved for a company’s customers. To draw an analogy, would Zomato or Paytm have offered shares to users of their apps when they made their IPO? Indeed, the subset of shares reserved for policyholders from within the portion reserved for retail investors appears to be a clever move to buy the silence of policyholders who have suffered a massive ripoff in the run-up to the IPO.

Indeed, there are those who claim the special nature of the LIC’s organisational structure since its inception in 1956 meant that it functioned more as a giant cooperative or a mutual company in which policyholders were much more than mere customers. The fact that the government invested a mere ₹5 crores as equity capital between 1956 and 2011, meant that the motive force for the expansion of the LIC as well as the propagation of the culture of life insurance was provided by policyholders who provided the risk capital. Isn’t it ironic that they are now being offered a piffling ₹60 per share as a “special” discount after they have been expropriated en masse?

The valuation scandal

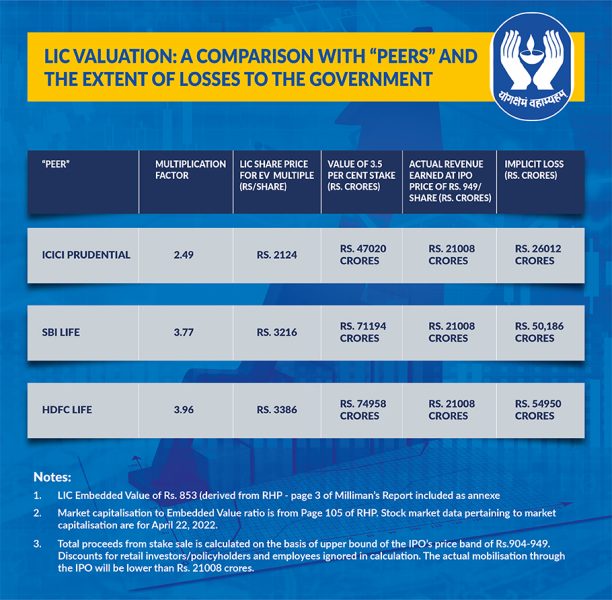

Even those who swear by the EV acknowledge that it is only the absolute base level of valuation. The latest EV estimate for LIC of ₹5.40 lakh crore implies that the absolute rock bottom price is ₹853 per share (for the 632.50 crore shares that have been issued). The fact that each of the three major IPO floats of private insurers in india — HDFC Life, SBI Life and ICICI Prudential — had applied a multiplication factor of between 2.5 and 4 to arrive at their issue price justified the need for using an appropriate multiplication factor in the case of the LIC too. And, this is where the plot thickens.

At the time of the filing the DRHP, it was expected that a multiplication ranging between at least 2.5 and 3.5 would be adopted. It now turns out that the multiplication factor used for the LIC float ranges between 1.04 (for the portion offered to Policyholders) and 1.11 for all other non-retail bidders. What does this imply for the government’s exchequer?

Over the last few weeks, unnamed officials in the Finance Ministry and elsewhere in the government have claimed that the war in Ukraine and the consequent turmoil in global markets have made investors turn risk-averse. A concerted move has been on to justify the use of a lower multiplication factor, in order to make the IPO super attractive to investors. Is this justifiable by any means? It turns out that data presented in the Red Herring Prospectus filed by LIC on April 26 with the market regulator Securities and Exchange Board of India (SEBI) run counter to these claims. In its filing LIC revealed that the ratio of market capitalisation of its “peers” in the industry — SBI Life, HDFC Life and ICICI Prudential — were 3.77, 3.96 and 2.49, respectively. Most importantly, these figures pertain to stock market information as on April 22, just days before the IPO. Crucially, this indicates that the share price to EV ratio fully encapsulates the “adverse” market conditions that the government has cited while justifying the gross undervaluation of the LIC IPO.

Let us now get down to estimating the loss to the government exchequer as a result of this undervaluation. For the moment, let us ignore the fact that the LIC’s “peers” are much smaller insurers — LIC has a market share of almost two-third in terms of premium income and three-fourths in terms of number of policies sold. At a multiple of 2.49, which was what was applicable for ICICI Prudential, the sale of 22.1375 shares (3.50 per cent of the 632.50 shares on offer), the LIC share ought to have been priced at ₹2,132 apiece. At this price the government would have earned ₹47,020 crore. The fact that it stands to earn a maximum of ₹21,008 crore, implies a loss of at least ₹26,012 crore.

Also read: Why LIC IPO may not be as attractive as it’s made out to be

But it gets even worse than this. Using the multiplication factor of 3.77 applicable to SBI Life, the LIC share ought to have been priced at ₹3,216. At this price the government would have raised ₹71,194 crore; instead it stands to make a loss of ₹50,186 crore. But wait, it gets even worse, if we adopt the multiplication factor relevant to HDFC Life. At a multiple of 3.96, the LIC share ought to have been priced at ₹3,386, implying a total yield of ₹74,958 crore. The implicit loss to the government at this price is a whopping ₹54,950 crore.

IPO is not about meeting divestment targets

Two things become evident from L’affaire LIC. The first is that the headlong rush to the IPO has nothing to do with the Modi government meeting its disinvestment target. If it was indeed motivated to meet those targets, why on earth would it willingly suffer losses of the magnitude that it is now going to suffer? The second arises from the government being over backwards to meet the demands of global investors. It possibly sees the listing day “pop” as an indicator of success, a feel-good effect that it is so prone to suffer from. But that offers zilch to either the government or policyholders who have already suffered serious losses; gains would only accrue to speculative investors out to make a fast buck.

The argument that the deep discount offers great opportunities for retail investors can only come from those without a moral compass of any kind. Such a discount can only arise from commensurate or even greater losses to two entities: policyholders and the government, which, by implication, still supposedly works to serve the greater common good.

This IPO is the first step towards the dismantling of the LIC, a peerless pioneer anywhere in the world. The most important aspect of the sui generis institution, its unique ownership structure and its collective-like character, recognisable to generations of Indians, is now about to change. That it has taken a huge scam to deliver the blow adds painful insult to injury to millions of Indians.

(The author, a senior journalist, is a member of the People’s Commission on Public Sector and Public Services)